The Federal Reserve is widely expected to reaffirm its ultra-dovish monetary policy in today’s FOMC meeting and the futures market continues to price the odds of a rate hike at 0% deep into 2021. But real-world conditions in government bond trading are hinting, if only on the margins, that a post zero-forever world may not be forever after all.

Monthly Archives: December 2020

Macro Briefing: 16 December 2020

* GOP Senate Majority Leader McConnell publicly acknowledges Joe Biden’s victory

* Economists expect decline in today’s November report on US retail spending

* Congress still negotiating details for Covid-19 relief package

* Eurozone economy “close to stabilizing” via PMI survey data for December

* German economy reflects “ongoing resilience” in December PMI data

* Japan’s economy continues to contract in December, PMI data shows

* UK economy growing slightly via December PMI survey data

* Will the Fed change its bond-buying program in today’s policy meeting?

* NY Fed Mfg Index in Dec continues to post moderate growth

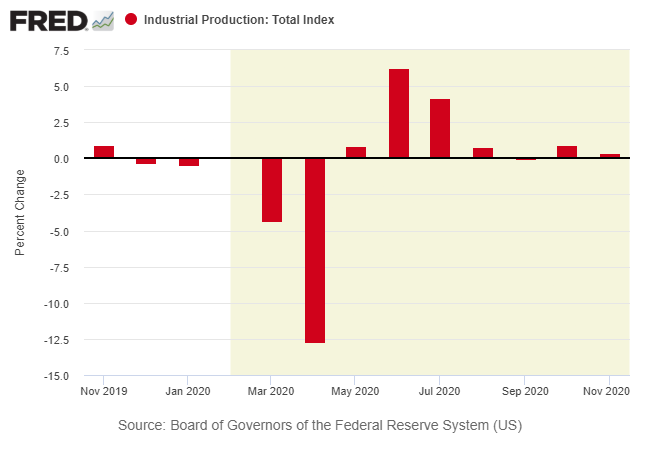

* US industrial output growth slowed in November, rising 0.4%:

Is It Timely To Hold A Dollar-Hedged Investment Portfolio?

A bear-market bias continues to weigh on the US Dollar Index, which has tumbled sharply this year. That’s a bullish tailwind for US investors holding assets denominated in foreign currencies. Owning gold and cryptocurrencies – alternative forms of “money” untethered to the greenback – have been a profitable trades this year too.

Continue reading

Macro Briefing: 15 December 2020

* Electoral College officially confirms Biden as the next US president

* Poor nations expected to endure long wait for vaccines

* US Covid-19 death toll above 300,000 as vaccine rollout begins

* US Attorney General Will Barr says he’ll step down next week

* FTC begins privacy probe of major tech firms

* US tech giants must change business practices in EU or face hefty fines

* US imports from China are surging

* China retail spending and industrial output continued to rebound in Nov

* UK layoffs rose to record high in Oct

* Does the US economy face a zombie recovery?

* CBOE Market Volatility Index — VIX — rises to highest level in over a month

Commodities Rallied As US REITs Tumbled Last Week

Broadly defined commodities posted the strongest gain for the major asset classes in last week’s trading, followed closely by wide-ranging rallies in fixed-income markets around the world, based on set of ETFs. US real estate investment trusts (REITs), by contrast, posted the deepest loss by the end of the trading week (Friday, Dec. 11).

Continue reading

Macro Briefing: 14 December 2020

* US vaccine rollout begins, offering hope for a beleaguered nation

* Electoral College today is set to formally cast votes for Biden as next president

* Vaccine rollout will likely be a topic at this week’s Fed meeting

* EU and UK extend trade talks but say no-deal Brexit is likely

* Eurozone industrial output picked up in October, rising 2.1%

* ECB expects inflation will remain below its just-under 2% target for years

* Russian hackers appear to have broken into US federal agency networks

* US consumer sentiment rebounded in recent weeks

* Policy sensitive 2yr Treasury yield drops sharply ahead of Wed’s Fed meeting:

Book Bits: 12 December 2020

‘● Competition is Killing Us: How Big Business is Harming Our Society and Planet – and What To Do About It

‘

Michelle Meagher

Interview with author via Pitchfork Economics

Neoliberal economics says free trade is always good, and its followers try to lower trade barriers without discretion. Freedom is an essential ingredient for successful international trade—but that doesn’t mean all trade should be unregulated. Competition law expert Michelle Meagher joins Goldy to debunk common competition myths and talk about strategies to hold powerful monopolies accountable.

The ETF Portfolio Strategist: 11 Dec 2020

Latin America Equities Continue To Lead: Global markets delivered mixed results for the week ended Friday, Dec. 11. For iShares Latin America 40 (ILF), however, the good times roll on.

US Economic Recovery At Risk As Coronavirus Rages

It’s been clear for weeks that economic growth is slowing due to the resurgent coronavirus. A clear sign of the change in the macro trend emerged in yesterday’s update of the ADS Index, the Philadelphia Fed’s real-time business cycle index.

Macro Briefing: 11 December 2020

* Few signs of progress in Congress on passing coronavirus relief bill

* US close to approving Covid-19 vaccine

* US expected to sanction Turkey after purchasing Russian defense system

* EU prepares for no-deal in final days of Brexit talks

* UK reviewing adverse reactions to Pfizer vaccine

* Economic recovery expected to slow as US awaits vaccine rollout

* Global supply of negative-yielding bonds rises to $18 trillion

* US inflation increased more than forecast in November

* US jobless claims rose more than expected last week