* Embattled British Prime Minister Liz Truss under pressure to resign

* Fed’s Beige Book: US economy expands modestly since early September, but…

* Fed survey finds US firms becoming more pessimistic about economic conditions

* Japanese yen at weakest level vs. US dollar since 1990

* Price hikes boost earnings for Procter & Gamble

* Amazon founder Jeff Bezos warns of trouble ahead for US economy

* Home sales fall sharply in September, reports real estate firm Redfin

* Mortgage applications in US slide to a 25-year low in week through Oct. 14

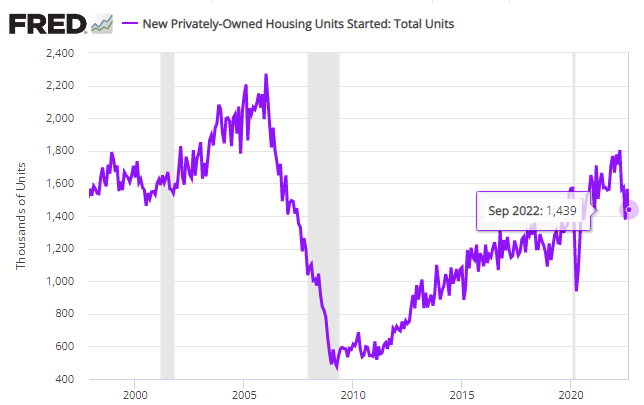

* US housing starts fell more than expected in September:

Yearly Archives: 2022

S&P 500 Risk Profile: 19 October 2022

The US stock market’s bounce in recent days has inspired speculation in some quarters that equities have found a bottom. Maybe, but the strength of downside momentum and other factors suggest otherwise.

Macro Briefing: 19 October 2022

* Biden set to announce of additional oil reserve sales to reduce gas prices

* Central banks will continue to raise rates to fight inflation, predicts Nordea

* Inflation in Britain rose 10.1% n September–a 40-year high

* US homebuilder sentiment falls to 2-1/2 year low in October

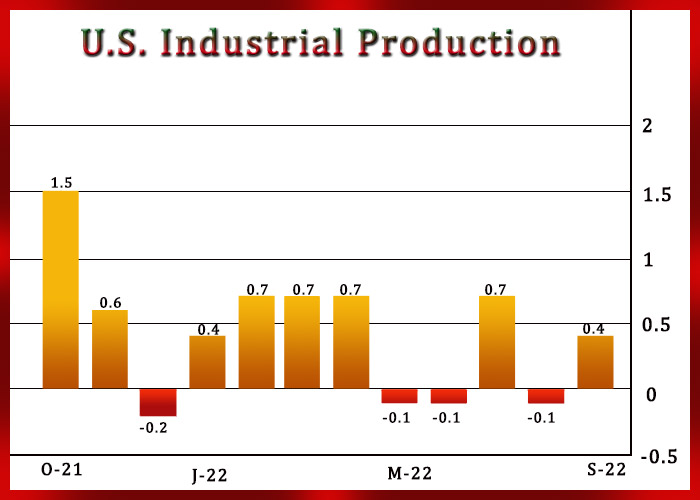

* US industrial production rebounds more than expected in September:

10-Year Treasury Yield ‘Fair Value’ Estimate: 18 October 2022

The US 10-year Treasury yield has been on a tear over the past two months, its rise fueled by persistent high inflation and ongoing increases in short-term interest rates by the Federal Reserve. But CapitalSpectator.com’s fair-value model suggests the 10-year rate’s upside bias is now limited, although strong momentum forces could easily push the benchmark yield higher still in the immediate future.

Macro Briefing: 18 October 2022

* Russia continues to attack Ukraine with drones, targeting energy facilities

* Europe generates record level of wind, solar power as Russian gas supply falls

* China economic outlook downgraded via Xi Jinping’s political agenda

* Strong US dollar is spreading economic pain around the world

* Solid earnings growth for Bank of America imply strong US consumer sector

* Microsoft announces job cuts, citing softer growth in revenue and sales

* Oil market eyes another possible release from Strategic Petroleum Reserve

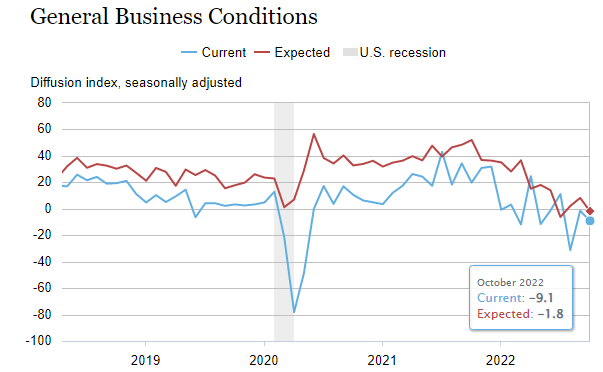

* NY Fed Mfg Index contracts for third straight month in October:

Last Week’s Upside Outlier: US Inflation-Linked Treasuries

US government bonds offering inflation hedging provided the only positive return for the major asset classes in last week’s trading through Friday, Oct. 14, based on a set of proxy ETFs.

Macro Briefing: 17 October 2022

* Russia attacks Ukraine capital with more drone strikes

* China delays release of key economic data

* US assets expected to lead rebound once bear market ends, survey finds

* Strong US dollar is a factor supporting rebound in small-cap stocks

* Supply chain congestion shows signs of easing after two years of disruption

* Sterling rebounds after new UK finance minister announces policy changes

* The recent surge in rental costs continues to cool in September

* US retail spending was flat in September as prices rose sharply

* US consumers’ year-ahead inflation expectations rise to 5.1% in October:

Book Bits: 15 October 2022

● Permanent Distortion: How the Financial Markets Abandoned the Real Economy Forever

Nomi Prins

Review via Jacobin.com

During the pandemic, Prins explains, “too big to fail” became “too big to correct.” As economies ground to a halt around the globe, central banks printed trillions more to keep markets afloat. The result has been perhaps the single greatest transfer of wealth in human history. Between the fourth quarters of 2019 and 2020, she writes, the planet’s more than two thousand billionaires saw their net worth increase by $1.9 trillion — a figure that has only increased in the years since. In December of 2020, when the United States averaged approximately 2,500 COVID deaths per day, the Dow Jones Industrial Average soared to a then record 30,606.48. Meanwhile, poverty rose from 9.3 percent in June of that year to 11.7 percent in November, with eight million more people falling below the poverty line. The latest Congressional Budget Office report indicates that the poorest half of the country now holds just 2 percent of its wealth.

Peak Inflation Watch: 14 October 2022

If we’re generous, the case for arguing that inflation has peaked is mixed. Depending on the indicator of choice, there’s supporting evidence for deciding that worst of the inflation surge is behind us. But there’s also data to assert the opposite, as yesterday’s update on consumer prices reminds.

Macro Briefing: 14 October 2022

* Russia expected to hold large-scale exercises of nuclear forces soon

* US inflation data suggests Fed will hike rates again by 0.75-Point

* US social security recipients will receive 8.7% increase in payouts–a 40-year high

* China inflation increases at highest pace in two years in September

* European Central Bank needs more rate hikes, says Belgium’s central bank chief

* UK pension fund sales is warning for global bond markets

* Japanese yen trades at 32-year low against US dollar

* US jobless claims rose again last week but remain historically low

* US core consumer inflation rose in September, reaching 40-year high: