* More rate hikes needed despite slowing inflation, say Fed officials

* Traders downgrade expectations for a 75-basis-points rate hike in September

* Atlanta Fed’s GDPNow model raises Q3 nowcast to solid +2.5%

* US average gasoline prices below $4 a gallon for first time in months

* Ford CEO doesn’t see lower costs for electric vehicle batteries on horizon

* Hot inflation could boost Social Security payments by $1700 on average in 2023

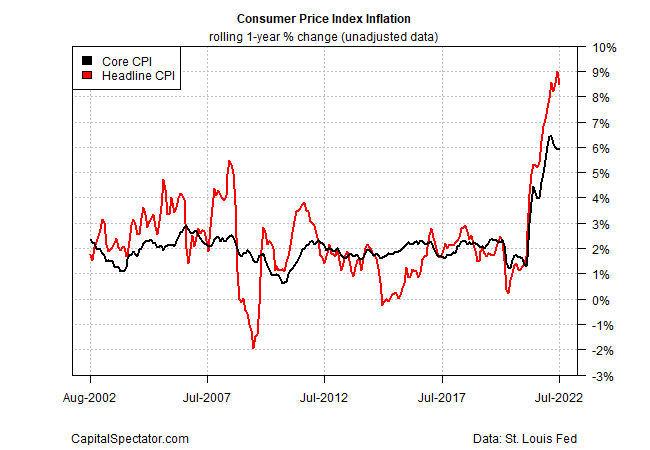

* July data for US consumer price data suggests inflation may have peaked:

Yearly Archives: 2022

Modest Rebound Expected For US Q3 GDP

Early estimates for US economic activity in the third quarter point to a mild recovery in output following two straight quarterly declines, based on the median for a set of nowcasts compiled by CapitalSpectator.com. The bounce is encouraging but should be viewed cautiously this early in the quarter. For the moment, however, a bit of relief appears to be brewing ahead of the government’s initial Q3 estimate, scheduled for release on Oct. 27 via the Bureau of Economic Analysis.

Macro Briefing: 10 August 2022

* Russia says oil flows to three central European nations have been halted

* Can Taiwan hold out against a Chinese invasion? Yes, a war game predicts

* China’s consumer inflation rises to highest level in two years

* Low water level in key rivers in Europe threaten to cripple trade

* US workers’ wages continue rising briskly, contributing to high US inflation

* US national average for gas falls below $4 a gallon for first time since March

* Rebound in value stocks continues to fade relative to growth shares:

Predicting Risk: Not Easy, But Easier Relative To Return, Part II

Predicting market risk is easier than predicting return, as demonstrated in the first installment of this series. The caveat is that we shouldn’t conflate easier with easy. Nonetheless, a simple model of using yesterday’s return volatility proves to be a reliable forecast for today. The key question: how far into the future can we effectively forecast vol with this naïve model? The short answer: the reliability fades, quickly.

Macro Briefing: 9 August 2022

* FBI searches Trump’s Mar-a-Lago home

* Consumer inflation expectations decline, NY Fed survey finds

* Small Business Optimism Index ticks up but still below 48yr average

* US housing sentiment falls to lowest level in a decade, Fannie Mae reports

* Housing inventory in US soars as homebuyers pull back

* Reducing inflation is going be challenging, says markets analyst Jim Bianco

* Public pension plans suffer worst annual performance since 2009

* 3mo/10yr US Treasury yield curve holds above zero, just barely:

US Stocks Led Markets Last Week As Commodities Tanked

American shares rose for a third straight week in trading through Friday’s close (Aug. 5), posting the leading performance for the major asset classes, based on a set of ETFs. Commodities, by contrast, lost ground, suffering the deepest loss last week.

Macro Briefing: 8 August 2022

* Senate passes ambitious health care and climate bill

* China announces more military drills around Taiwan

* China’s trade surplus reaches record high in July

* UN chief condemns “suicidal” shelling around Ukrainian nuclear plant

* SF Fed president says Fed is “far from done” with rate hikes

* The world’s first climate-induced famine torments Madagascar

* US payrolls rose sharply in July, far above expectations

* US 10yr Treasury yield rose last week — first increase in four weeks:

Book Bits: 6 August 2022

● After the Ivory Tower Falls: How College Broke the American Dream and Blew Up Our Politics―and How to Fix It

Will Bunch

Q&A with author via Inside Higher Ed

In his new book, After the Ivory Tower Falls: How College Broke the American Dream and Blew Up Our Politics—and How to Fix It (William Morrow), Pulitzer Prize–winning journalist Will Bunch, national opinion columnist for The Philadelphia Inquirer, traces the evolution of American higher education since World War II, exploring how it fueled—and was fueled by—the country’s deep political and cultural divides. In a phone interview with Inside Higher Ed, Bunch attributed many of this country’s current travails—from climate change denial to the Jan. 6 insurrection—to “a failure of education.” Excerpts of the conversation follow, edited for length and clarity.

He largely absolves the Fed of blame for this (though I would have noted that the Greenspan Fed was reluctant to use the regulatory muscle it did have).

Research Review | 5 August 2022 | Multi-Factor Strategies

Combining Factors

Christoph Reschenhofer (Vienna University of Economics and Business)

July 2022

While the academic literature primarily investigates factor exposures based on covariances (i.e. beta exposure), most practitioners apply characteristics-based scorings to obtain factor portfolios. It hereby remains largely unexplored how firm-level characteristics can be combined to obtain optimal factor portfolios. This paper derives multi-factor portfolios that are formed via a combination of stock characteristic scores. Portfolios that are formed on multiple characteristics are less volatile, and exhibit higher after cost returns compared to the market and single factor portfolios. In addition, return, risk and turnover preferences are very sensitive to buy- and sell-thresholds. We further identify optimal weights for individual factor characteristics, but have to recognize the 1/N factor portfolio as a tough benchmark.

Macro Briefing: 5 August 2022

* China continues to conduct provocative military drills around Taiwan

* China imposes sanctions on US House Speaker Pelosi after her trip to Taiwan

* Sharp decline in longer-term bond yields is a key factor in the rebound in stocks

* Americans may be gloomy but remain upbeat about labor market, poll finds

* Bank of England warns that UK will fall into recession this year

* US jobless claims resume upward trend, near 8-month high: