* China President Xi warns Biden on interference with Taiwan

* Biden and China President Xi, after call, plan to meet in person

* China signals no big stimulus planned to support slowing economy

* Is the US in a recession? Answer depends on the analyst you ask

* Inflation in Eurozone in July reaches record-high 8.9% for past year

* Eurozone GDP growth picked up to +0.7% in Q2, but…

* German GDP ground to a halt in Q2

* Big tech looks resilient as economy weakens

* US jobless claims edge lower but remain near 2022’s highest level

* US Q2 GDP declines, marking second straight quarterly loss:

Yearly Archives: 2022

Peak Inflation Watch: 28 July 2022

The inflation battle continues. The Federal Reserve yesterday raised interest rates by a hefty 75 basis points, again, in a renewed effort to tame inflation’s recent surge. The key question: When will we start to see results?

Macro Briefing: 28 July 2022

* Federal Reserve raises interest rates 75 basis points… again

* Senator Joe Manchin, key Democrat vote, agrees to climate legislation

* Senate passes $52 billion bill supporting US semiconductor production

* North Korea returns to saber rattling with new threat

* CBO predicts sharp increase in US public debt burden and deficit

* Eurozone economic sentiment falls sharply in July, signaling recession is near

* US 10yr Treasury yield holds below 2.8% after another Fed rate hike:

Energy Holds On To Hefty Lead For US Equity Sectors In 2022

Energy stocks have stumbled in recent weeks, but this sector is showing signs of regaining its mojo. It could be noise or even a last gasp after an extraordinary bull run. But for the moment, shares in this corner remain the clear leader year to date, based on a set of sector ETFs through Tuesday’s close (July 26).

Macro Briefing: 27 July 2022

* Biden to speak with Chinese counterpart Xi as tensions rise

* Global growth slowing, raising recession risk, IMF warns

* Fed may be just getting started in battling inflation

* Fed-induced recession is worse than inflation, writes former Fed economist

* Recession in Europe is all but assured as Russia squeezes gas flow

* US home prices post second month of slower but still strong growth in May

* New home sales in US fell more than expected in June

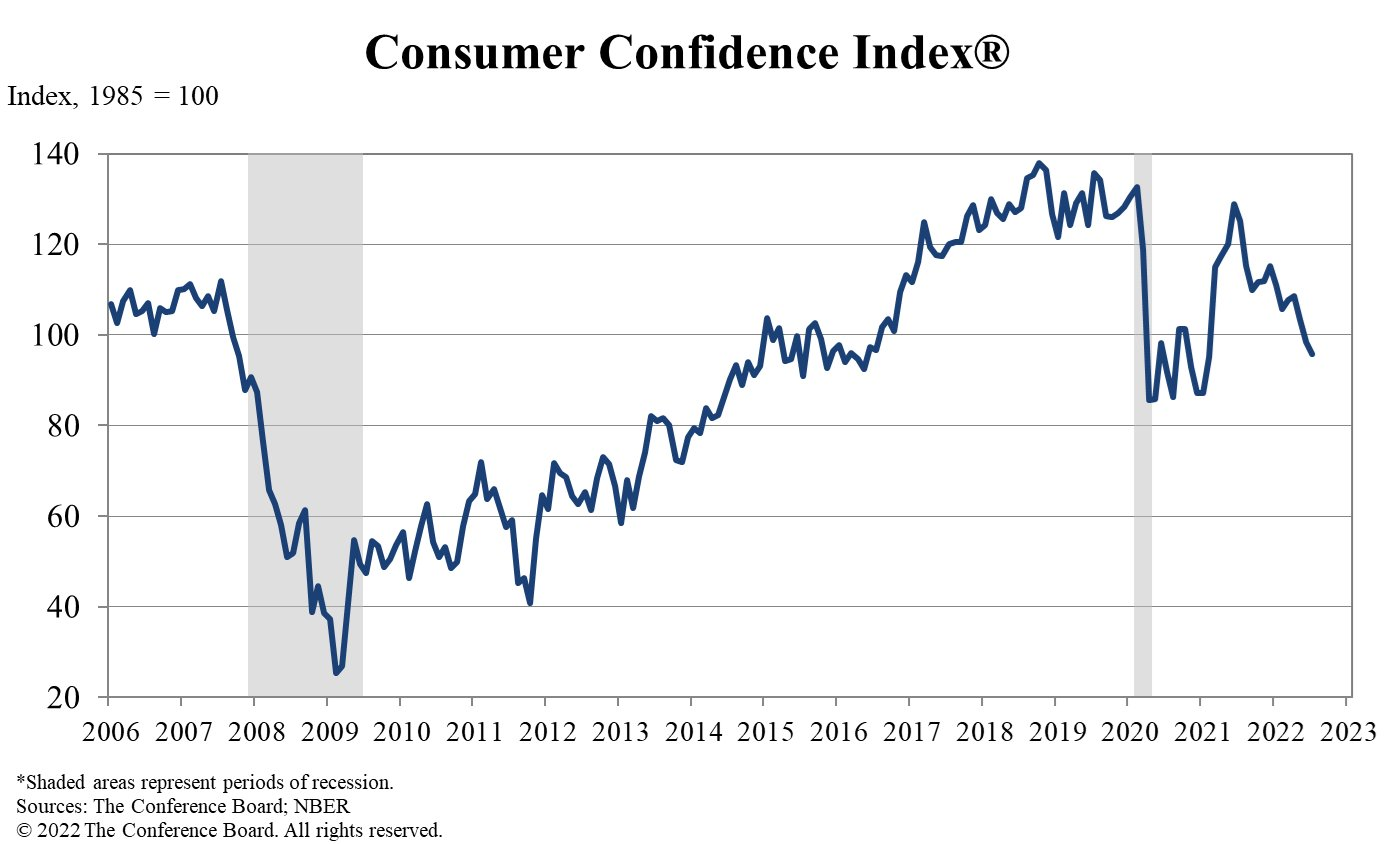

* US consumer confidence falls for third straight month in July:

Is There A Case For A Return Of Disinflation/Deflation?

It’s all about high inflation at the moment. The Federal Reserve is certainly focused on inflation risk and is set to raise interest rates again in tomorrow’s policy announcement (Wed., July 27). The view that “inflation is transitory” is all but dead as a viable narrative on Wall Street and beyond and so the future looks obvious. Considering the potential for a return of disinflation/deflation (D/D) risk, in other words, appears clueless in the extreme. For that reason alone, let’s consider its likelihood at some point in the near future, if only as an exercise in contrarian thinking.

Macro Briefing: 26 July 2022

* Tensions rise between US and China over planned Taiwan trip by Pelosi

* Russia set to further cut gas deliveries to Germany

* Is the US recession? Deciding yea or nay is tricky at the moment

* Economist Nouriel Roubini predicts deep recession due partly to high debt loads

* Supply of negative-yielding debt has fallen sharply since late-2020

* US growth running below historical average for second month in June:

Across-The-Board Rebounds For Major Asset Classes Last Week

One solid weekly bounce doesn’t mean much after months of losses, but hope still springs eternal. Only time will tell if the latest bounce marks a turning point, or not. But for one week, at least, global markets delivered something other than gloom via a uniform rise in prices for the major asset classes over the trading week through Friday, Jul. 22, based on a set of proxy ETFs.

Macro Briefing: 25 July 2022

* Treasury Sec. Yellen downplays US recession risk

* Peak inflation signs are emerging, but questions remain on how fast it can fall

* US economic headwinds strengthen via slower growth and more rate hikes

* Wall Street sees possibility of rate cuts for 2023

* Gold can’t catch a break, despite high inflation

* Eurozone economy contracts in July via PMI survey data

* German business sentiment falls to 2-year low in July

* Africa and south Asia expected to bear brunt of climate change instability.

* A survey-based GDP proxy shows the US economy contracting in July:

Book Bits: 23 July 2022

● The Upside of Uncertainty: A Guide to Finding Possibility in the Unknown

Nathan Furr and Susannah Harmon Furr

Review via Financial Times

Uncertainty in life is, ironically, certain. The past two years amid a pandemic have been no exception. Whether you’re a chief executive steering a business through the negative effects of lockdowns, a furloughed employee or, worse, someone who has faced job loss, at times the uncertainty for many has felt crippling.

However, Nathan Furr, a strategy and innovation professor at Insead business school in Paris, and Susannah Harmon Furr, an entrepreneur, believe we can reframe uncertainty in a way that helps us use it to our advantage.

According to the authors, our brains are wired to fear uncertainty’s downsides, but since it is not going away “learning to face the unknown well is critical to our ability to survive and thrive”. Based on both research and interviews, the book provides a practical framework that can be applied to help us find the possibilities from uncertainty and act on them.