Three economic reports released on Thursday point to a rising possibility that a recession is near for the US economy. The threat of a contraction still doesn’t appear imminent and there’s still room for debate on the question of whether a recession is fate. But as new data on jobless claims, the Leading Economic Index and the Philly Fed Manufacturing Index remind, the trend continues to soften. At the very least, the latest numbers show that economic activity continues to slow.

Yearly Archives: 2022

Macro Briefing: 22 July 2022

* European Central Bank raises interest rates more than expected

* Eurozone appears to slip into recession in July via PMI survey data

* UK economy continues to grow in July but at 17-month low via PMI survey data

* US Leading Economic Index declines for fourth straight month

* Russia-Ukraine deal expected to restart grain exports

* Federal gov’t tells states in West to make urgent cuts in water use

* US jobless claims rise to new 8-month high, signaling labor market warning:

Using Multiple Yield Curves To Predict Recessions

The Treasury yield curve is widely used as a first approximation of estimating recession risk. This is usually limited to one or two sets of maturities. Does this simple model find traction if we expand the analytics across the full sweep of the yield curve? The short answer, yes.

Macro Briefing: 21 July 2022

* Russia restarts gas flow to Europe

* Is the world ready for higher interest rates? Maybe not

* EU urges nations in currency bloc to cut gas use by 15%

* US consumer spending still looks resilient. Will it last?

* 2yr/10yr Treasury yield curve is inverted, predicting recession

* Italian Prime Minister Draghi resigns, sending Italy into new political turmoil

* US existing home sales fall for fifth straight month in June:

US Q2 GDP Estimate Continues To Slide Ahead Of Official Update

Expectations continue to slide for next week’s release of GDP data for the second quarter (scheduled for July 28). The median estimate is still positive, just barely, but has fallen recently, based a set of nowcasts compiled by CapitaSpectator.com.

Macro Briefing: 20 July 2022

* Brutal heatwave continues to bake Europe

* Extreme heat damages estimated at 0.3% to 0.5% of Europe’s GDP

* Global warming raises risk of extreme heat events

* EU will outline plan to curb Russian gas use as Putin issues new warning

* 100 million Americans issued heat advisory warnings

* UK inflation reaches new 40-year high: +9.4% at annual pace

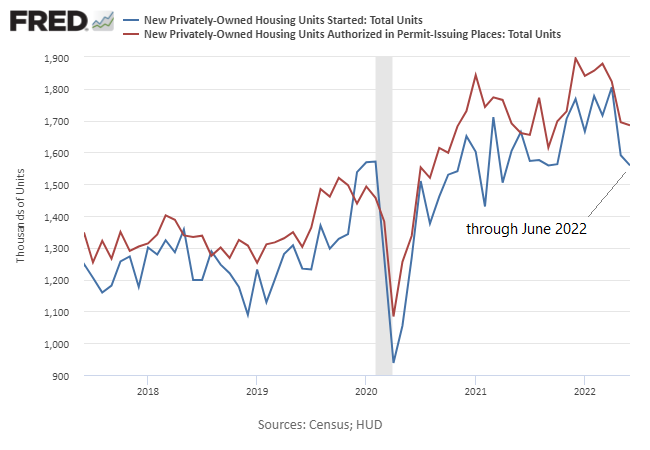

* US housing starts in June fell to lowest level in nine months:

10-Year Treasury Yield ‘Fair Value’ Estimate: 19 July 2022

US headline inflation continues to set to new four-decade highs and the Federal Reserve continues to signal that it will continue raising interest rates. The bond market, however, is starting to consider the possibility that peak inflation and peak policy tightening is approaching.

Macro Briefing: 19 July 2022

* Russia edges closer to shutting gas flow to Europe

* China will take “forceful measures” if US House Speaker Pelosi visits Taiwan

* New coronavirus lockdowns in China raise questions about economic outlook

* Eurozone inflation rises to new record high, adding pressure for rate hikes

* Inflation is “deeply entrenched” in global economy, says Goldman CEO

* Strong dollar is factor weighing on recent fall in commodity prices

* UK is expected to set hottest day for Tuesday

* US homebuilder confidence fell sharply in July:

US Bonds Rallied Last Week, Offering Ballast Vs. Losses Elsewhere

Fixed-income markets in the US reverted to their traditional role of delivering upside support when the rest of the portfolio tanks. It’s too soon to say if this is a return to form for bonds for an extended period, but with more rate hikes expected there’s still plenty of room for debate.

Macro Briefing: 18 July 2022

* Russia’s war against Ukraine looks increasingly like terrorism

* US retail sales rose more than expected in June

* Fed officials signal they are likely to raise interest rates by 0.75 percentage point

* Economic pain is sweeping across Europe (and Russia)

* Consumer sentiment ticked up in July but remains near record low

* US industrial output fell in June–first monthly decline this year

* Earnings season off to slow start, adding new headwind for stocks

* Strong dollar could help the Fed fight inflation

* Mixed jobs data lift uncertainty for US labor market outlook

* Real wage growth is taking a hit from inflation: