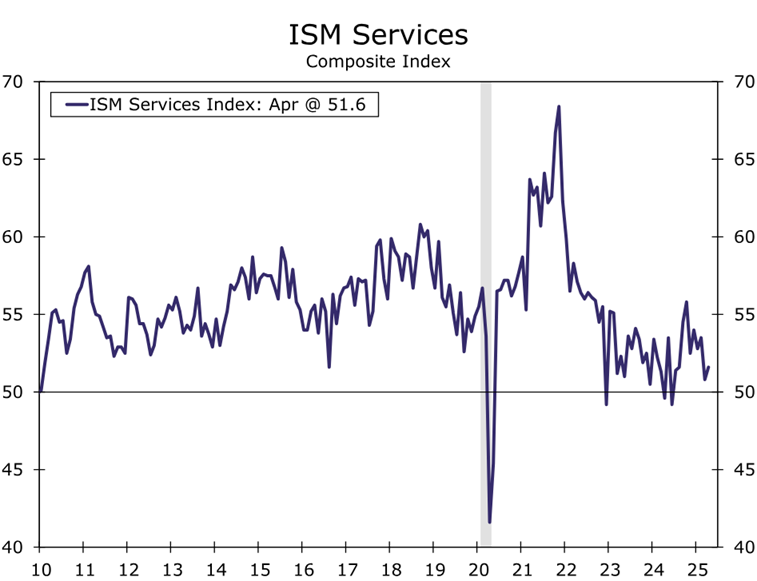

The US services sector posted a stronger growth rate in April, according to the survey-based ISM Services PMI. The indicator edged up to 51.6, reflecting a modest pace of growth by printing above the neutral 50 mark. But in a worrisome sign for the inflation outlook, the prices paid component of the survey rose to a 27-month high.

Monthly Archives: May 2025

Fed Set To Keep Rates Steady, Despite Pressure From Trump

President Trump said he wouldn’t fire Federal Reserve Chairman Powell, but the pressure for rate cuts continues. The market, however, is still betting that the central bank will stand firm and leave its target rate steady at Wednesday’s policy announcement.

Macro Briefing: 5 May 2025

The US unemployment rate was steady in April at 4.2% and nonfarm payrolls rose increased a seasonally adjusted 177,000 last month. “We can push recession concerns to another month. Job numbers remain very strong, suggesting there was an impressive degree of resilience in the economy in play before the tariff shock,” said Seema Shah, chief global strategist at Principal Asset Management. “The economy will weaken in the coming months but, with this underlying momentum, the U.S. has a decent chance of averting recession if it can step back from the tariff brink in time.”

Book Bits: 3 May 2025

● The Singularity Paradox: Bridging the Gap Between Humanity and AI

● The Singularity Paradox: Bridging the Gap Between Humanity and AI

Anders Indset and Florian Neukart

Summary via publisher (Wiley)

The Singularity Paradox: Bridging the Gap Between Humanity and AI is a comprehensive exploration of how the fusion of biology, neuroscience, and artificial intelligence can lead to the creation of Artificial Human Intelligence (AHI) as a conscious response to the unconscious development of superintelligence. Singularity highlights the tension between the boundless possibilities of technological advancement and the potential loss of human autonomy, control, and relevance. AHI may become essential in navigating this singularity and preventing the severe consequences that could arise. The convergence of humanity and technology, shedding light on the ethical, social, and scientific implications of this transformation is taken on with a fresh perspective.

Total Return Forecasts: Major Asset Classes | 02 MAY 2025

The long-run expected total return for the Global Market Index (GMI) ticked higher in April, inching up to an annualized 7.0% from the previous month’s 6.9%. The analysis is based on three models (defined below) for GMI, a global benchmark that’s based on a market-value weighted mix of the major asset classes (excluding cash).

Macro Briefing: 2 May 2025

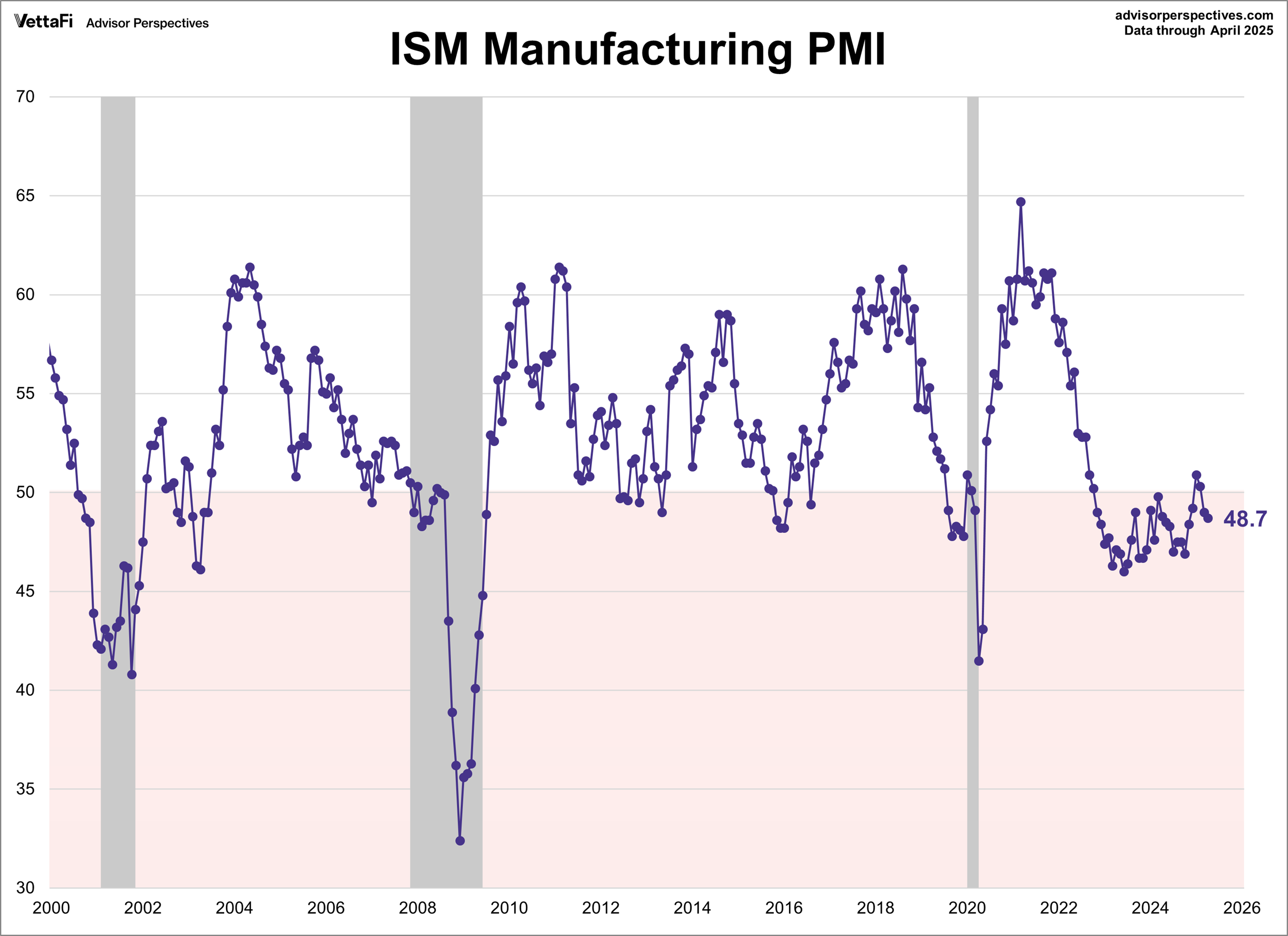

US manufacturing activity contracted for a second month in April, according to the ISM Manufacturing Index, a survey-based profile of the sector. The weak reading indicates that the brief recovery, following a 26-month run of contraction, has faded. “Demand and output weakened while input strengthened further, conditions that are not considered positive for economic growth,” said Institute for Supply Management chair Timothy Fiore said in a press release.

Major Asset Classes | April 2025 | Performance Review

Foreign markets continued to rally in March, leading returns for the major asset classes and extending a bullish trend for foreign assets in 2025, based on a set of ETFs. US stocks, US junk bonds and US property shares, by contrast, continued to lose ground. The big loser in March: commodities, which posted an unusually steep decline.

Macro Briefing: 1 May 2025

US economic activity contracted in the first quarter, according to the government’s preliminary estimate of GDP for the January-through-March period. A key factor in the 0.3% decline was a surge of imports, which subtract from growth for calculating GDP. Imports reduced the headline pace of growth by nearly 5 percentage points, the biggest negative impact on record for this category (since 1947). “Maybe some of this negativity is due to a rush to bring in imports before the tariffs go up, but there is simply no way for policy advisors to sugar-coat this. Growth has simply vanished,” said Chris Rupkey, chief economist at Fwdbonds.