This is the view from my “office” for the next several days, which is to say that the usual routine will be on hiatus until your editor returns to the world headquarters of The Capital Spectator on Friday, Aug. 1. Have a great week. I certainly will. Cheers!

This is the view from my “office” for the next several days, which is to say that the usual routine will be on hiatus until your editor returns to the world headquarters of The Capital Spectator on Friday, Aug. 1. Have a great week. I certainly will. Cheers!

Monthly Archives: July 2025

Book Bits: 26 July 2025

● The Evidence-Based Investor: Overcoming Investment Myths for Better Performance

● The Evidence-Based Investor: Overcoming Investment Myths for Better Performance

Summary via publisher (Palgrave Macmillan/Springer)

Investing is simple in theory, yet difficult in practice. Investors give up returns and often unknowingly increase risk by falling for one or more of the investment myths. This open access book explores why countless investors keep falling into the same traps, warns against the alluring though deceptive voices of the investment world, and unravels ten specific myths that often lead investors astray. To avoid these pitfalls, a scientifically-based and disciplined approach to investing is presented, one which is centered around only three sub-portfolios. Based on empirical and theoretical insights, this book empowers readers to make smarter, better-informed investment decisions. If you want to master the art of investing and build a prosperous financial future, this book will serve as your essential guide. Note: a free, digital “open access” copy of the book is available at the publisher’s site via the “Summary” link above.

Next Week’s Q2 GDP Data Expected To Report Moderate Growth

The US economy remains on track to post a moderate recovery in next week’s second-quarter GDP report, according to nowcasts compiled by CapitalSpectator.com. Meanwhile, new PMI survey data for July suggests growth will strengthen further in the first month of Q3.

Macro Briefing: 25 July 2025

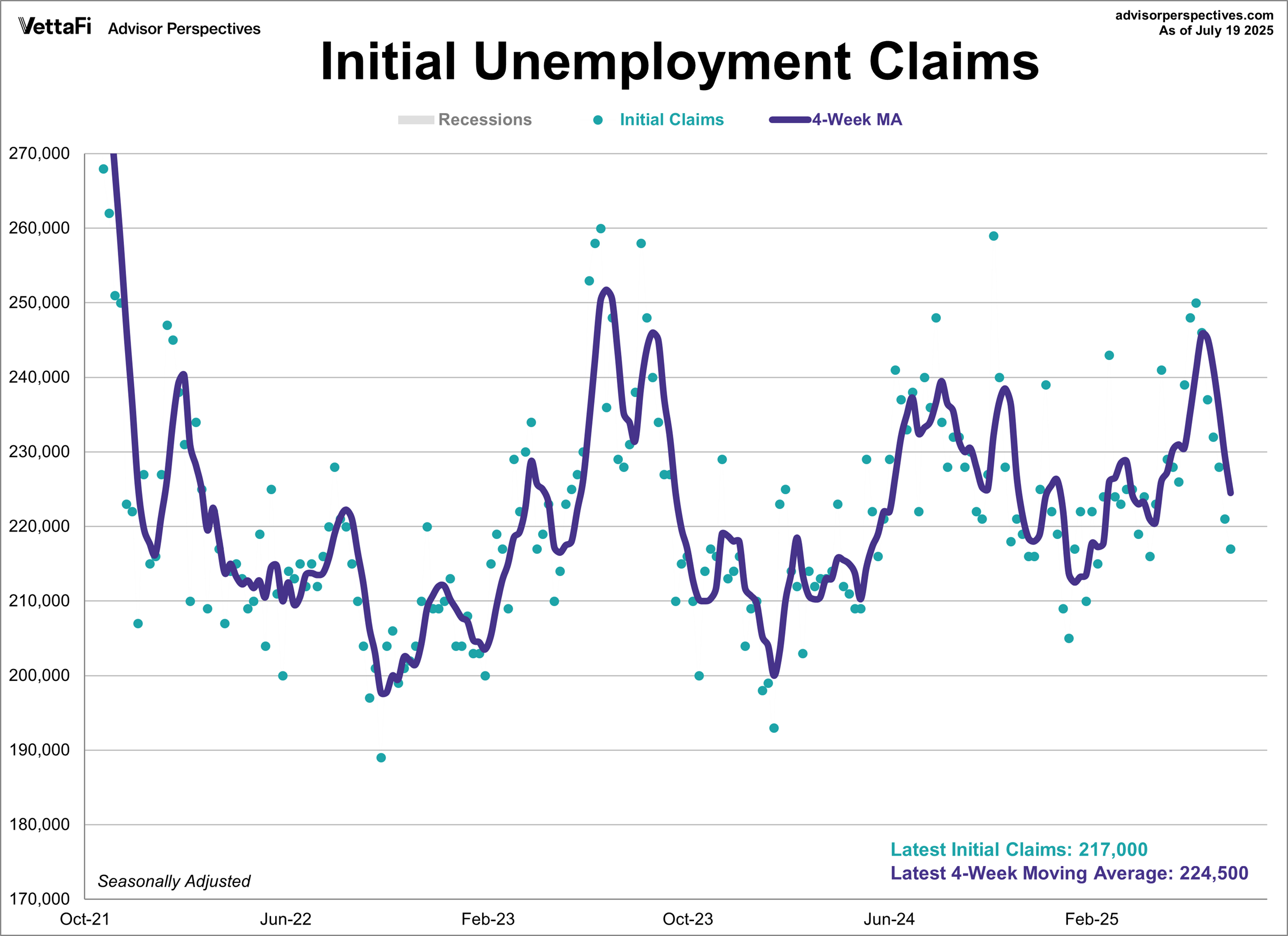

US jobless claims fell for a sixth straight week, dropping to a 3-month low and signaling labor market strength. “The weekly jobless claims give Fed officials no cover whatsoever if they are seriously thinking of cutting interest rates at next week’s meeting,” said Christopher Rupkey, chief economist at FWDBONDS.

Japan Trade Deal Boosts Return Premium For Foreign Stocks

Global equities ex-US were already leading US stocks in 2025 by a wide margin ahead of the trade deal announced this week between the US and Japan. Following the news, shares in Japan surged, providing lift to foreign stocks generally. The US market also rallied on the news, lifting the S&P 500 Index to a new record high. But in relative terms, the international return premium this year has continued to widen, based on a set of ETFs through Wednesday’s close (July 23).

Macro Briefing: 24 July 2025

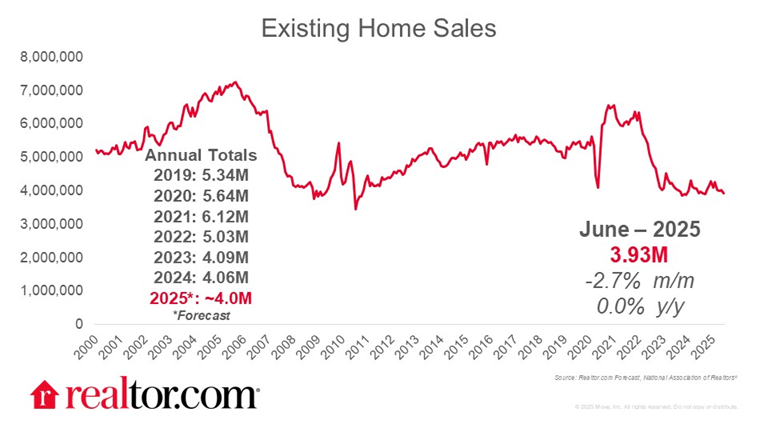

US existing home sales fell 2.7% in June, more than economists expected. The decline left the number of homes sold at the slowest since Sep. 2024. The year-over-year change was flat while the median home price rose 2% two percent from a year ago to $435,300, a record high for the month of June. “Multiple years of undersupply are driving the record-high home price,” said NAR chief economist Lawrence Yun in a statement.

Medium-Term Corporates Lead US Bond Market In 2025

As reported yesterday at CapitalSpectator.com, the bond market is showing a degree of resiliency despite tariff-related inflation risk. Leading the resiliency this year: medium-term corporate bonds, based on a set of ETFs tracking various types of US fixed income securities through Tuesday’s close (July 22).

Macro Briefing: 23 July 2025

Trump announces trade deal with Japan, with tariffs at 15%. Trump said that Japan will “open their Country to Trade including Cars and Trucks, Rice and certain other Agricultural Products, and other things.” Stocks in Japan rose sharply on the news.

Have The Bond Vigilantes Dismissed Tariff-Inflation Risk?

There is no shortage of items to worry about for the bond market. From threats to strongarm the Federal Reserve to push interest rates lower to projections of a deepening federal budget deficit to the potential for higher inflation from tariffs, risk factors abound. Treasury yields, however, continue to trade in a range.

Macro Briefing: 22 July 2025

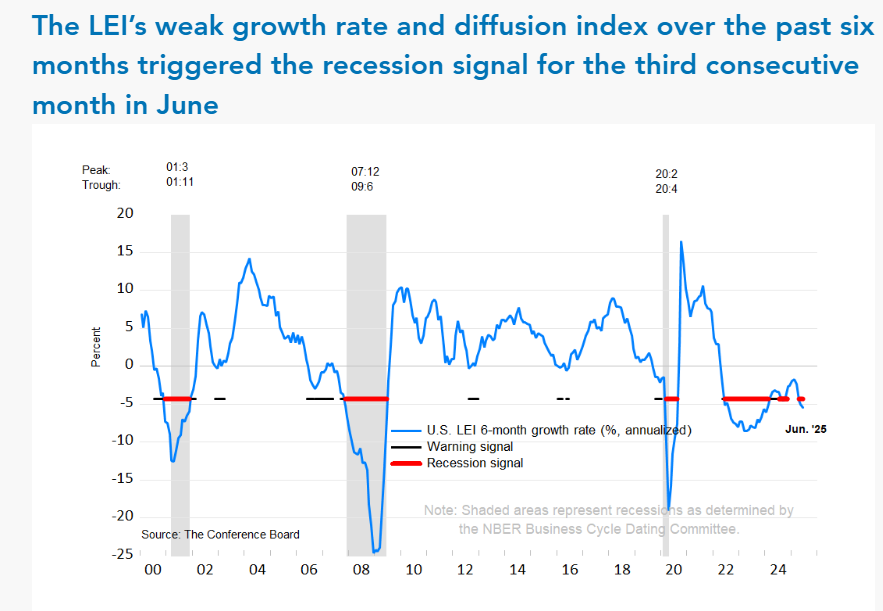

The Conference Board’s Leading Economic Index signaled elevated US recession risk for a third straight month. A spokesperson for the consultancy said: “At this point, The Conference Board does not forecast a recession, although economic growth is expected to slow substantially in 2025 compared to 2024.”