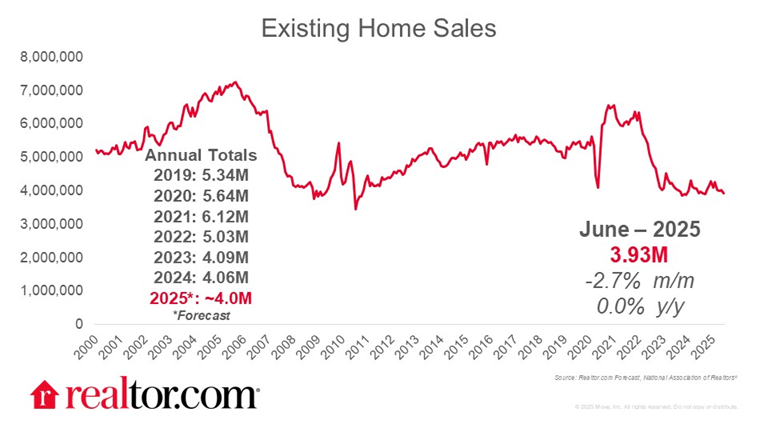

US existing home sales fell 2.7% in June, more than economists expected. The decline left the number of homes sold at the slowest since Sep. 2024. The year-over-year change was flat while the median home price rose 2% two percent from a year ago to $435,300, a record high for the month of June. “Multiple years of undersupply are driving the record-high home price,” said NAR chief economist Lawrence Yun in a statement.

Business year-ahead inflation expectations fell to 2.3%, on average, according to the Atlanta Fed’s July survey. The decline marks the lowest inflation forecast since February.

US importers are paying for most of US tariffs, and higher prices for US shoppers are “in the pipeline,” according to Deutsche Bank. “For now, however, the top-down macro evidence seems clear: Americans are mostly paying for the tariffs,” the bank wrote in a research note.

Europe and Asia continued to show resilience despite uncertainty about tariffs, according to surveys. “Despite the slow downward trend for exports, much of survey data shows the tariff threat hasn’t impacted trade as much as feared when President Trump announced many potential levies in early April,” reports The Wall Street Journal.

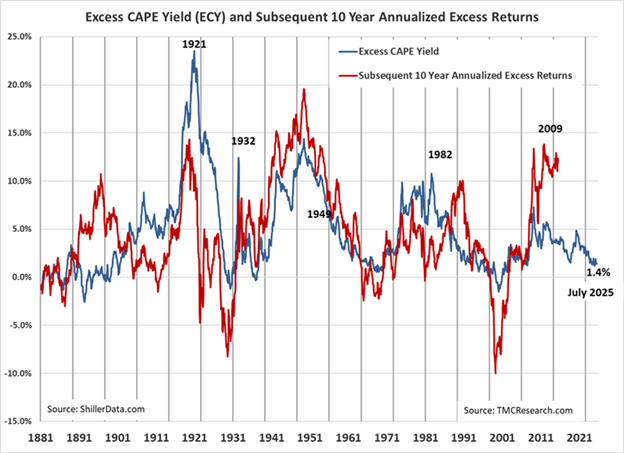

Is it time to consider hedging stock market risk? The answer depends on the investor and the state of the portfolio, advises a note from TMC Research, a unit of The Milwaukee Company.