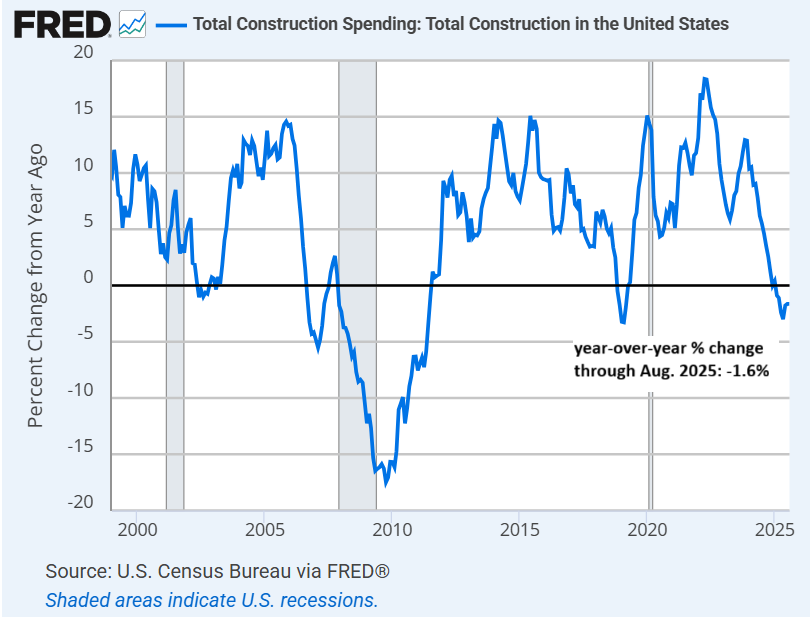

US construction spending continued to decrease in year-over-year terms, dropping 1.6% in August vs. the year-ago level. Spending on an annual basis has been contracting continuously since Feburary.

Fed Governor Waller on Monday voiced support for another interest rate cut at the central bank’s December meeting. “I am not worried about inflation accelerating or inflation expectations rising significantly,” he said. “My focus is on the labor market, and after months of weakening, it is unlikely that the September jobs report later this week or any other data in the next few weeks would change my view that another cut is in order.”

Home Depot’s third-quarter was mixed, the company announced. “While underlying demand in the business remained relatively stable sequentially, an expected increase in demand in the third quarter did not materialize. We believe that consumer uncertainty and continued pressure in housing are disproportionately impacting home improvement demand,” CEO Ted Decker said. The company lowered its fiscal 2025 adjusted earnings forecast but raised its expectations for sales growth.

Goldman Sachs said the stock market has already priced in the AI boom. “Individual companies may be capable of stunning earnings growth for periods of time. But what is true for a single company may not be true on aggregate,” analysts at the firm wrote.

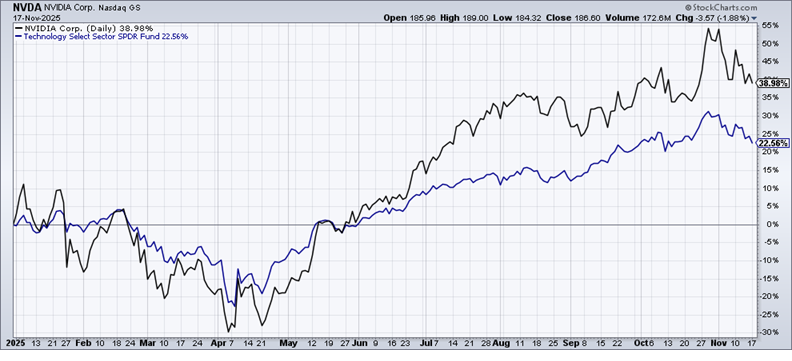

Wall Street is anxiously awaiting earnings data due tomorrow from tech darling Nvidia. “The company, stock and expectations are now so overanalyzed that (it) feels hard for the company to beat and guide up enough to really create a rush of buying right after the fact,” wrote Mizuho Securities trading-desk analyst Jordan Klein in a report Monday. Analysts polled by FactSet expect Nvidia to earn an adjusted $1.25 a share on sales of $54.8 billion in the quarter ended Oct. 26. That would translate to year-over-year growth of 55% in earnings and 56% in sales. Nvidia’s shares continue to outperform tech stocks overall (XLK) by a wide margin year to date: