The delayed third-quarter GDP report will, presumably, be published eventually, but it’s ancient history at this point. The focus has turned to an array of data from various sources for October and November. A consensus view is still evolving, but the main takeaway at the moment is that recession risk still appears low so far in Q4.

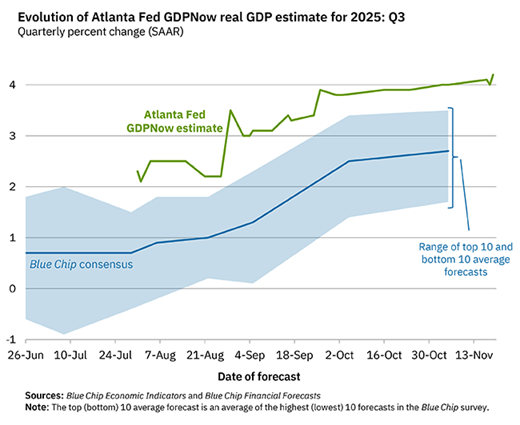

On a GDP level, the tailwind in Q3 still looks strong, based on the Atlanta Fed’s GDPNow model. Last week’s update shows growth accelerated to 4.2% in Q3, up slightly from Q2’s strong 3.8%. Other numbers point to a slowdown in Q3, but even if you favor the lower GDP estimates it seems likely that the worst you can say about the July-through-September period is that the economy slowed, but only moderately.

A similar debate is shaping up for Q4. The main question: How much is the economy slowing in the final quarter of the year?

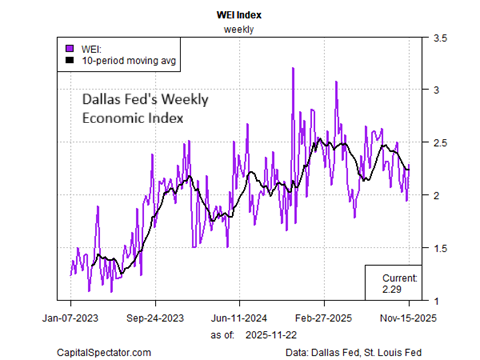

Using the Dallas Fed’s Weekly Economic Index (WEI) as a guide highlights a clear downshift, based on data through Nov. 15. The current estimate indicates four-quarter GDP growth at 2.3%, up slightly from Q2’s 2.1%. The trend has softened recently for WEI estimates, but recession risk remains low by this measure.

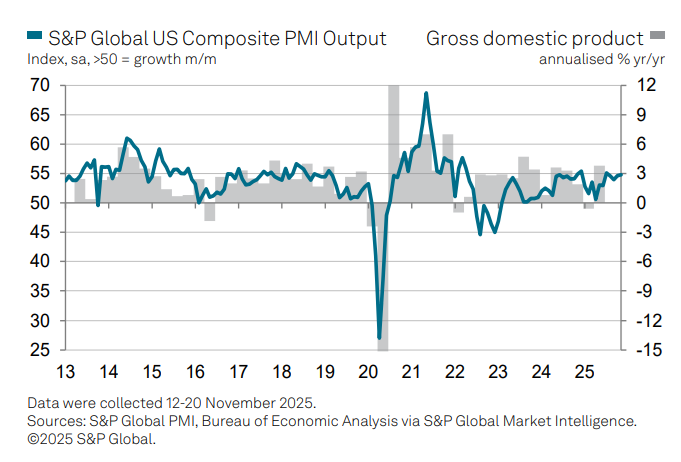

Another early look at November economic activity also paints a relatively upbeat profile. US business activity accelerated for a second successive month in November, according to the US Composite PMI Output Index, a survey-based GDP proxy. “The upturn looks encouragingly broad-based for now, with output rising across both manufacturing and the vast services economy,” said Chris Williamson, chief business economist at S&P Global Market Intelligence. “A marked uplift in business confidence about prospects in the year ahead adds to the good news.”

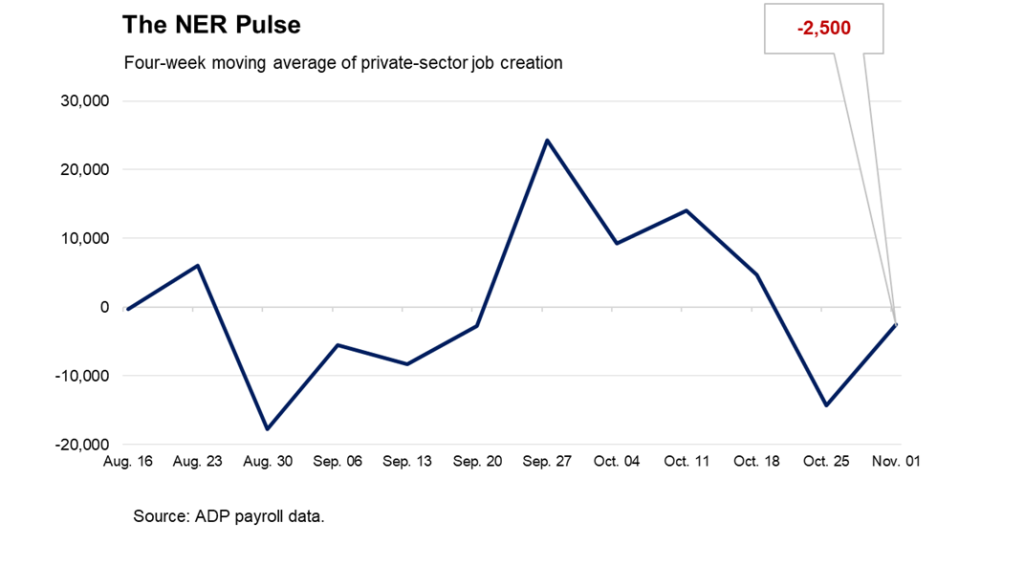

Yet some analysts see trouble approaching. Neil Dutta, head of economics at Renaissance Macro Research, lays out a worrisome scenario, explaining that while “the economy seems OK on the surface” at the moment, “there are serious dangers lurking beneath the surface of our economy, and it is better to clearly identify them than to ignore them in favor of broad aggregate measures.”

The main concern is payrolls, Dutta advises, with “the most worrying signals,” warning that “the labor market remains a source of downside risk for the broader economy.”

Several private sources suggest as much. Revelio Labs estimates that the payrolls contracted in October while ADP reports that “private employers shed an average of 2,500 jobs a week as employment losses slowed heading into November.”

The key question for the near-term economic outlook centers on how the labor market evolves. The payrolls data cited above suggests the die has been cast, but weekly jobless claims – a leading indicator for the labor market – have yet to confirm the darker forecasts. New filings for unemployment benefits fell 8,000 to a seasonally adjusted 220,000 for the week ended November 15, the Labor Department reported last week. In the context of history, that’s a low level and suggests that the labor market is not yet signaling elevated recession risk.

All of this is subject to change, of course. As the government numbers continue to reappear on key aspects of the economy, some of the mystery will lift on Q4. For now, it’s premature to assume that a recession has started or is imminent.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report