● Pay Up!: Conservative Myths About Tax Cuts for the Rich

● Pay Up!: Conservative Myths About Tax Cuts for the Rich

John C. Campbell

Summary via publisher (Cambridge U. Press)

Since the Reagan era, conservatives in the United States have championed cutting taxes, especially for wealthy individuals and corporations, as the best way to achieve economic prosperity. In his new book, Pay Up!, John L. Campbell shows that while these claims are highly influential, they are also wrong. Using historical and cross-national evidence, the book challenges and refutes every justification conservatives have made for tax cuts – that American taxes are too high; they hurt the economy; they facilitate government waste; they constitute an unfair downward redistribution of income; and they threaten individual freedom – and conversely shows that countries can actually benefit from higher taxes, especially when tax increases fall most heavily on those most able to pay them.

Foreign Bonds Remain A Winning Trade In 2025

Tilting portfolios toward non-US bonds has been a successful strategy for fixed-income allocations in 2025. The Federal Reserve’s recent pivot to rate cuts could keep the trend humming through the rest of the year.

Macro Briefing: 26 September 2025

US jobless claims fell again last week, blunting concerns that the labor market is in danger. First-time filings for the week ended Sept. 20 totaled a seasonally adjusted 218,000, close to the lowest level this year.

Is A Highly Valued Stock Market A Warning Or The New Normal?

The legendary investor Sir John Templeton famously warned: “The four most dangerous words in investing are: ‘This time it’s different.'” The caveat is once again topical as the stock market continues to rise despite high valuations. The rationale: artificial intelligence has changed the game.

Macro Briefing: 25 September 2025

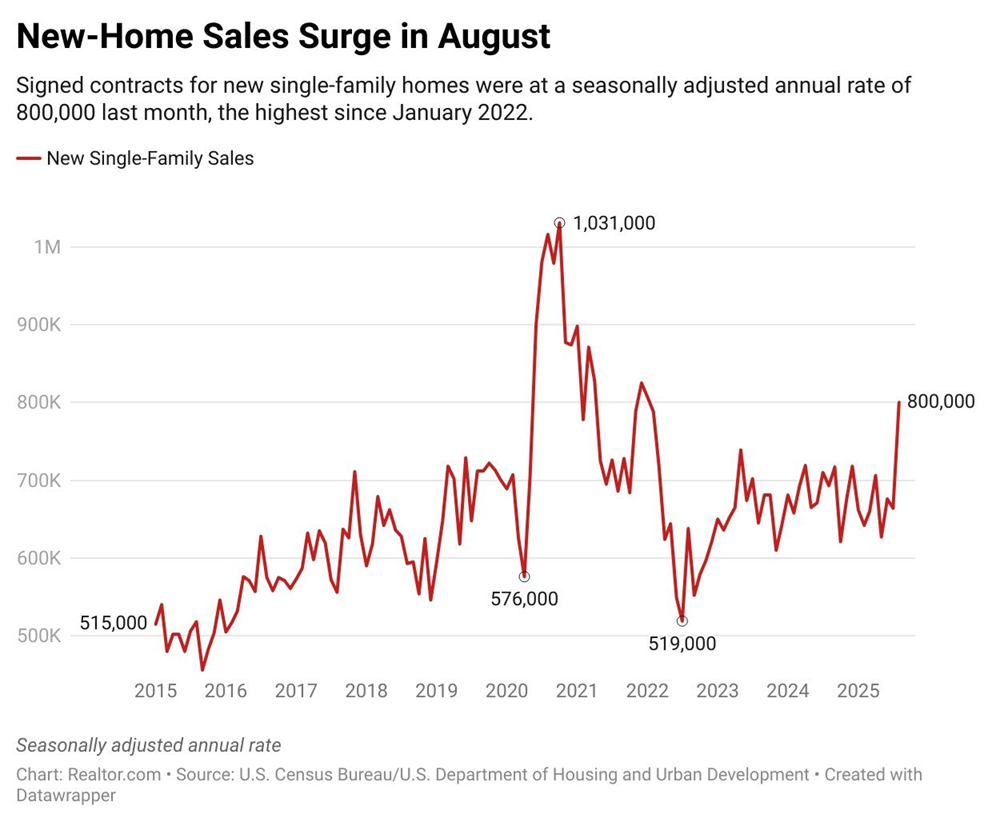

New US home sales surged in August. Signed contracts for new single-family homes jumped to a seasonally adjusted annual rate of 800,000, a 21% from the previous month and 15% above the year-ago level. Nancy Vanden Houten, a lead US economist at Oxford Economics, said the increase “likely overstates any improvement in housing activity. New home sales are prone to heavy revisions. A flat-ish trend in sales, similar to what has been evident all year, seems more likely.”

US Q3 GDP Nowcasts Indicate Solid Growth After Fed Rate Cut

US economic growth is still on track to expand at a moderate pace in the third quarter, based on the median estimate for a set of nowcasts compiled by CapitalSpectator.com. The upbeat outlook follows last week’s decision by the Federal Reserve to cut its target interest rate to address concerns that the labor market is cooling.

Macro Briefing: 24 September 2025

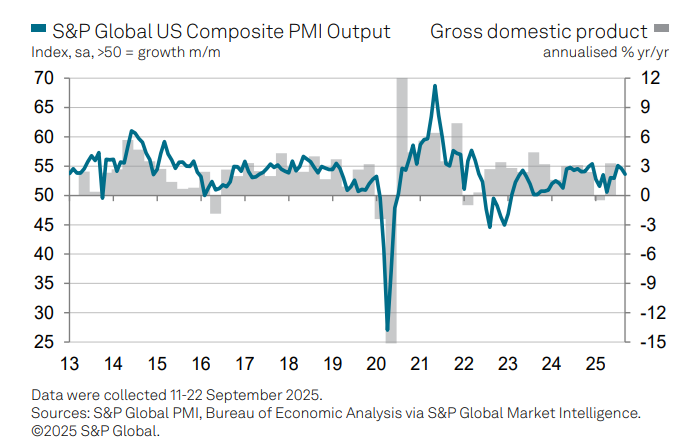

US economic growth cools in September, according to the Composite PMI Output Index, a survey-based GDP proxy. Although the pace downshifted for a second month, “Further robust growth of output in September rounds off the best quarter so far this year for US businesses,” says Chris Williamson, chief business economist at S&P Global Market Intelligence.

US Recession Risk Is Still Low – Will It Last?

Recession forecasts are in vogue again, and for obvious reasons. The status quo on the macro front has been torn asunder this year and uncertainty has spiked about what it means for the economy. The unsettling news flow has triggered warnings in some circles that the end is near for the current economic expansion. Perhaps, but a careful review of a broad range of indicators suggests that its still premature to assume that something worse than a growth slowdown is fate.

Macro Briefing: 23 September 2025

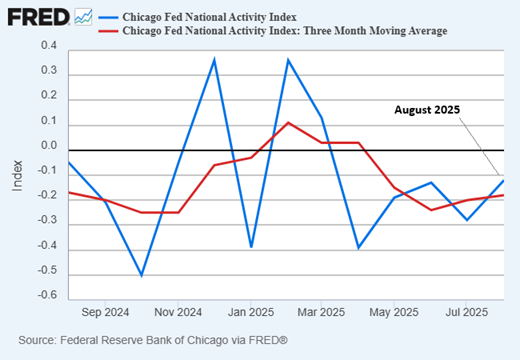

US economic activity strengthened in August, according to the Chicago Fed National Activity Index. Although output remained below trend, the monthly reading picked up to the strongest reading since March.

Mega And Micro Cap Stocks Are Battling For First Place In 2025

For much of the year, bigger has been better in terms of performance based on market cap. But the smallest tier of firms (micro-caps) are suddenly giving the biggest names (mega caps) a run for their money in year-to-date terms, based on a set of ETFs through Friday’s close (Sep. 19).