The legendary investor Sir John Templeton famously warned: “The four most dangerous words in investing are: ‘This time it’s different.'” The caveat is once again topical as the stock market continues to rise despite high valuations. The rationale: artificial intelligence has changed the game.

Macro Briefing: 25 September 2025

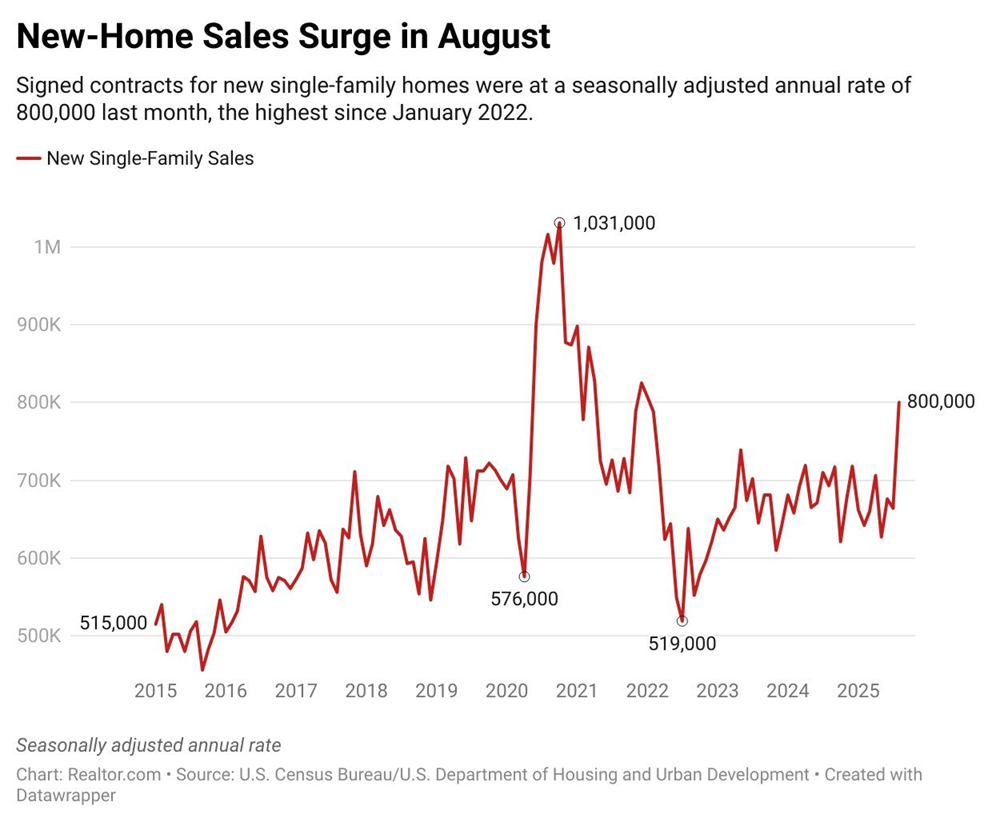

New US home sales surged in August. Signed contracts for new single-family homes jumped to a seasonally adjusted annual rate of 800,000, a 21% from the previous month and 15% above the year-ago level. Nancy Vanden Houten, a lead US economist at Oxford Economics, said the increase “likely overstates any improvement in housing activity. New home sales are prone to heavy revisions. A flat-ish trend in sales, similar to what has been evident all year, seems more likely.”

US Q3 GDP Nowcasts Indicate Solid Growth After Fed Rate Cut

US economic growth is still on track to expand at a moderate pace in the third quarter, based on the median estimate for a set of nowcasts compiled by CapitalSpectator.com. The upbeat outlook follows last week’s decision by the Federal Reserve to cut its target interest rate to address concerns that the labor market is cooling.

Macro Briefing: 24 September 2025

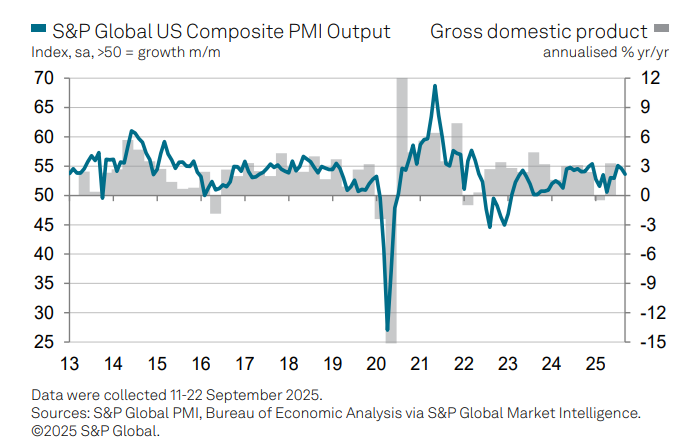

US economic growth cools in September, according to the Composite PMI Output Index, a survey-based GDP proxy. Although the pace downshifted for a second month, “Further robust growth of output in September rounds off the best quarter so far this year for US businesses,” says Chris Williamson, chief business economist at S&P Global Market Intelligence.

US Recession Risk Is Still Low – Will It Last?

Recession forecasts are in vogue again, and for obvious reasons. The status quo on the macro front has been torn asunder this year and uncertainty has spiked about what it means for the economy. The unsettling news flow has triggered warnings in some circles that the end is near for the current economic expansion. Perhaps, but a careful review of a broad range of indicators suggests that its still premature to assume that something worse than a growth slowdown is fate.

Macro Briefing: 23 September 2025

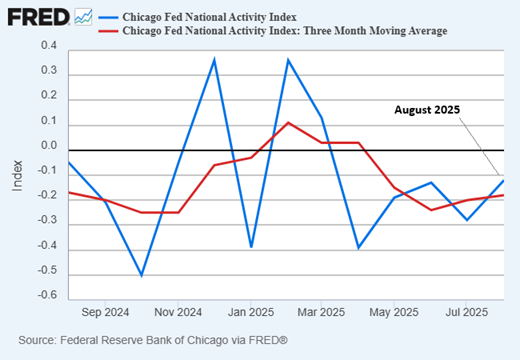

US economic activity strengthened in August, according to the Chicago Fed National Activity Index. Although output remained below trend, the monthly reading picked up to the strongest reading since March.

Mega And Micro Cap Stocks Are Battling For First Place In 2025

For much of the year, bigger has been better in terms of performance based on market cap. But the smallest tier of firms (micro-caps) are suddenly giving the biggest names (mega caps) a run for their money in year-to-date terms, based on a set of ETFs through Friday’s close (Sep. 19).

Macro Briefing: 22 September 2025

Markets signal more Fed rates cuts ahead. After the Federal Reserve cut interest rates last week, Fed funds futures are pricing in high odds that the central bank will ease monetary policy again at the next two policy meetings remaining in 2025. The policy-sensitive 2-year yield is trading well below the current target-rate range, which equates with expectations for more rate cuts. Meanwhile, TMC Research’s Fed funds model is indicating that policy remains moderately tight, which implies the central bank will continue to ease.

Book Bits: 20 September 2025

● How Progress Ends: Technology, Innovation, and the Fate of Nations

● How Progress Ends: Technology, Innovation, and the Fate of Nations

Carl Benedikt Frey

Review via Publishers Weekly

Technological advancement stagnates when met with bureaucratic sclerosis and corporate monopoly, according to this probing study from Oxford economic historian Frey (The Technology Trap). From early civilizations to the modern era, Frey examines countervailing systems for nurturing technological progress. One is a centralized state that imposes change from the top—like ancient China, which developed cast iron, printing, and other technologies long before Europe did. The other is a decentralized system that encourages exploration—as in the U.S. from the Industrial Revolution onward—where inventors can find private and public investors to fund long-shot experiments. Moving to the present, Frey argues that Silicon Valley dominated the digital age through its startup and venture capital symbiosis, and China became an industrial behemoth with a hybrid of capitalist firms and a strong state. He’s pessimistic about the future prospects for innovation in both countries, however

Corporates Are Leading The Bond Market This Year

In a turbulent year for the fixed-income market, corporate bonds have emerged as the top performer for the asset class in 2025, based on a set of ETFs through Thursday’s close (Sep. 18).