Commodities have joined the party. After last week’s rally that lifted a broad measure of commodities, all the major asset classes are now posting gains for the year to date through Friday’s close (July 28), based on a set of ETFs.

WisdomTree Enhanced Commodity Strategy Fund (GCC) rose 1.5% in the past trading week. The gain marks the ETF’s fourth straight weekly advance, a boost that lifted the fund in positive terrain for year-to-date results, albeit fractionally, for the first time since April. Several other broadly defined commodity ETFs are also posting year to date gains, including iShares S&P GSCI Commodity-Indexed Trust (GSG), which is up 1.0% in 2023.

Higher energy prices have been key driver of recent strength in broad commodity indexes. Crude oil (USO), for instance, is on track to record its biggest monthly gain in more than a year.

“Oil prices are up 18% since mid-June as record high demand and Saudi supply cuts have brought back deficits, and as the market has abandoned its growth pessimism,” note analysts at Goldman Sachs in a research note published July 30.

The renewed strength in commodities translates into across-the-board gains for the major asset classes. One thing that hasn’t changed: US stocks continue to lead global markets by a wide margin.

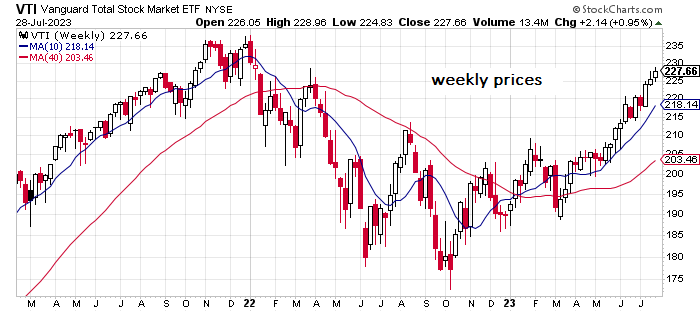

Vanguard Total US Stock Market Index Fund (VTI) has rallied 20.0% this year. Last week’s 1.0% gain for the ETF is the third straight increase, lifting the fund to its highest close since January 2022.

The Global Market Index (GMI) is also enjoying a strong year-to-date performance. GMI is up 14.6% through Friday’s close, a sizzling gain for a multi-asset-class benchmark. This unmanaged index (maintained by CapitalSpectator.com) holds all the major asset classes (except cash) in market-value weights and represents a competitive benchmark for multi-asset-class portfolios.

This year’s broad-based rally in markets suggests that most investment strategies are sitting on handsome gains too, in no small part due to a solid tailwind. For strategies that are underperforming or underwater, the likely explanation is bad luck or incompetence. Any active strategy can suffer in relative and/or absolute terms, but it takes extraordinary effort to stumble at a time when everything’s rallying.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Animal Spirits: Everything Is Up This Year - The Irrelevant Investor