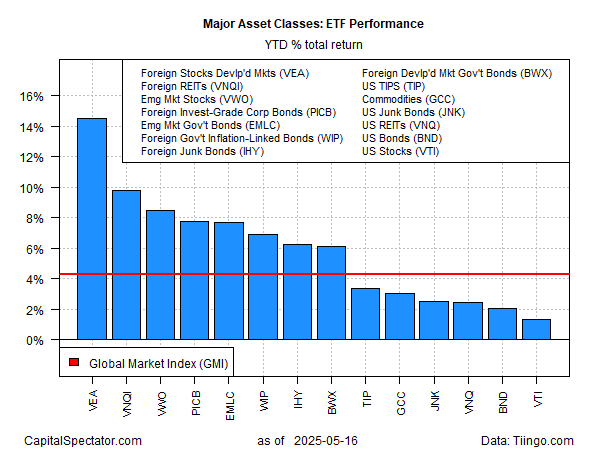

Market sentiment has been a wild ride in recent months, but for the moment investors are breathing a sigh of relief, based on a set of ETFs tracking the major asset classes for year-to-date returns through Friday’s close (May 16).

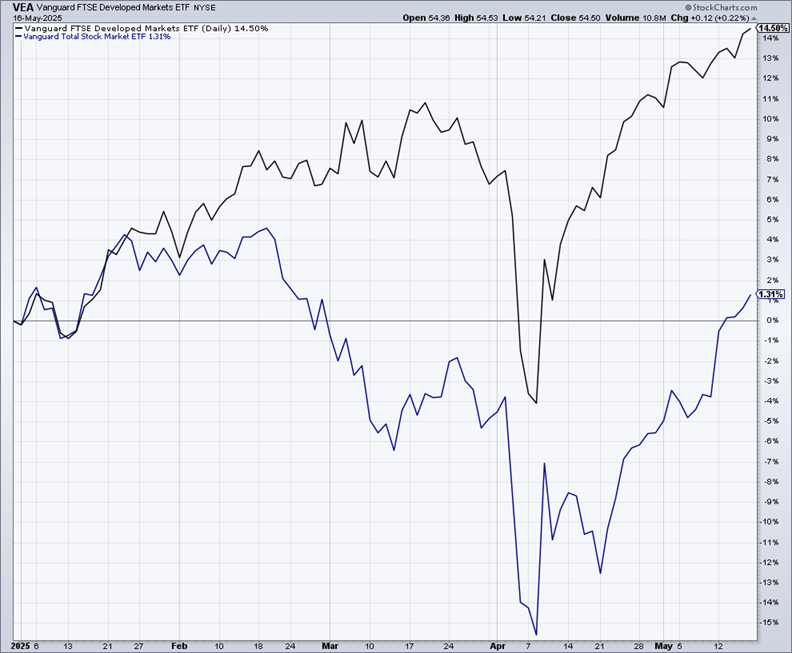

Foreign stocks in developed markets ex-US remain the top performer in 2025. Vanguard FTSE Developed Markets (VEA) is up a strong 14.5% so far this year, far ahead of the rest of the field.

US stocks have also rebounded and are no longer in the red, although American shares continue post the weakest performance this year. The Vanguard Total US Stock Market ETF (VTI) is up 1.3%. Although that’s a modest gain, it marks a sharp recovery after posting a year-to-date decline of more than -15% at one point in April (blue line in chart below).

The Global Market Index (GMI) is up 4.3% so far this year. GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolio strategies.

The recovery in asset prices suggests that investors have become more comfortable with tariff risk, the dominant factor that triggered the recent selloff. But there’s still uncertainty about where markets go from here as the end game for the trade war remains open for debate. The pause in tariffs is temporary and negotiations are, at best, a mixed bag of results so far.

Meanwhile, investors will be monitoring how markets react this week to Friday’s news that Moody’s downgraded the US credit rating a notch due to the to the federal government’s growing budget deficit and inability of politicians to reign in spending growth. The current Republican spending bill that was approved by the Budget Committee in the House late Sunday night suggests that fiscal reform is still a low priority. As reported by The Wall Street Journal: the bill doesn’t reduce the federal deficit and instead is projected to increase the red ink on the government ledger by nearly $3 trillion through 2034.

“What Moody’s sees, plain and simple, is that the ballooning debt is not being addressed,” said George Lagarias, chief economist at Forvis Mazars, a tax and accounting consultancy. “The Republican mega bill is also contributing to rising yields.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report