For a second straight week, all the major asset classes fell in trading through Friday’s close (Sep. 23), based on a set of ETF proxies. From bonds to stocks, along with real estate shares and commodities, red ink swept across global markets.

US bonds posted the softest loss, based on Vanguard Total Bond Market (BND). This broad portfolio of governments and investment-grade corporates fell 1.6%, marking the ETF’s sixth consecutive weekly decline.

The key catalyst, of course, is ongoing rate hikes by the Federal Reserve, which announced another hefty 75-basis-points increase last week. Fed funds futures are currently pricing a 70%-plus probability of a repeat performance at the next FOMC meeting on Nov. 2, according CME data.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

“Bottom line, all those years of central bank interest-rate suppression — poof, gone,” says Peter Boockvar, chief investment officer at Bleakley Advisory Group. “These bonds are trading like emerging market bonds, and the biggest financial bubble in the history of bubbles, that of sovereign bonds, continues to deflate.”

The deepest loss last week: real estate shares ex-US: Vanguard Global ex-U.S. Real Estate (VNQI) fell nearly 7%.

A second week of losses weighed on the Global Market Index (GMI.F), which fell 4.6% — the fifth weekly loss in the past six. This unmanaged benchmark, maintained by CapitalSpectator.com, holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive index for multi-asset-class portfolio strategies overall.

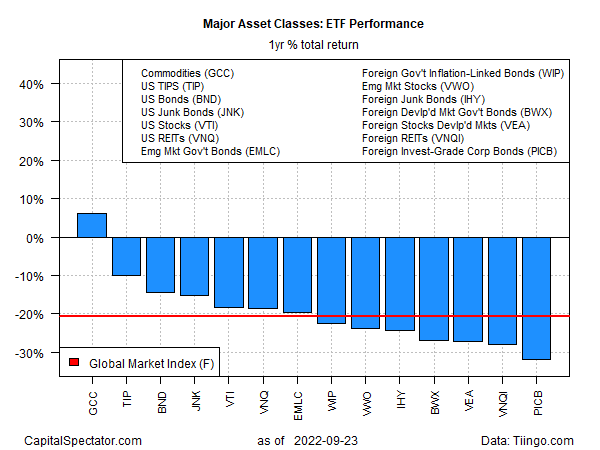

For the one-year window, commodities (GCC) are holding on to a moderate gain — the only asset class that’s still up for this trailing period.

The rest of the major asset classes remain in the red. Foreign corporate bonds (PICB) continue to post the deepest one-year loss: a steep 30%-plus decline.

GMI.F is down a bit more than 20% for the past year.

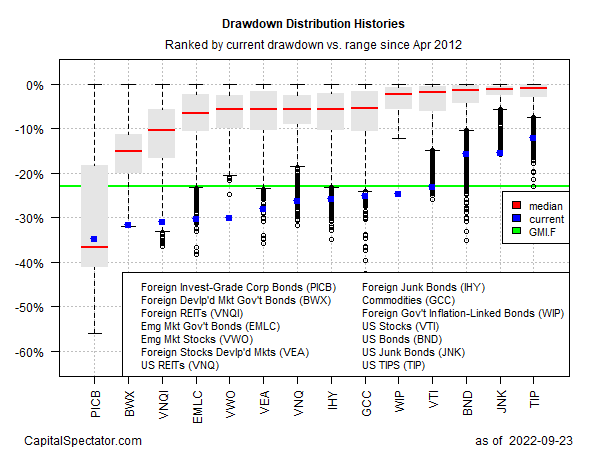

Using a drawdown lens to review price trends shows that all the major asset classes are posting peak-to-trough declines deeper than -10%. The smallest drawdown at last week’s close: a relatively modest 12.1% slide from the previous peak for inflation-protected Treasuries (TIP).

GMI.F’s drawdown: -23.0% (green line in chart below).

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno