* Ukraine asks for more help, says Russia wants to split nation

* Territorial integrity is essential, Ukraine insists ahead of talks with Russia

* Biden’s remark on Putin creates anxiety for allies in West

* Defense companies eye rising military budgets sparked by Ukraine invasion

* Europe’s economy slows as Ukraine war takes a toll

* India buys discounted Russian oil and China may follow

* Part of the Treasury yield curve inverts for first time since 2006

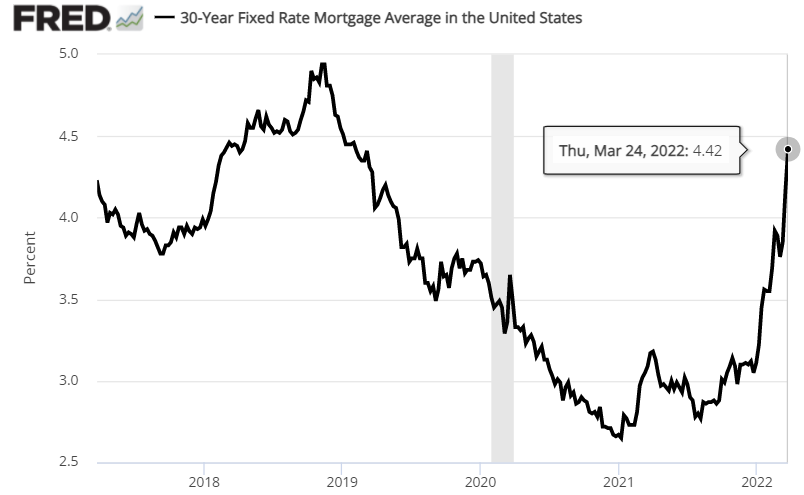

* US average 30-year mortgage rate rises to three-year high:

Author Archives: James Picerno

Book Bits: 26 March 2022

● In Defence of Wealth: A Modest Rebuttal to the Charge the Rich Are Bad for Society

Derek Bullen

Q&A with author via Grit Daily

Q: When you speak of wealth creators you refer to “the few who can invest, take risks, innovate and transform their ideas into successful businesses that create wealth and employ others.” Do you think that would grind to a halt if the earnings of hedge fund managers were taxed as income instead of as capital gains, or if the marginal tax rate were increased a few percent?

A: Yes, I do believe that unfair taxation is extremely costly to the society that imposes it. Taxing the rich has been popular over the centuries, yet always with disastrous consequences. Wealthy people know when they are overtaxed and either move or stop buying. This isn’t my opinion, this is fact. Here are two recent examples of how a tax increase of a few percent was enormously costly to the governments of France and the US….

US Economy Appears Resilient As Headwinds Strengthen

The blowback from the war in Ukraine has only just started to rock the global economy, but the early clues for the US remain encouraging. There’s a long road ahead and it’s too early to make high-confidence forecasts, but preliminary data for March suggest that growth still has the upper hand.

Macro Briefing: 25 March 2022

* Biden meets with NATO allies, which strengthen troops in eastern Europe

* Poland becomes America’s ‘indispensable’ ally as Ukraine war rages

* EU signs deal with US for more shipments of liquefied natural gas to Europe

* Will Putin lash out dangerously if Russia becomes bogged down in Ukraine?

* Biden says to expect food shortages due to Ukraine war

* German leading indicator tumbles in March amid Ukraine war blowback

* Considering how inflation could ease without a recession

* Durable goods orders in US fell in February–first monthly slide in 5 months

* US business activity accelerated in March via PMI survey data

* US jobless claims fell last week to lowest level since 1969:

Market Volatility Triggers Reset In Asset Class Correlations

The relatively high return correlations across markets in recent years are giving way as volatility surges in 2022. As a result, assumptions about relationships between markets, and the degree of diversification benefits, may be in need of updating.

Macro Briefing: 24 March 2022

* Biden in Brussels for meetings with NATO, G-7 and European Union

* N. Korea test fires intercontinental ballistic missile, Japan reports

* Eurozone business activity slowed in March via PMI survey data

* Fed’s goal of soft landing for economy appears to face low odds

* Oil prices rise after Russia reports extended pipeline outage

* Putin says ‘unfriendly’ countries must pay for gas in rubles

* Russia’s invasion of Ukraine marks end of globalization, writes BlackRock’s Fink

* New US home sales fell for a second month in February

* US gasoline prices remain elevated, close to previous high in 2008:

Profiling The Key Macro Drivers For The US Labor Market

Morningstar recently observed that accurately assessing the directional strength or weakness of the US labor market requires a broad review of factors. Correctly advising in December that the weak print for the then-current payrolls report (November) was “likely just a blip given strength,” based on a more expansive read of economic data. The analysis inspires a deeper look into macro factors in search of perspective to the question: What’s relevant (or not) for evaluating labor market activity?

Macro Briefing: 23 March 2022

* US and allies to unveil new Russia sanctions as Biden visits Europe this week

* Is it time for NATO to take a more direct response to Russia’s war on Ukraine?

* Will the war in Ukraine disrupt Europe’s shift to clean energy?

* Global bond market posts biggest drawdown on record (since 1990)

* US gasoline prices rise at fastest pace on record

* UK inflation reaches new multi-decade high, driven by energy prices

* Fed funds futures predicts 60%-plus probability of 1/2 point rate hike in May

* US 10yr Treasury yield continues rising, reaching highest since May 2019:

Is US Recession Risk Rising?

The easy answer is almost certainly “yes.” The more challenging question: Does a recession call rise to the level of a high-confidence forecast? No, not yet. For now, and probably for the immediate future, a high level of uncertainty will continue to keep the crowd guessing.

Macro Briefing: 22 March 2022

* European Union support is rising for banning Russian oil

* Intelligence indicates growing Russian cyber threat to US, Biden says

* Fed will raise rates more aggressively if needed, says Fed’s Powell

* Powell’s comments on tackling inflation are wake-up call for Wall Street

* Fed’s Powell says short-Term yield curve is better recession risk predictor

* US housing market set for ‘substantial downshift in activity,’ economist predicts

* US economic growth remained solid in February, via Chicago Fed index: