Most markets around the world staged a strong rebound last week, led by stocks in foreign developed markets ex-US, as of Friday’s close (Mar.18). The main exceptions: US bonds and commodities, which posted the only setbacks for the major asset classes last week, based on a set of ETFs.

Author Archives: James Picerno

Macro Briefing: 21 March 2022

* Russia’s war on Ukraine forces 10 million-plus people to abandon their homes

* Ukraine rejects Russia’s demand to surrender city of Mariupol

* Biden to visit Poland on Europe trip this week

* Strained US-Saudi relations complicate effort to raise oil output

* US Supreme Court Justice Clarence Thomas admitted to a hospital

* European Union considers banning Russia oil imports

* Germany reports long-term agreement with Qatar for natural gas supply

* US existing home sales fell more than expected in February

* 10-year Treasury pulled back on Friday after reaching 2.20%:

Book Bits: 19 March 2022

● The Bond King: How One Man Made a Market, Built an Empire, and Lost It All

Mary Childs

Review via The Wall Street Journal

“The Bond King” titillates with its subtitle: “How One Man Made a Market, Built an Empire, and Lost It All.” But Wall Street has a slightly different recollection of Bill Gross, co-founder, in 1971, of Pimco, the giant California money management firm. Closer to the plain truth might be: “How One Man Reimagined a Market, Built a Business, Got Rich, and Stayed Rich.” Mr. Gross, 77, was the chief investment brain, public voice and institutional face of Pimco until his exasperated partners gave him the gate in 2014.

Research Review | 18 March 2022 | Commodities and Inflation

Performance of Gold as a Financial Asset During Different Phases of Financial Cycles

Aniket Ranjan and Naveen Kumar (Reserve Bank of India)

January 2022

The paper examines the fundamental relationship between gold and financial markets within the framework of unobserved components model. It measures the performance of gold as a financial asset during different phases of financial cycles (credit, equity and property). The paper explores discrete series of peaks and troughs to determine the financial cycles across markets using a combination of Baxter-King filter and Harding and Pagan’s methodology. The paper estimates the time varying coefficients by regressing gold returns on other assets like US dollar (DXY) and stocks (MSCI) to evaluate the diversifying attribute of gold. It further explores the time-dependent relationship between gold returns and financial market characteristics like liquidity, volatility and yield spread to better understand its role as a safe haven. The results show that gold does behave like a diversifying asset and can be used as a risk hedge during turbulent times. The results illustrate that this attribute is strengthened during periods of volatility which places gold as a safe haven asset. This behaviour is also reflected in the rise of gold prices after the global financial crisis as well as the most recent Covid-19 related market upheavals.

Macro Briefing: 18 March 2022

* Biden and Chinese leader Xi Jinping set for talk today

* Chinese carrier sails through Taiwan Strait ahead of Biden-Xi call

* Russian missiles strike western Ukraine city, near Polish border

* Surging Covid-19 cases in Europe suggest new wave will soon strike US

* Russian oil exports to India have quadrupled this month

* Mega-drought in American West is expected to continue in the months ahead

* US jobless claims fell last week, signaling tight labor market

* Philly Fed manufacturing indicator indicates faster growth in March

* US housing construction rose in February to highest level since 2006:

US Bond Market Under Pressure As Fed Raises Interest Rates

The Federal Reserve on Wednesday raised its target interest rate by ¼ point, the first hike since 2018. The shift in the posture of monetary policy isn’t surprising, given the surge in inflation. Equally unsurprising is the weak performance of fixed-income securities this year, which continue to price in rough times ahead for the asset class overall.

Macro Briefing: 17 March 2022

* West says Russia becoming bogged down in Ukraine war

* Fed raises its benchmark interest rate 1/4 point–first hike since 2018

* Fed Chair Powell says recession risk is “not particularly elevated,” but…

* Some economists predict the Fed will cause a recession

* Russia is seizing hundreds of commercial jets owned by US and European firms

* Import prices for US rose 10.9% over past year, feeding into high inflation

* US homebuilder sentiment slips in March, fourth straight monthly decline

* Atlanta Fed business inflation expectations continue rising in March

* US retail sales rose less than expected in February as inflation heats up:

Fed To Start Hiking Rates As US Growth Slows And Inflation Spikes

The Federal Reserve finds itself in an especially tough spot: raising interest rates at a time when economic growth is slowing. The rationale for tightening policy is that inflation is surging and so pricing pressure overrides any concerns for growth.

Macro Briefing: 16 March 2022

* Ukraine’s Zelensky to ask US Congress for more help in speech today

* European leaders travel to Kyiv as Russia bombs the Ukrainian city

* Russia’s foreign minister says there is ‘hope’ for compromise with Ukraine talks

* Russia may default on its debt today as payments are due

* Forecasters raise US recession risk estimates as inflation outlook increases

* Fed funds futures predict a 25-basis-point rate hike for today’s FOMC meeting

* Raskin withdraws her candidacy for Federal Reserve board

* US wholesale inflation eases in February but still up 10% from year ago

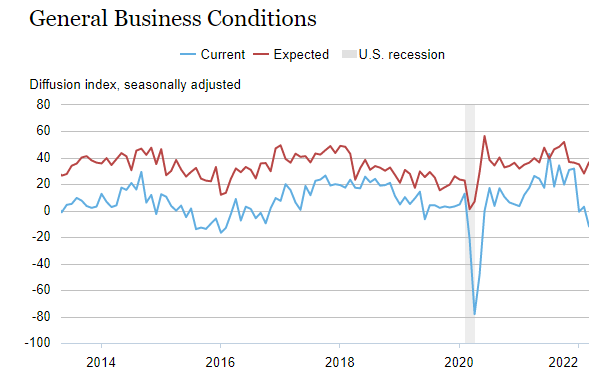

* NY Fed Mfg Index shows contraction in March–first decline in nearly two years:

The Inflation “Cycle” Looks Unusually Hot

We already know that the recent inflation surge is still accelerating, and that it’s likely to heat up further in the months ahead as effects from the Ukraine war begin to factor into the data. One question that comes up is whether some or most of this pricing pressure is noise or signal? For some perspective, let’s estimate the inflation “cycle,” based on a simple estimate that attempts to capture the longer-term ebb and flow of inflation.