The US stock market appears to be caught in another one of its extended corrections. Is this the start of a long bear market? Or could this be just another garden variety correction that ends quickly? As always, the future’s uncertain. All the more so given the global blowback due to the war in Ukraine.

Author Archives: James Picerno

Macro Briefing: 8 March 2022

* Ukraine president remains defiant as Russian invasion continues

* US moving closer to Russian oil ban

* Russia says it may cut off gas supply to Germany if West bans Russian oil

* Five possible outcomes for the war in Ukraine

* A global food crisis may be lurking due to the war in Ukraine

* UK facing recession if energy prices remain high, research group advises

* Biden will sign exec order for overseeing cryptocurrencies

* US gasoline prices reaches a record high

* Can China bail out Russia’s economy? That’s going to be quite challenging

* Despite surging oil prices, Russia’s oil industry is heading for rough times

* Germany’s industrial output surged in January, ahead of the war in Ukraine

* US Dollar Index at highest in nearly 2 years as demand increases for safe assets :

Commodities Continue To Soar As Ukraine War Rages

Commodities remained the best-performing asset class by far last week for the major asset classes, based on a set of ETFs through Friday’s close (Mar. 4). The ongoing Ukraine war is the catalyst and for the immediate future more of the same appears to be the likely path ahead.

Macro Briefing: 7 March 2022

* US and European officials discussing plans for Ukrainian government in exile

* US talking with allies re: banning imports of Russian oil, says US Sec. of State

* West resists calls from Ukraine for establishing a no-fly zone

* US walks fine line supplying arms to Ukraine and avoiding direct conflict

* Ukraine war will shock food supply and cost, warns exec at fertilizer firm

* Average US gasoline price tops $4 a gallon, highest since 2008

* Forecasters increasingly cautious on US economic outlook

* US payrolls rebounded in February, rising well above the consensus forecast:

Book Bits: 5 March 2022

● Trillion Dollar Triage: How Jay Powell and the Fed Battled a President and a Pandemic—and Prevented Economic Disaster

Nick Timiraos

Review via Publishers Weekly

Timiraos weaves a lucid behind-the-scenes narrative of the early Covid panic, when Powell and the Fed staff struggled hour by hour to get money out to a collapsing economy and worked with Treasury Secretary Steve Mnuchin and a fractious Congress to cobble together emergency fiscal measures, while cogently exploring the economic trade-offs among unemployment, inflation, stability, and moral hazard. This is a riveting story of policy making in crisis and an illuminating examination of how drastically the Fed’s role in the economy has changed.

US Q1 Growth Estimates Continue To Slide

As the Ukraine war rages on, the global economy will suffer and the blowback will spill over to the US in some degree. The repercussion is starting to show up in first-quarter nowcasts for first-quarter GDP activity.

Macro Briefing: 4 March 2022

* Russian forces attack and then seize Ukrainian nuclear power plant

* Bipartisan pressure rising on Biden administration to end Russian oil imports

* As Western pressures increase on Russia, how will Putin react?

* Fed’s Powell admits ‘we should have moved earlier’ to end pandemic stimulus

* Global economic growth picks up in February after slowing to 1-1/2 year low

* US ISM Services Index slows to a one-year low in February, but…

* US Services Index in February posts ‘sharp upturn in activity’

* US factory orders rose more than expected in January

* US jobless claims last week fell to lowest level since start of the year:

Major Asset Classes | February 2022 | Risk Profile

The Global Market Index’s (GMI) risk-adjusted performance continues to retreat after peaking in December, based on the trailing 3-year Sharpe ratio, a measure of return adjusted by volatility. The sharp reversal has also dragged down the 10-year rolling Sharpe ratio. Both measures fell in February to their lowest levels in nearly a year for this multi-asset-class benchmark.

Macro Briefing: 3 March 2022

* Fed Chair Powell says rate hikes coming, but Ukraine creates uncertainty

* First major Ukrainian city ‘fallen’ to Russian troops

* More than 1 million people flee Ukraine after Russia’s invasion

* The West’s reaction to Ukraine war could cripple Russia’s economy, say analysts

* Commodity prices soar — S&P GSCI index at highest level since 2008

* MSCI pulls Russian stocks from emerging markets indices

* China Composite PMI shows economic growth was “muted” in February.

* Is eastern Europe at risk from Russia?

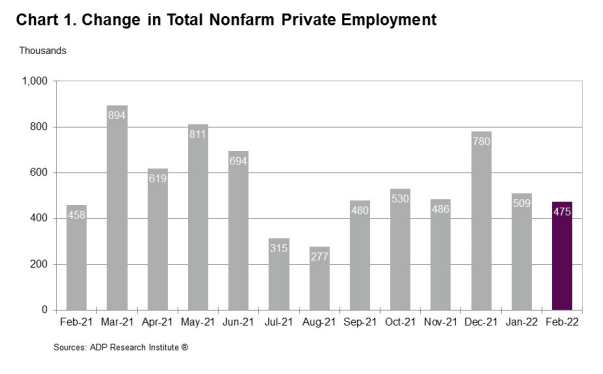

* US companies continued to hire workers at a strong pace in February:

Risk Premia Forecasts: Major Asset Classes | 2 March 2022

War, turmoil and chaos tend to shorten our attention span, and Russia’s invasion of Ukraine is no different. As the world reels from the crisis, the blowback is rippling across the world economy and markets. Volatility and uncertainty have spiked – for the short term. But when it’s hard to look past the next 24 hours, it’s still useful to think long term as a tool to look through the crisis and consider how the long game may unfold for investment strategies.