Yes, according to the 3-month average of the Chicago Fed National Activity Index (CFNAI-MA3), which rebounded sharply in July. But the usual routine of business-cycle analysis has been unusually volatile since the coronavirus hammered the economy and so there’s reason to remain cautious on issuing an all-clear signal.

Continue reading

Author Archives: James Picerno

Macro Briefing | 25 August 2020

Republicans open convention with dark warnings about Democrats: BBG

Fauci, top US virus expert, warns against rushing out a vaccine: BBC

Tropical storm becoming hurricane as it heads to Louisiana: CNN

China’s recovery has momentum, closing gap with US economy: WSJ

Worst of economic hit from coronavirus may be over, says economist: CNBC

Global dividends fall to lowest level in more than a decade: MW

Exxon Mobil removed from Dow Jones Industrials in reshuffling of index: BBG

Business sentiment in Germany improved more than expected in August: Reuters

Revised GDP for Germany shows a slightly softer 9.7% Q2 decline: Reuters

Chicago Fed Nat’l Activity Index (3mo avg) signals end of recession in July: ChiFed

Foreign Property Shares Led Asset Class Gains Last Week

The majority of the major asset classes continued rising for the trading week through Aug. 21, based on a set of exchange traded funds. Leading the rally: real estate stocks outside the United States.

Macro Briefing | 24 August 2020

US FDA announces approval of plasma treatment for Covid-19: CNN

Two storms target US Gulf of Mexico: CNN

Companies rethink plans to reopen offices after Labor Day: WSJ

Sovereign wealth funds reconsider prospects for real estate investments: Reuters

More than half of US oil production is shut down as storms approach: Reuters

Majority of economists in survey: US recession will end late-2020/early 2021: BBG

Existing home sales continued to surge in July: Reuters

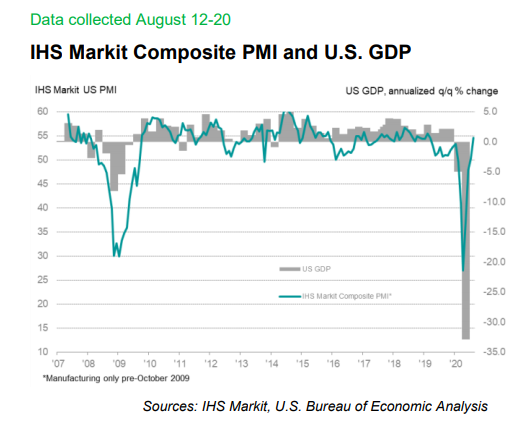

US Composite PMI, a GDP proxy, rises to 18-month high in August: IHS Markit

The ETF Portfolio Strategist: 23 Aug 2020

Beta portfolios had a good week at the close of trading on Aug. 21, based on our four passive benchmark strategies. By contrast, the two proprietary strategies posted mixed results and for one of the portfolios another sell signal was issued, joining the two that were triggered the previous week.

Book Bits | 22 August 2020

● Money for Nothing: The Scientists, Fraudsters, and Corrupt Politicians Who Reinvented Money, Panicked a Nation, and Made the World Rich

Thomas Levenson

Summary via publisher (Penguin Random House)

Money for Nothing chronicles the moment when the needs of war, discoveries of natural philosophy, and ambitions of investors collided. It’s about how the Scientific Revolution intertwined with finance to set England—and the world—off in an entirely new direction… Unlike science, though, with its tightly controlled experiments, the financial revolution was subject to trial and error on a grand scale, with dramatic, sometimes devastating, consequences for people’s lives. With England at war and in need of funds and “stock-jobbers” looking for any opportunity to get in on the action, this new world of finance had the potential to save the nation—but only if it didn’t bankrupt it first.

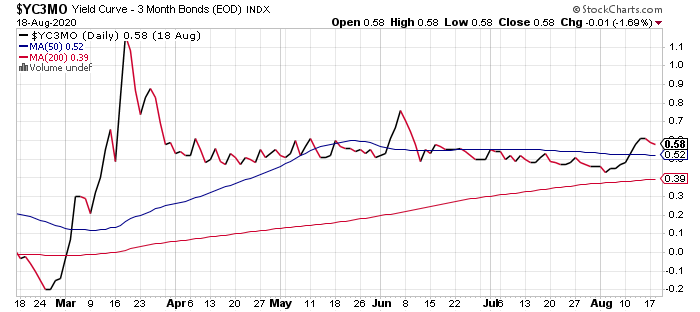

Conflicting Treasury Market Signals Keep Investors Guessing

Depending on the slice of the Treasury market, inflation expectations are rebounding — or the outlook for economic growth is weakening. One of these implied forecasts is probably wrong, or least less useful for estimating future macro risks. Higher inflation and softer economic growth isn’t impossible (think “stagflation” in the 1970s). But it’s not yet obvious that the conditions that produced that malaise are recurring and so the odds still favor one scenario at the expense of the other.

Macro Briefing | 21 August 2020

Biden accepts Democratic nomination, pledges to lead US out of darkness: WSJ

Allies reject US bid to reimpose sanctions on Iran: CNN

EU’s chief negotiator: Brexit deal looks unlikely for now: BBG

UK retail sales continued to grow in July, rising past pre-Covid-19 peak: Reuters

Eurozone’s economic rebound loses momentum in Aug via PMI data: IHS Markit

Japan’s steep downturn continues in Aug, according to PMI survey data: IHS Markit

Philly Fed Mfg Index: sector growth in bank’s region slows in August: Mstar

US jobless claims increased more than expected last week: CNBC

Deep-Value ETF Report: 20 August 2020

The coronavirus blowback and the crowd’s ongoing preference for high-flying growth investments aren’t doing any favors for value investing strategies. Perhaps the chaos of 2020 is laying the groundwork for a performance revival in assets (and asset classes) that have suffered the most. The lagging results of value generally in recent years suggest otherwise, at least by some accounts. But if there’s opportunity in beaten-down assets, at least we know where to look.

Macro Briefing | 20 August 2020

China’s commerce ministry: US and China will hold trade talks: CNBC

Fed minutes: Fed staff lowers economic growth outlook for rest of 2020: MW

Earnings surge for big retailers, including Target and Walmart: NYT

Are stocks increasingly vulnerable to currency risk? BBG

Apples becomes first company to reach $2 trillion market cap: CNET

10yr-3mo Treasury yield curve remains in a tight range, settling at 0.58% on Wed: