US protests continue but subdued after after new charges in Floyd case: AP

Much of US govt’s coronavirus stimulus funds have been spent or committed: WSJ

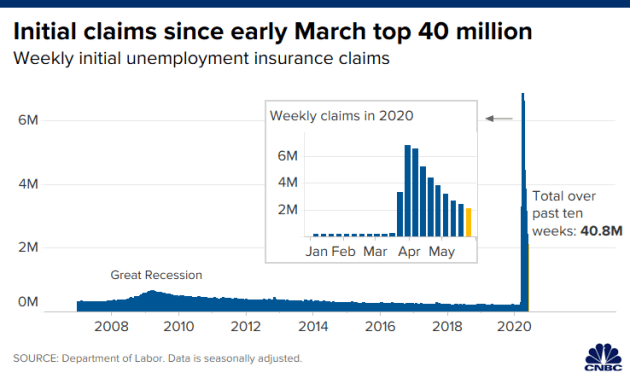

Today’s US jobless claims set for slower rise but still painfully high: Reuters

European Central Bank set to ramp up stimulus program: CNBC

Will China weaponize its $1 trillion-plus hoard of US Treasuries? MW

Hedge funds prepared for second stock-market downturn: FT

Global economic downturn eases in May after record decline: IHS Markit

US factory orders continued to plunge in April: Reuters

Speed of US downturn in US services sector eased in May: IHS Markit

US private sector lost 2.76 million jobs in May: MW

Author Archives: James Picerno

Back In The Saddle Again: Growth And Momentum Equity Factors

The ongoing rebound in US stocks has been uneven across the main factor strategies, but two corners stand out as revival leaders: large-cap growth and momentum. On both fronts, these risk factors are the first to return to positive year-to-date performances, based on a set of exchange traded funds.

Macro Briefing | 3 June 2020

George Floyd protests continue across US with fewer clashes: CNN

Will Trump militarize response to US protests? Reuters

Dr. Fauci worries about the “durability” of a coronavirus vaccine: CNBC

US firms warily eye Hong Kong but no plays to exit yet: CNN

China Services PMI rebounded sharply in May as economy reopened: IHS Markit

Eurozone Composite PMI up slightly in May but still signals recession: IHS Markit

Does economic recovery for the US require negative interest rates? CNBC

Global mfg activity bounced in May but still deep in recession: IHS Markit

Risk Premia Forecasts: Major Asset Classes | 2 June 2020

The long-term forecast for the Global Market Index’s (GMI) risk premia ticked higher in May, rising for a second month after a run of declines earlier in the year. The revised annualized total return estimate for GMI is currently 4.5%, which reflects the index’s long-run projection over the “risk-free” rate, based on a risk-centered model outlined by Professor Bill Sharpe (details below).

Macro Briefing | 2 June 2020

Trump considers using military to end protests: Bloomberg

CBO projects a slow US economic recovery after deep loss in Q2: CBO

US economic reopening plans challenged by protests in cities: NY Times

G7 members at odds over Trump’s plan to re-admit Russia: BBC

US dollar’s safe-haven status faces new challenges: Reuters

US construction spending dropped less than forecast in April: MW

A slightly softer US mfg recession in May via PMI survey data: IHS Markit

US ISM Manufacturing Index up modestly in May but still deep in recession: ISM

Major Asset Classes | May 2020 | Performance Review

Asset prices continued to rebound in May, building on April’s widespread gains. Commodities joined the party this time by leading the across-the-board celebration in global markets last month.

Macro Briefing | 1 June 2020

George Floyd protests continue across US: Reuters

Will protests trigger second wave of Covid-19 infections? NY Times

Does Russia have an effective treatment for Covid-19? CNBC

Trump postpones G7 summit: CNBC

Eurozone mfg sector continued to contract sharply in May: IHS Markit

UK mfg sector fell sharply in May but not as deep vs. Apr: IHS Markit

Consumer sentiment in US edged up in May after sharp decline in April: CNBC

Chicago-region business activity fell in May–lowest level since 1982: Chicago PMI

US trade deficit widened more than expected in April: MW

US consumer spending collapsed in April, falling nearly 14%: Reuters

Book Bits | 30 May 2020

● The Next Fifty Things That Made The Modern Economy

Tim Harford

Summary via publisher (Little, Brown)

In Fifty Things that Made the Modern Economy, the revolutionary, acclaimed book, radio series and podcast, bestselling economist Tim Harford introduced us to a selection of fifty radical inventions that changed the world. Now, in this new book, Tim Harford once again brings us an array of remarkable, memorable, curious and often unexpected ‘things’ – inventions that teach us lessons by turns intimate and sweeping about the complex world economy we live in today.

Continue reading

Tech Stocks Offer A Rare Bright Spot For 2020 Sector Returns

The US stock market’s volatile run in 2020 has left most corners of the equity market with deep losses or mostly flat results this year — with one glaring exception: technology. Year to date, the tech sector is enjoying a solid gain – a conspicuous outlier so far in 2020, based on a set of exchange traded funds.

Continue reading

Macro Briefing | 29 May 2020

House sends China sanctions bill to Trump: CNBC

Civil unrest roils Minneapolis: Reuters

What will Trump announce in today’s press conference today on China? CNBC

US charges two-dozen-plus N. Korean bankers with money laundering: CNN

What happens when the unemployment checks run out? NY Times

US Q1 GDP loss revised down to -5%: CNN

Durable goods orders in US fell sharply for a second month in April: BBG

Pending home sales fell to the lowest level on record in April: BBG

KC Fed Mfg Index continued to decline in May but at slower rate: KCF

US jobless claims continue to surge–up 2.1 million last week: CNBC