Some US states begin to reopen their economies: WSJ

Treasury Sec. Mnuchin expects Q3 rebound for US economy: MW

Stock market’s rise is a bet on on testing, treatments to restart economy: Reuters

Bond market considers deflation risk ahead of this week’s Fed meeting: BBG

Surge in gov’t spending will lead to higher taxes… eventually: CIO

Consumer sentiment tumbles for 3rd month in April: CNBC

US Composite PMI: economic output collapses in April: IHS Markit

US durable-goods orders plunged 14% in March: MW

Daily rise in US Covid-19 deaths falls to 3-week low for Apr. 26: Johns Hopkins

Author Archives: James Picerno

Book Bits | 25 April 2020

● The Technologized Investor: Innovation through Reorientation

Ashby Monk and Dane Rook

Summary via publisher (Stanford U. Press)

Institutional Investors underpin our capitalist world, and could play a major role in addressing some of the greatest challenges to society such as climate change, the ballooning wealth gap, declining infrastructure, aging populations, and the need for stable funding for the sciences and arts. Advanced technology can help institutional Investors deliver the funds needed to tackle these grave challenges. The Technologized Investor is a practical guide showing how institutional Investors can gain the capabilities for deep innovation by reorienting their strategies and organizations around advanced technology. It dissects why technology has historically failed institutional Investors and recommends realistic changes that they can make to unlock technological superpowers. Grounded in the actual experiences of institutional Investors from around the globe, it’s a unique reference manual for practitioners on how to reboot their organizations for long-term performance.

Research Review | 24 April 2020 | Covid-19 Blowback

Pandemics and Systemic Financial Risk

Howell E. Jackson (Harvard Law School) and Steven L. Schwarcz (Duke U.)

April 19, 2020

The coronavirus has produced a public health debacle of the first-order. But the virus is also propagating the kind of exogenous shock that can precipitate – and to a considerable degree is already precipitating – a systemic event for our financial system. This currently unfolding systemic shock comes a little more than a decade after the last financial crisis. In the intervening years, much as been written about the global financial crisis of 2008 and its systemic dimensions. Additional scholarly attention has focused on first devising and then critiquing the macroprudential reforms that ensued, both in the Dodd-Frank Act and the many regulations and policy guidelines that implemented its provisions. In this essay, we consider the coronavirus pandemic and its implications for the financial system through the lens of the frameworks we had developed for the analysis of systemic financial risks in the aftermath of the last financial crisis. We compare and contrast the two crises in terms of systemic financial risks and then explore two dimensions on which financial regulatory authorities might profitably engage with public health officials. As we are writing this essay, the pandemic’s ultimate scope and consequences, financial and otherwise, are unknown and unknowable; our analysis, therefore, is necessarily provisional and tentative. We hope, however, it may be of interest and potential use to the academic community and policymakers.

Continue reading

Macro Briefing | 24 April 2020

House approves $484 billion for small business coronavirus relief: USA Today

Millions of US workers continued to file for jobless benefits last week: WSJ

Trump may extend social distancing rules through early summer: CNBC

US economic sentiment falls dramatically in April: IHS Markit

US banks pulling back from lending to European firms: FT

China is a crucial source of coronavirus gear for US: NY Times

Which companies should get bailed out from coronavirus blowback? New Yorker

Why are stocks up when millions are losing their jobs? MW

US coronavirus deaths had been trending down but reversed course on Thursday:

Standard Asset Allocation Faces New Scrutiny And Suspicion

Recent history has been humbling for nearly every corner of portfolio management. There are exceptions, of course. Several managed futures ETFs, for example, have been relatively stable in the recent market correction. But extreme stress has afflicted most corners of the financial markets, which in turn has unleashed unexpected challenges for many portfolio strategies.

Macro Briefing | 23 April 2020

The grim calculus for deciding when to reopen the economy: NY Times

US jobless claims expected to rise 4.5 million in today’s report: USA Today

Trump signs order to suspend immigration: Bloomberg

Eurozone PMI: “unprecedented collapse of Eurozone economy” in April: IHS Markit

Record decline in UK economic output in April amid public health crisis: IHS Markit

Japan’s economic decline intensified in April via PMI survey data: IHS Markit

Bankruptcy threatens US energy industry after supply/demand shock: Reuters

A closer look at IMHE’s widely cited Covid-19 forecasting model: Quartz

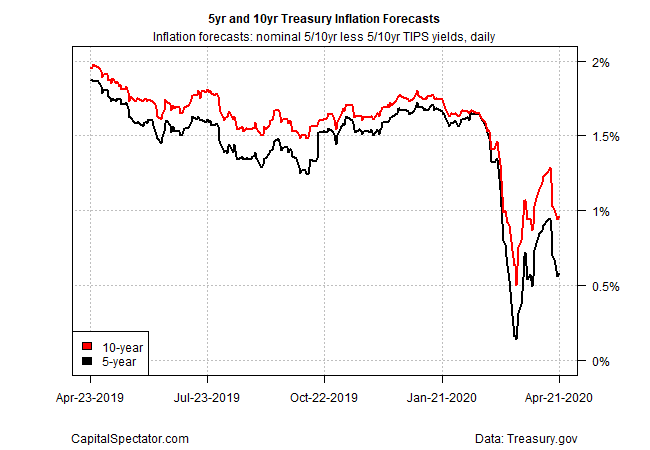

Treasury market’s implied inflation outlook is below 1% for 5- and 10-yr maturities:

Health Care Stocks Lead This Year For US Equity Sector Returns

Every sector of the US stock market has lost ground so far in 2020, but the dispersion of results is wide and health care shares have lost considerably less than the rest of the field, based on a set of exchange-traded funds.

Macro Briefing | 22 April 2020

Senate passes coronavirus bill for small business: CNBC

Oxford University’s coronavirus vaccine may start human trials this week: MW

CDC director warns that a 2nd coronavirus could strike next winter: CNN

Federal gov’t response to coronavirus still falls short of what’s needed: Politico

Trump promises to save oil industry after epic price collapse: CNN

Collapse in oil prices is a warning for stocks markets and economies: FT

Dramatic slide in oil prices will hit hard in US oil patch economies: WSJ

US-China tensions rise in disputed waters of South China Sea: NY Times

How many department stores will survive coronavirus shock? ‘Very few’: NY Times

US existing home sales fell sharply in March: CNBC

Are daily death tolls for coronavirus peaking? FT

Next Week’s Q1 GDP Data Expected To Show US Recession’s Start

There had been hope that the coronavirus-triggered recession that’s now roiling the US economy wouldn’t show up in the data until the second quarter. But recent updates for March have smashed that idea and so next week’s initial estimate of Q1 GDP is on track to post a loss, based on several nowcasting models and survey results compiled by CapitalSpectator.com.

Macro Briefing | 21 April 2020

Trump says he’s temporarily suspending immigration due to coronavirus: CNBC

Oil futures fall below $0 as demand collapses: WSJ

Global hunger set to double this year due to coronavirus: Reuters

Congressional leaders still negotiating deal for small biz relief: BBG

States quickly depleting funds targeted for laid-off workers: WSJ

Health of N. Korea’s leader, Kim Jong Un, draws US attention: CNN

Chicago Fed Nat’l Activity Index (3mo avg) signaled deep recession for March: CF