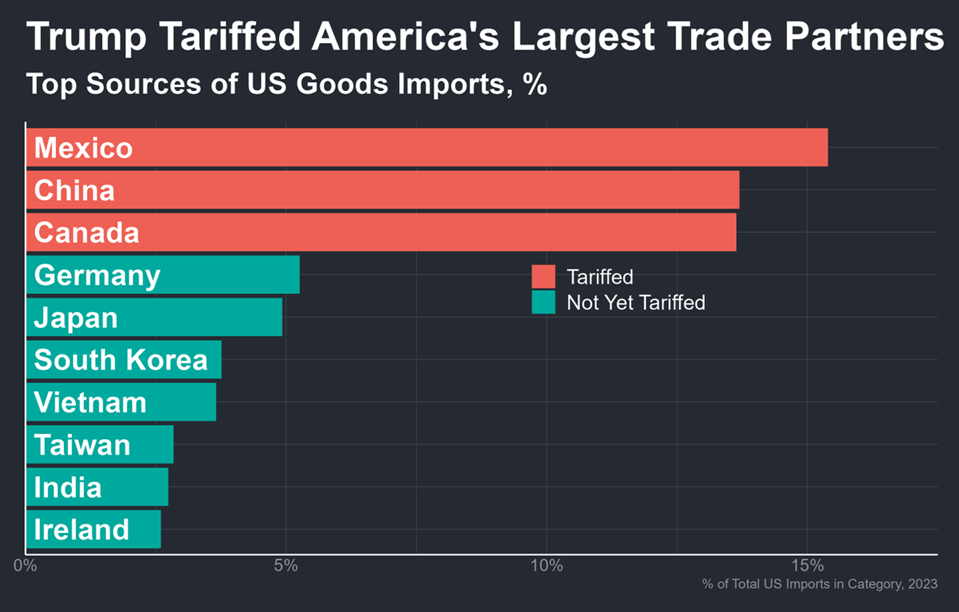

Canada and Mexico vow to retaliate after Trump imposes sweeping tariffs on both countries. The White House also announced higher tariffs on China. The tariffs are expected to lift inflation and slow growth in the US and elsewhere. “There was some optimism in the [US Treasury] market that [tariff threats] were just for negotiation, but the market may have underestimated the determination of the Trump administration,” says Jason Lui, head of Asia-Pacific equity and derivative strategy at BNP Paribas.

Author Archives: James Picerno

Book Bits: 01 February 2025

● The New Rules of Investing: Essential Wealth Strategies for Turbulent Times

● The New Rules of Investing: Essential Wealth Strategies for Turbulent Times

Mark Haefele and Richard C. Morais

Excerpt via Barron’s

The notion that the global financial order could one day suffer or collapse under the weight of its debt has understandably given rise to a survivalist impulse to do whatever it takes to escape the financial system we have, and perhaps create a new system in the process. That impulse, for good or bad, stands behind the rise of cryptocurrency, but I am highly doubtful that cryptocurrencies will save us.

Cryptocurrencies are perceived by officials to be both a threat to the existing financial system and a facilitator of money laundering, which explains why, when Bitcoin fell 50 percent in short order, government officials went out of their way to say, “We told you so.” The U.S. secretary of the treasury pointedly warned Americans against “extremely risky” cryptocurrencies lacking “appropriate supervision and regulation.”

US Bond Market Rebounds So Far In 2025

Several risk factors that could end the bond market’s party, but for the moment US fixed-income markets are having a good year so far, based on prices through Thursday’s close (Jan. 30).

Macro Briefing: 31 January 2025

US fourth-quarter GDP increased less than expected. Output rose 2.3% (annualized), marking a slowdown from Q3’s 3.1%. Consumer spending accelerated in Q4, rising 4.2%, the fastest pace in nearly two years. “Holding back growth was a decline in business investment, flat reading in net exports, and sharp decline in inventories,” advises Nationwide chief economist Kathy Bostjancic. “The drawdown in inventories, especially at the wholesale level indicates that retailers also scurried to stock up before possible tariffs. This could continue into early 2025.”

Momentum Leading US Equity Factors For 2025’s Kickoff

It’s been a good year so far for the momentum factor. That’s hardly surprising given that momentum was red hot in 2024. Momentum, it seems, still has momentum.

Macro Briefing: 30 January 2025

The Federal Reserve left its target rate unchanged at a 4.25%-4.50% range in yesterday’s policy announcement. Following the decision, Fed funds futures are pricing in an 82% probability that the central bank will continue to leave rates unchanged at the next FOMC meeting on March 19. Meanwhile, President Trump on Wednesday said the central bank “failed to stop the problem they created with inflation” and have done a “terrible job on bank regulation.”

US Q4 GDP Growth Nowcast Rises Ahead Of Thursday’s Report

Economic output in the fourth quarter is expected to increase at a solid rate in this week’s initial GDP estimate from the Bureau of Economic Analysis. Thursday’s report from the government (Jan. 29) is on track to rise 2.7%, based on the median estimate from several sources compiled by CapitalSpectator.com.

Macro Briefing: 29 January 2025

US Consumer Confidence Index fell in January, but “has been moving sideways in a relatively stable, narrow range since 2022. January was no exception,” writes the chief economist at The Conference Board. “All five components of the Index deteriorated but consumers’ assessments of the present situation experienced the largest decline. Notably, views of current labor market conditions fell for the first time since September, while assessments of business conditions weakened for the second month in a row.”

Does China AI Threaten US Tech Dominance?

And just like that, the formerly high-flying US tech sector is on the defensive. If you blinked, you missed it.

Anxiety about the competitive threat from Chinese artificial intelligence lab DeepSeek triggered a sharp selloff in US equities on Monday, with the worst of the decline centered in tech. Chipmaker Nvidia was especially hard hit, suffering a near-$600 billion loss of market cap in one day.

Macro Briefing: 28 January 2025

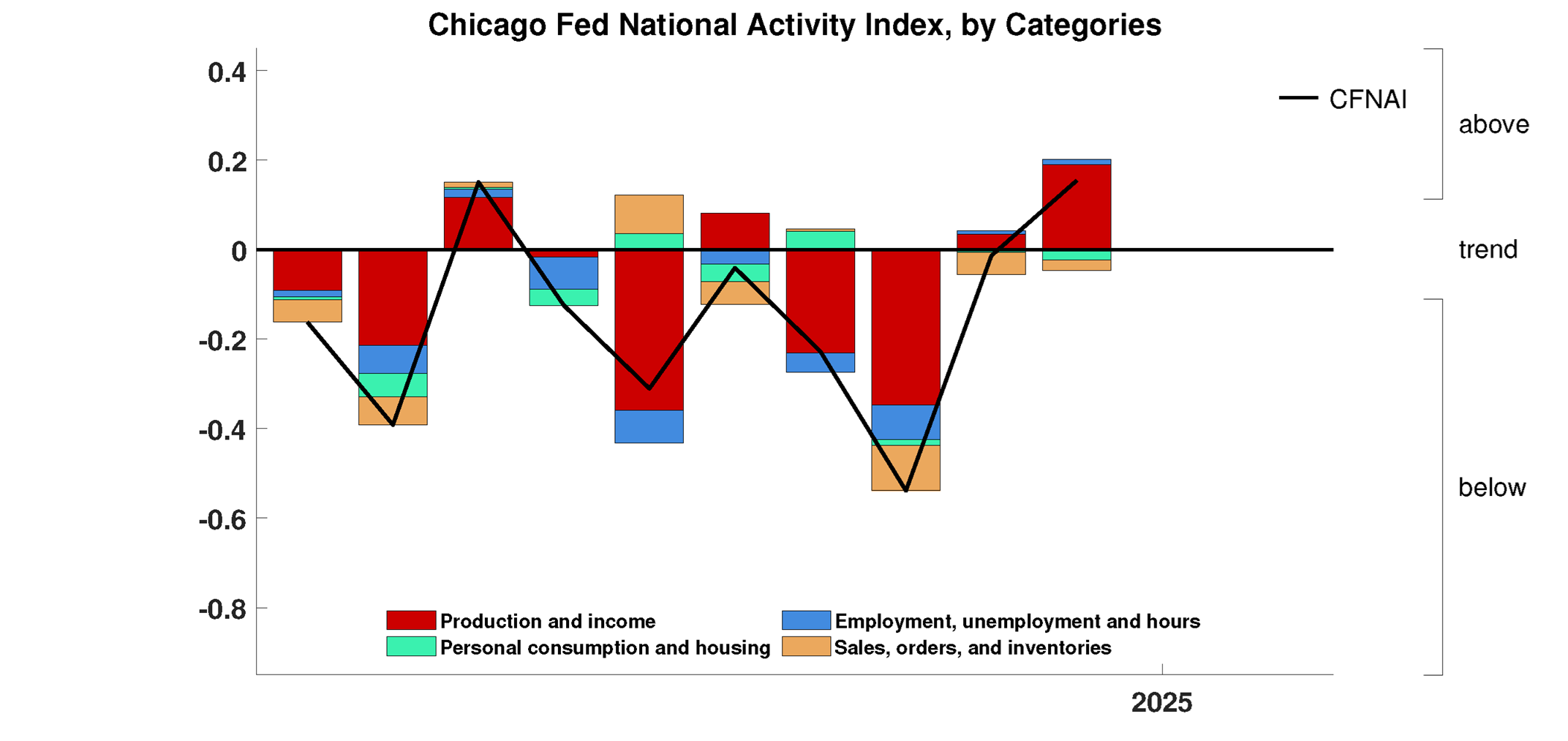

US economic activity strengthened in December, according to the Chicago Fed National Activity Index. This benchmark rose to the strongest reading last month since May, reflecting a firmer pace of growth at 2024’s close.