The pace of hiring at companies slowed in November, according to this morning’s monthly update from the Labor Department. The softer-than-projected gain pared the year-over-year trend to a three month low. The economy’s still creating a healthy number of jobs, but today’s results reaffirm the view that US growth has peaked.

Continue reading

Author Archives: James Picerno

Low Volatility Stocks Take The Lead In 2018’s US Factor Race

The latest bout of turbulence in the stock market has reshuffled leadership for US equity factor strategies, leaving the low-volatility strategy as this year’s front runner, based on a set of ETFs. Growth and momentum are still posting gains this year, but they’re now trailing, slightly, low vol. One thing that hasn’t changed: value stocks remain in the hole on a year-to-date basis, based on trading for 2018 through yesterday’s close (Dec. 6).

Continue reading

Macro Briefing: 7 December 2018

Trump to name State Dept spokeswoman as UN Ambassador: The Hill

Congress OKs short-term spending bill to avert gov’t shutdown: Reuters

Fed Chair Powell says US labor market ‘very strong’: Bloomberg

ISM Non-Mfg Index in Nov near highest print in 13 years: MW

By contrast, US Services PMI for Nov reflects relatively slow growth: IHS Markit

Factory orders fell in Oct — biggest monthly slide in more than a year: Reuters

US productivity grew 2.3% in Q3, slower vs. Q2: Fox

US jobless claims fell last week, but remain near 5-month high: MW

Trade deficit for US increased to a 10-year high in Oct: CNBC

US private employment growth slowed in Nov to +179k: ADP

US job cuts fell in Nov vs. Oct, but annual change is up over 50%: CG&C

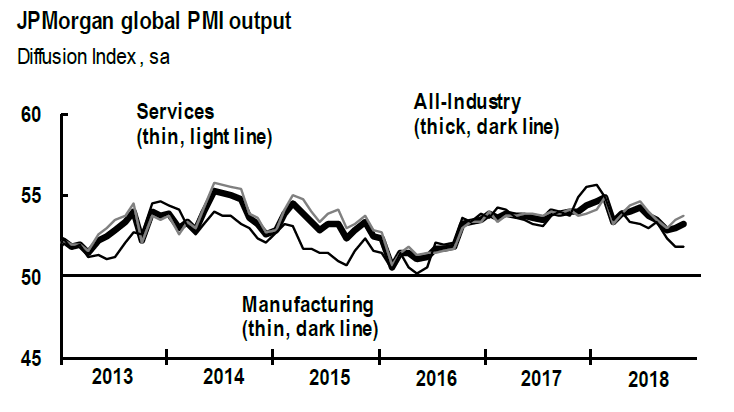

PMI: Global economic growth edged up in Nov, reaching 3-mo high: IHS Markit

US Labor Department Payrolls Report: Trend Outlook (Nov. 2018)

Hiring growth slowed in November among US companies, according to this morning’s update of the ADP Employment Report. Payrolls increased 179,000 last month, down from 225,000 in October. As expected, the annual pace of growth also ticked lower — just barely — although rounding the year-over-year change to one digit leaves the year-over-year trend at a healthy 2.0% for a second month – the fastest rise in over two years.

Continue reading

US Q4 GDP Growth Remains On Track For Moderate Slowdown

Early futures trading points to another rocky session for the US stock market today, in part due to rising concern over trade relations with China. Judging by the current outlook for US economic output in the fourth quarter, however, the macro trend still looks set to post moderate growth in GDP for 2018’s final three months, based on a set of nowcasts compiled by The Capital Spectator.

Continue reading

Macro Briefing: 6 December 2018

CFO of Chinese telecoms giant Huawei arrested in Canada: BBC

Does Huawei arrest threaten Trump-Xi trade truce? Reuters

US stock index futures drop sharply in early trading on Thursday: Bloomberg

Global greenhouse gas emissions rising at accelerating pace: NY Times

UK Parliament restrains Prime Minister May’s Brexit plan. What’s next? Vox

N. Korea reportedly expands a long-range missile base, defying US: Independent

Former President George H.W. Bush honored at National Cathedral funeral: CBS

One part of the US yield curve inverted this week: Reuters

Fed’s Beige Book: economy still growing but headwinds are noted: MW

German 10-year yield fell to 0.25% on Wed–lowest in more than a year:

Treasury Market Flashing A Warning For US Economy

Recession risk remains low for US, based on the latest economic data overall, but the Treasury market is pricing in a higher probability that growth will slow and perhaps lead to a downturn at some point in 2019. It’s still unlikely that output will contract in the near term, although a combination of political and economic risk factors has unleashed a repricing of the macro outlook for the year ahead.

Continue reading

Macro Briefing: 5 December 2018

Stocks trade sharply lower on trade worries and economic outlook: Reuters

China vows fast action on trade commitments to US: BBC

Trump: no immediate plans to impose tariffs on German cars: NY Times

GOP senators say Saudi Crown Prince responsible for Khashoggi killing: The Hill

Former President George H.W. Bush to be honored at today’s state funeral: CNN

Political risk is a key threat for global economy in 2019: Bloomberg

Eurozone growth continued to slow in Nov, according to PMI data: IHS Markit

10yr-2yr Treasury yield spread tumbles to 11 basis points: CNBC

ADP Employment Report: Trend Outlook (Nov. 2018)

Thursday’s release of ADP’s estimate of US private payrolls for November looks set to deliver another sign that US economic activity has peaked. The projected year-over-over increase (due on Dec. 6) still aligns with a healthy pace of jobs creation, but the mild deceleration trend appears to be on track to continue in the months ahead. A downturn in payrolls growth will align with numbers from other corners of the economy that point to a softer macro trend for the foreseeable future relative to the strong gains posted earlier this year.

Continue reading

Risk Premia Forecasts: Major Asset Classes | 4 December 2018

The expected risk premium for the Global Market Index (GMI) ticked up to an annualized 4.6% in November, slightly above the 4.5% estimate in the previous month. This outlook for GMI (an unmanaged market-value-weighted portfolio that holds all the major asset classes) reflects the ex ante premium over the projected “risk-free” rate for the long run.

Continue reading