The hard data on inflation points to a modestly accelerating rate of inflation, a trend that supports the Federal Reserve’s ongoing policy of gently but consistently raising interest rates. The main push-back to that narrative is the Treasury market.

Continue reading

Author Archives: James Picerno

Macro Briefing: 7 September 2018

US payrolls expected to rebound in today’s Labor Dept report: MarketWatch

Global output slipped to five-month low in August: IHS Markit

ISM Non-Mfg Index for US reflects stronger growth in August: CNBC

US services sector growth eased to four-month low in August: IHS Markit

Jobless claims fell last week, near a 49-year low: Reuters

Job cuts in August rose to third highest this year: Challenger, Gray & Christmas

Productivity in US up at an unrevised 2.9% annualized rate in Q2: Reuters

US private employment growth eased to 10-month low in August: ADP

Considering The Implications Of Fidelity’s Zero-Fee Index Funds

Bloomberg reported on Tuesday that “investors poured almost $1 billion into Fidelity Investments’ two zero-fee index funds in their first month of operation.” As new fund launches go, this one looks like a win-win for all sides — for Fidelity as well as investors. It’s too early to say for sure how this plays out in the financial industry, but the early signs suggest we haven’t seen the last of the freemium model in asset management. For some perspective, take a look at a story I wrote for RIABiz.com, which was published a few days ago here.

Small Cap And Growth Factors Continue To Lead US Stocks In 2018

Year-to-date returns for US equity investing are still dominated by small-cap and growth factors, based on a set of exchange-traded funds (ETFs). By contrast, large-cap-value stocks are currently posting the weakest gain so far in 2018 among the main equity factor buckets.

Continue reading

Macro Briefing: 6 September 2018

Anonymous NY Times op-ed roils White House: Politico

Trump attacks NY Times for “gutless” op-ed: The Hill

Supreme Court nominee won’t recuse himself from Trump cases: Wash. Times

China vows retaliation if US imposes new trade tariffs: Reuters

N. Korea’s Kim affirms “unwavering trust in Trump: CNN

Emerging markets flirting with a bear market: Bloomberg

White House: US wages rising via alternative methodology: NY Times

US trade deficit jumped to a five-month high in July: Reuters

Tech stocks due for hefty weight cut in S&P 500 in upcoming sector revamp: LPL

Risk Premia Forecasts: Major Asset Classes | 5 September 2018

The expected risk premium for the Global Market Index (GMI) continued to inch up in August, reaching an annualized 5.0% — fractionally higher vs. the estimate in the previous month. The projection reflects the annualized return over the estimated “risk-free” rate for the long run for GMI, an unmanaged market-value-weighted portfolio that holds all the major asset classes.

Continue reading

Macro Briefing: 5 September 2018

New offensive operations begin in Syria: NY Times

Trump considers a government shutdown ahead of elections: Bloomberg

Senate confirmation hearing for Kavanaugh begins with chaos: Reuters

US ISM Mfg Index soared to 14-year high last month: MarketWatch

Global Mfg PMI fell to 21-month low in August: IHS Markit

US Mfg PMI dipped to nine-month low in August: IHS Markit

Construction spending in US ticked up 0.1% in July: AP

SUV sales in US rose sharply again in August: CNBC

Selling continues to weigh on assets in emerging markets: Bloomberg

Major Asset Classes | August 2018 | Performance Review

US equities topped the performance ledger for a second straight month in August for the major asset classes. The gain marked the fifth straight monthly increase and the strongest for the US stock market since January.

Continue reading

Macro Briefing: 4 September 2018

Trump warns Syria, Iran and Russia on new offensive in Syrian province: Reuters

Italy’s spending plans are rattling markets again: MarketWatch

GOP looks for plan to avoid gov’t shutdown ahead of elections: Politico

Considering Kavanaugh’s Supreme Court confirmation hearings this week: CNBC

South Africa falls into recession for first time since 2009: Bloomberg

UK Manufacturing PMI slips to 25-month low: IHS Markit

Amazon is moving into the online advertising industry: NY Times

Chicago PMI fell in August–first slide in five months: Chicago ISM

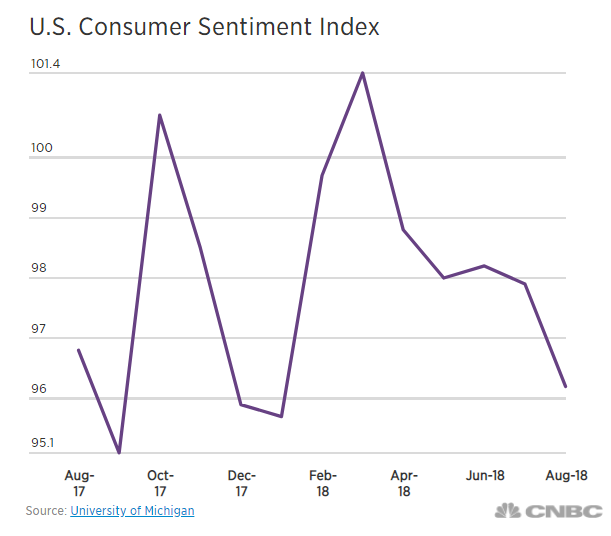

US Consumer Index dipped to 7-month low in August: CNBC

Happy Labor Day!

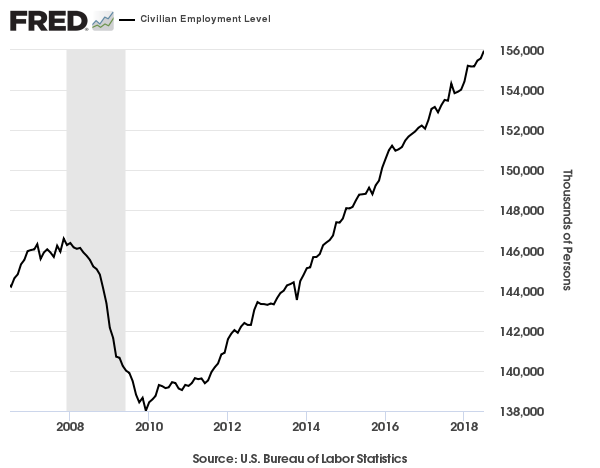

The good news this Labor Day regarding the celebratory subject du jour: there’s more of it. The quality of the jobs minted in recent years is a topic that’s open for debate, but the quantity is certainly moving in the right direction: US civilian employment reached 155.965 million, as of July 2018 — a record high.