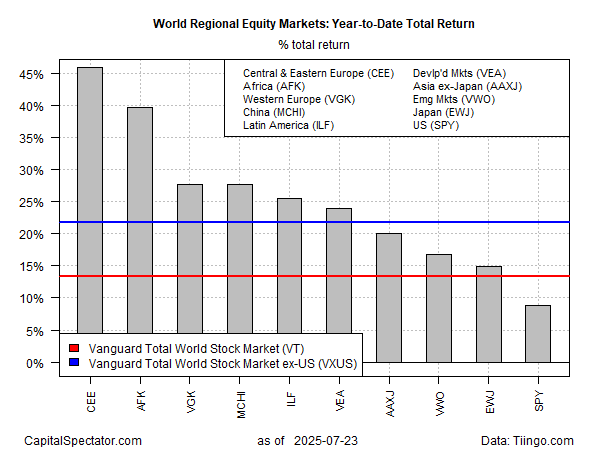

Global equities ex-US were already leading US stocks in 2025 by a wide margin ahead of the trade deal announced this week between the US and Japan. Following the news, shares in Japan surged, providing lift to foreign stocks generally. The US market also rallied on the news, lifting the S&P 500 Index to a new record high. But in relative terms, the international return premium this year has continued to widen, based on a set of ETFs through Wednesday’s close (July 23).

Vanguard International Stock ETF (VXUS) rose sharply yesterday, and is now up 21.8% year to date. US shares (SPY) are also rallying this year, but remain fair behind with an 8.9% increase. In fact, all the major slices of world equities continue to reflect American shares with the weakest gain so far in 2025.

The catalyst for the latest pop in foreign shares is the US-Japan trade news. On first glance, the deal isn’t an obvious trigger for macro optimism. US tariffs on Japan are now set at 15%, which marks a significantly stronger headwind for trade vs. the lower rate that marked the start of the year. But relative to the 25% “reciprocal” tariff that had been applied recently, markets responded with a sigh of relief, one could say.

The news also inspires optimism that the European Union will find common ground with the Trump administration ahead of the Aug. 1 deadline, when the US will raise tariffs on countries that don’t sign a new deal by that date.

FT reports: “The EU and US are closing in on a trade deal that would impose 15% tariffs on European imports, similar to the agreement Donald Trump struck with Japan this week.”

Some corners of US industry, however, aren’t happy. US automakers grumble that a 15% tariff on Japanese vehicles puts them at a competitive disadvantage, citing higher imports taxes on steel, aluminum and parts.

“We need to review all the details of the agreement, but this is a deal that will charge lower tariffs on Japanese autos with no US content,” said Matt Blunt, president of the American Automotive Policy Council, which represents General Motors, Ford and Stellantis.

Markets, however, are cheering. US equities are celebrating too, but so far this year the cheering in America is drowned out by the widening performance spread in favor of foreign stocks.