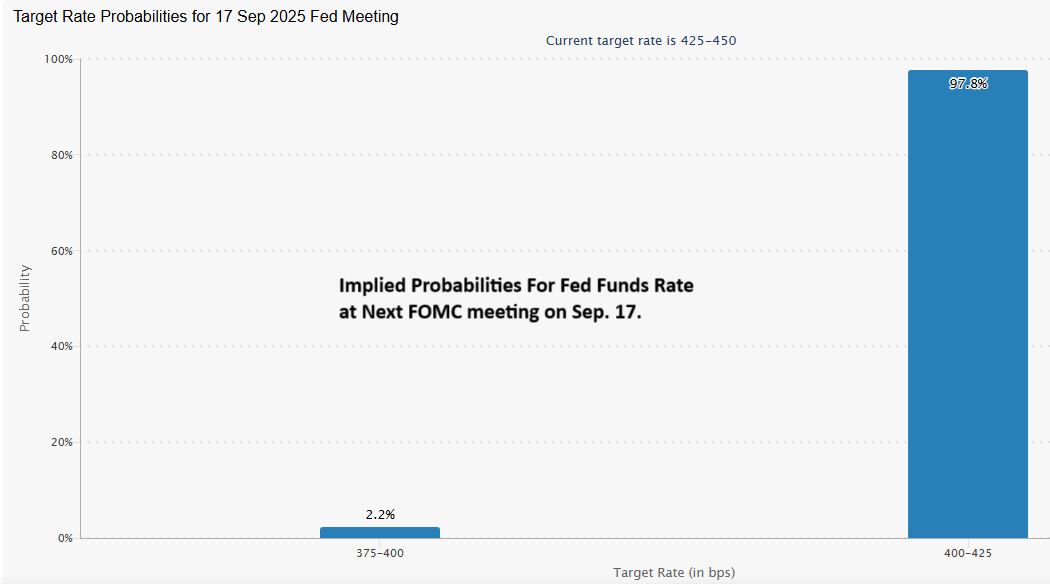

Fed funds futures are pricing in a near certainty of a rate cut at the next FOMC meeting on Sep. 17. The market expects a 1/4-point cut, which would reduce the current 4.25%-4.50% target range to 4.0%-4.25%. “The Fed has a difficult balancing act,” said Derek Horstmeyer, a finance professor at George Mason University’s Costello College of Business. “They have to weigh an expectation of slower job growth against an expectation of inflation. I think they’re weighing all of it.”

Goldman Sachs reaffirmed its tariff research after President Trump criticized the firm’s analysis. The Wall Street bank recently forecast that tariffs will begin to impact consumers through higher prices. “We stand by the results of this study,” said Goldman Sachs economist David Mericle. “If the most recent tariffs, like the April tariff, follow the same pattern that we’ve seen with those earliest February tariffs, then eventually, by the fall, we estimate that consumers would bear about two-thirds of the cost.”

Weekly mortgage refinancing demand rose 23% as the average 30-year mortgage rate declined. The increase in new loan applications was was the strongest week for refinancing since last April.

Uncertainty over tariffs drives record volumes at largest port in US. The Port of Los Angeles moved more than 1 million twenty-foot equivalent units (TEUs) in July, an 8.5% increase from a year ago, marking a record high. The surge was due to front-loading cargo imports ahead of Trump’s import duties, said the port’s Executive Director Gene Seroka.