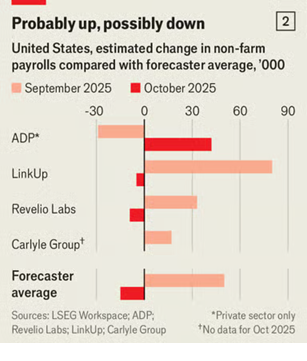

The US Labor Department said it will release the delayed payrolls report for September this week, on Thursday (Nov. 20). “The absence of timely official numbers left the markets and the Fed operating in a data fog, forced to scour alternate sources to gauge the underlying outlook,” Bank of America economist Shruti Mishra said in a note. “With the shutdown resolved, all eyes will now be on the incoming data dump.” The Economsit reports: “ADP’s numbers point to a decline in September, followed by a rebound in October. Those of Revelio Labs, a competitor, point to a rise in September and a decline in October.”

The US Labor Department said it will release the delayed payrolls report for September this week, on Thursday (Nov. 20). “The absence of timely official numbers left the markets and the Fed operating in a data fog, forced to scour alternate sources to gauge the underlying outlook,” Bank of America economist Shruti Mishra said in a note. “With the shutdown resolved, all eyes will now be on the incoming data dump.” The Economsit reports: “ADP’s numbers point to a decline in September, followed by a rebound in October. Those of Revelio Labs, a competitor, point to a rise in September and a decline in October.”

Wall Street dials down bets on a third straight interest rate cut next month as the Federal Reserve considers inflation risks. The probability of a cut at the Dec. 10 policy meeting is estimated to be less than 50%, down from 70% a week ago, based on Fed funds futures. “It is impossible to know which way this goes,” said Krishna Guha, vice-chair at Evercore ISI, on the December Fed vote.

Japan’s economy contracted at a 1.8% annual pace in July-September period. Key factors driving the decline: higher US tariffs hit exports and private residential investment plunged.

Warren Buffett’s Berkshire Hathaway bought shares in Google’s parent, Alphabet. Meanwhile, the firm reduced holdings of decreases, Apple and Bank of America.

Bitcoin fell below the $100,000 mark, reaching $96,600, amid a broader market sell-off in crypto currencies. The move marks the lowest print since May and follows another wave of risk-off selling across global markets, triggered by a sharp reversal in U.S. tech stocks and fading conviction among institutional allocators.

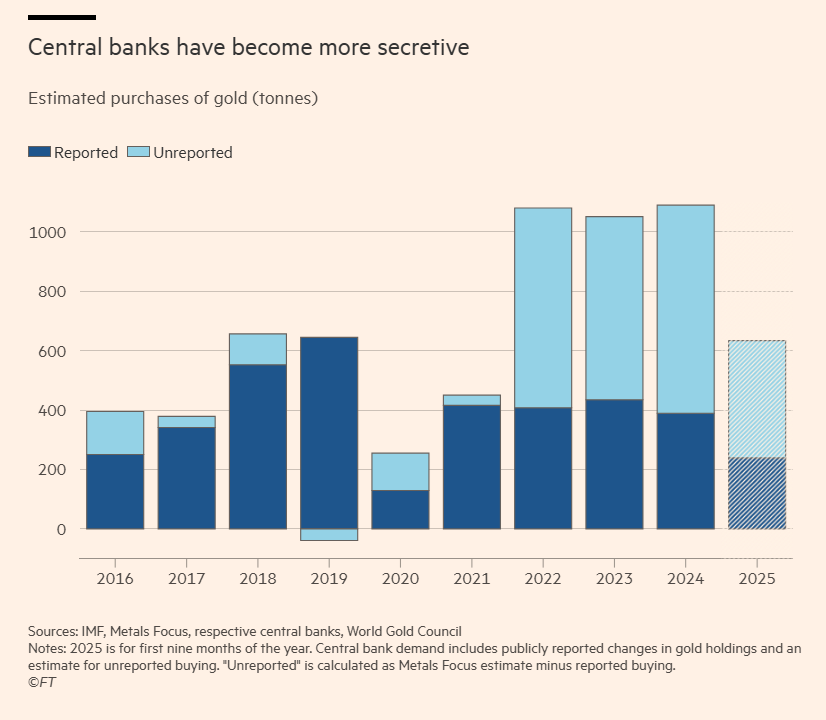

China’s unreported gold purchases could be more than 10 times its official figures, according to analysts at Société Générale. China’s total new additions of the precious metal could reach as much as 250 tons this year, or more than a third of total global central bank demand, the FT reports.