AI’s influence on tech stocks, and the market overall, will be in focus this week ahead of chipmaker Nvidia’s earnings report on Wednesday. The company, the world’s largest and an AI belwether, is outperforming the tech sector (XLK) this year by a wide margin: 33% vs. 13%.

China’s Evergrande property developer is de-listed from the Hong Kong stock exchange. Once the country’s largest real estate builder, the firm has been at the center of an ongoing financial crisis for China’s real estate industry.

Rich countries will need foreign workers to drive economic growth, central bankers advised at the Federal Reserve’s annual conference last week. “Although they represented only around 9 per cent of the total labour force in 2022, foreign workers have accounted for half of its growth over the past three years,” said ECB president Christine Lagarde. “Without this contribution, labor market conditions could be tighter and output lower.”

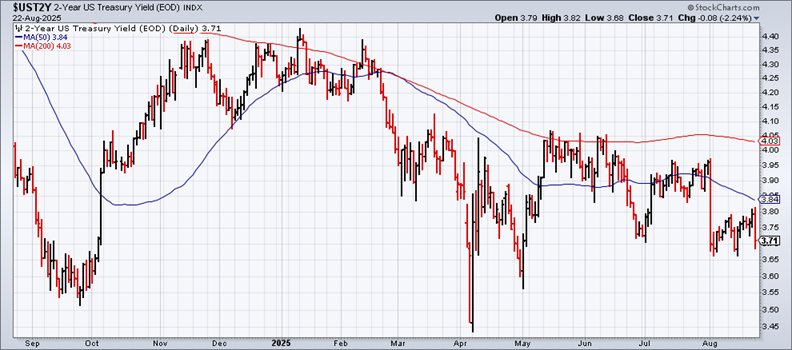

Fed funds futures are pricing in a high probability (85%) of a rate cut at next month’s Federal Reserve policy meeting. The policy-sensitive US 2-year Treasury yield aligns with that outlook as this maturity trades near its lowest level since April at 3.71% on Friday — well below the current 4.25%-4.50% Fed funds target range.