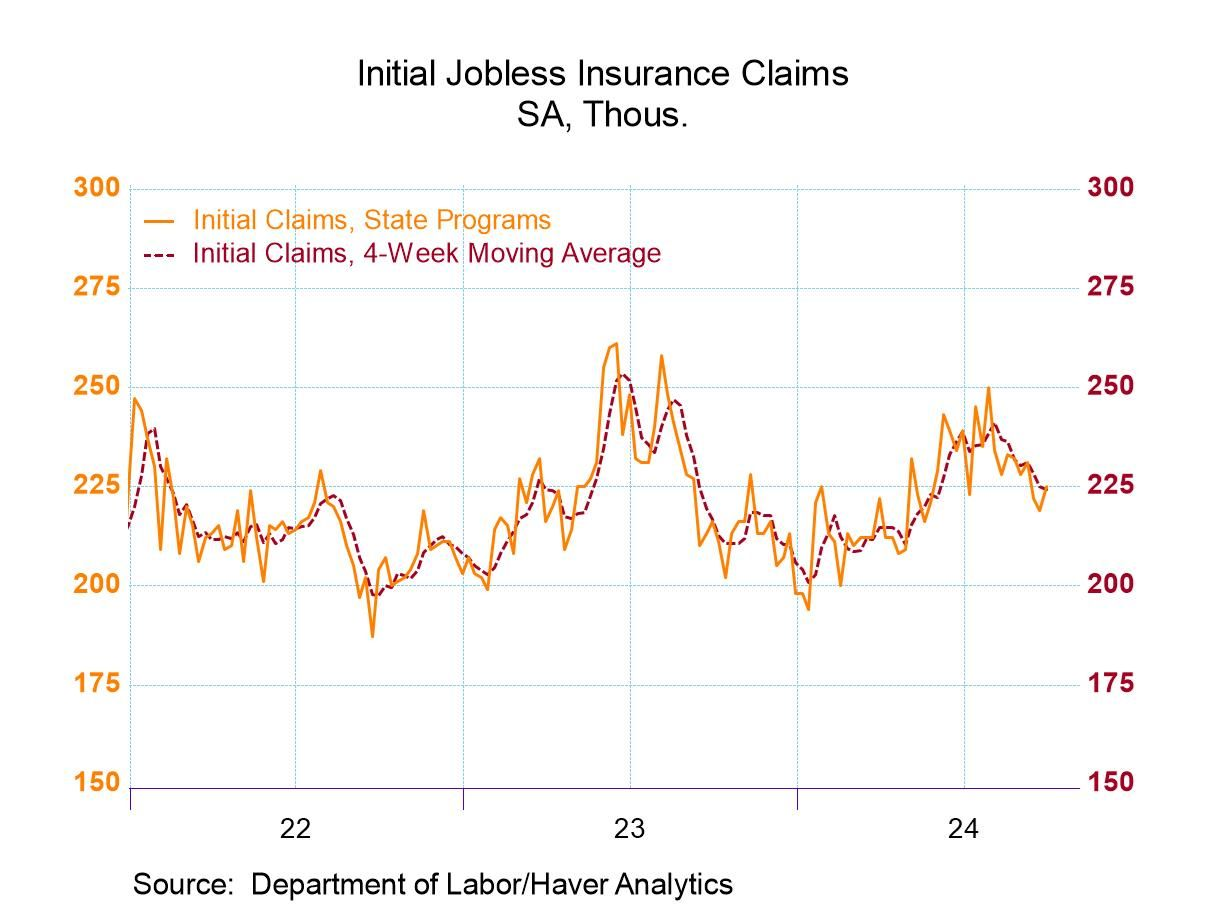

US jobless claims rose last week, but the number of new filings for unemployment benefits remains low relative to history. The 4-week average, which reduces some of the week-to-week noise, continues to trend lower. “For the moment, the labor market looks steady as a rock and the economy appears to have missed falling headlong over the cliff into the depths of recession,” says Christopher Rupkey, chief economist at FWDBONDS.

US ports reopen after workers suspend strike. The union representing workers reached a tentative deal with the management group representing shipping lines that will keep ports open through Jan. 15.

European Union votes to impose tariffs on Chinese electric vehicles. “Today, the European Commission’s proposal to impose definitive countervailing duties on imports of battery electric vehicles (BEVs) from China has obtained the necessary support from EU Member States for the adoption of tariffs,” the EU said in a statement.

Oil prices rose more than $5 a barrel this week to near-$78 for the international Brent benchmark as fears spread that Israel may bomb Iran’s energy infrastructure. CNBC reports: “Goldman Sachs says a sustained fall in Iranian output could send oil prices up $20 a barrel, while Swedish bank SEB has warned that crude futures could rally to more than $200 a barrel in an extreme scenario.”

US factory orders fell in August. The modest 0.2% decline follows a 4.9% surge in the previous month.

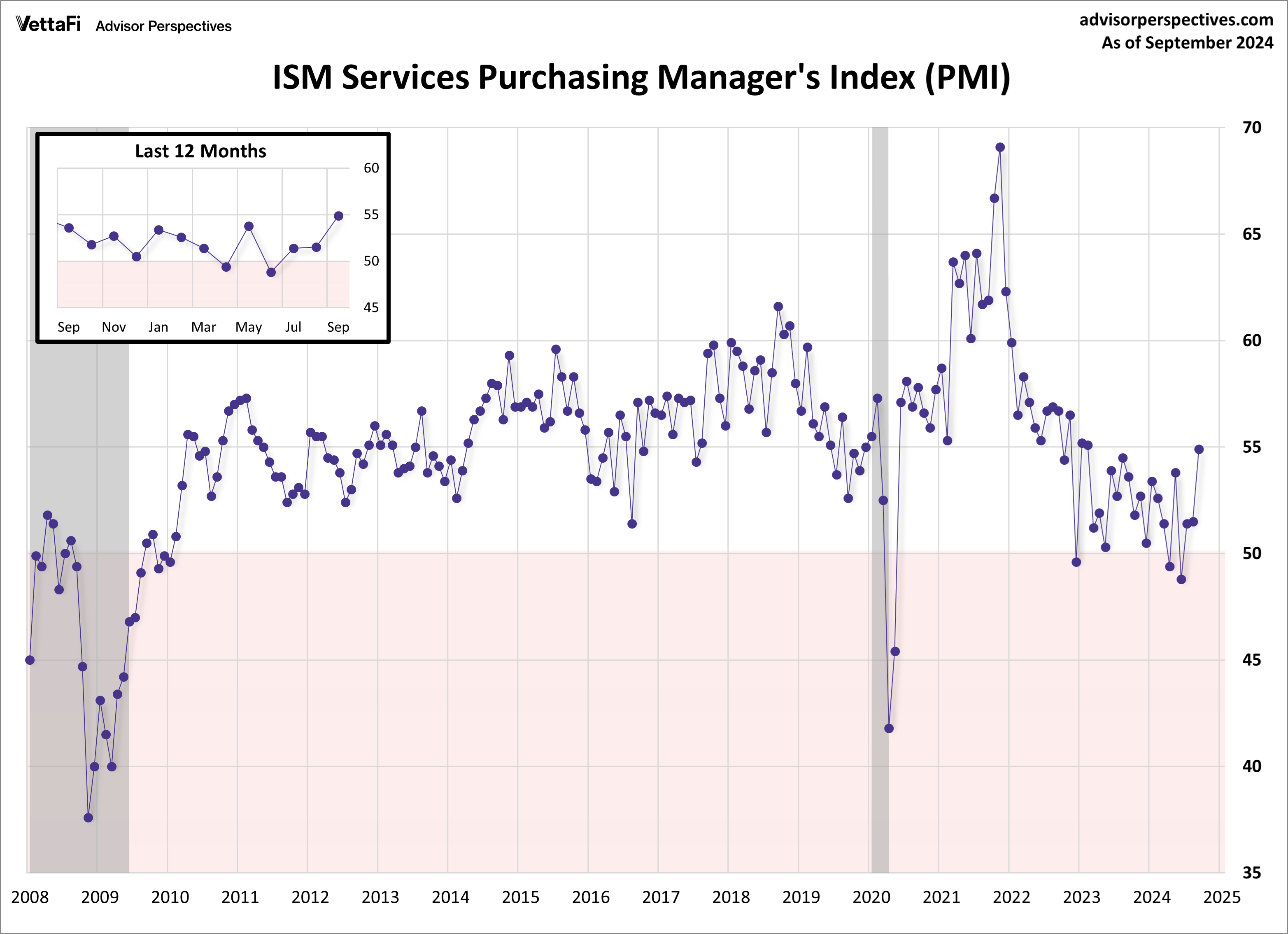

US services sector activity accelerated in September, based on the ISM Services Index. The survey-based indicator rose to 54.9 last month, indicator a moderate rate of growth. The positive reading marks the third straight month of growth and marks the highest level in 1-1/2 years. The upbeat data suggests that the recent soft patch for the US economy rebounded in the final month of the third quarter.