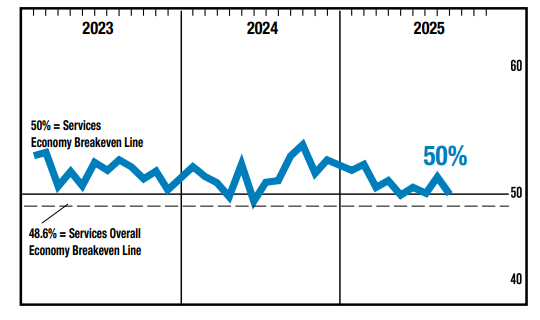

The US services sector stalled in September, downshifting to the weakest pace since 2020 via the survey-based ISM Services Index. The index dropped to a neutral 50 reading. The employment component of the ISM services gauge shows shows the number of workers in the sector contracting for fourth straight month.

White House National Economic Council Director Kevin Hassett on Sunday said that layoffs for federal employees will begin if President Donald Trump decides that congressional negotiations to end the government shutdown “are absolutely going nowhere.” The Trump administration has warned of mass layoffs during a shutdown, advising last week that they would be “imminent.”

The US Services PMI offers a relatively upbeat profile of the services sector in September vs. the ISM Services data. The S&P Global’s survey data for the sector indicates that growth downshifted last month, easing to the slowest pace in five months. “Service sector growth softened slightly in September but remained strong enough to round off an impressive performance over the third quarter a whole,” said Chris Williamson, chief business economist at S&P Global

Market Intelligence.

Markets shrugged off the closure of the US government last week, which postponed the September payrolls report. “There’s a certain amount of nihilism,” Steve Sosnick, chief strategist at Interactive Brokers, told Yahoo Finance on Friday. “All news is good news, and no news matters. By not getting this [jobs report], that’s one less impediment in the market’s relentless rise.”

Technology, financials, and consumer services led US private sector growth in September, according to survey data published by S&P Global. Six out of seven US sectors registered an upturn in business activity last month, the consultancy reports.

Tariffs are beginning to lift prices for US consumer goods even as overall US inflation rises at a moderate pace, reports the Financial Times: “Official data and statements from companies are pointing to accelerating price rises for an assortment of trade-dependent products after companies sold off inventories and moved to shift the cost burden of tariffs on to consumers.”

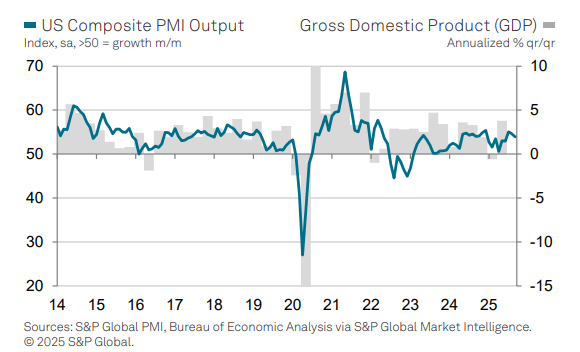

US economic activity eased in Septmeber, according to the US Composite PMI, a survey-based GDP proxy. The current reading is moderately above the neutral 50 mark that separates growth from contraction.