Economic output appears on track to post a second quarterly increase, based on the median nowcast for a set of estimates compiled by CapitalSpectator.com. At the same time, recession risk is elevated, according to several estimates of business-cycle activity. The conflicting signals suggest the potential for relatively sharp upside or downside surprises in economic updates in the weeks ahead.

The latest numbers paint a modestly upbeat profile for Q4 economic activity. Today’s median nowcast indicates a 1.5% increase in GDP (seasonally adjusted annual rate) for the final quarter of 2022. The nowcast marks a downshift from Q3’s 2.9% increase. The official Q4 data from the Bureau of Economic Research is scheduled for release on Jan. 26.

Although growth appears set to slow, today’s 1.5% Q4 nowcast is unchanged from the previous update on Dec. 6. The steady nowcast implies that recent data still supports the case for modest growth in the current quarter.

There are several caveats to consider, including the outlier GDP nowcast, based on the survey data via a regression model that analyzes history. The S&P US Composite PMI, a GDP proxy, continues to reflect a sharp downturn in business activity through December: the PMI tumble this month (matching the slide in August) marks the deepest decline since May 2020. The alternative method cited by S&P to estimate GDP via PMI, shown in the chart below, paints a brighter picture: a 1.5 annualized gain for GDP.

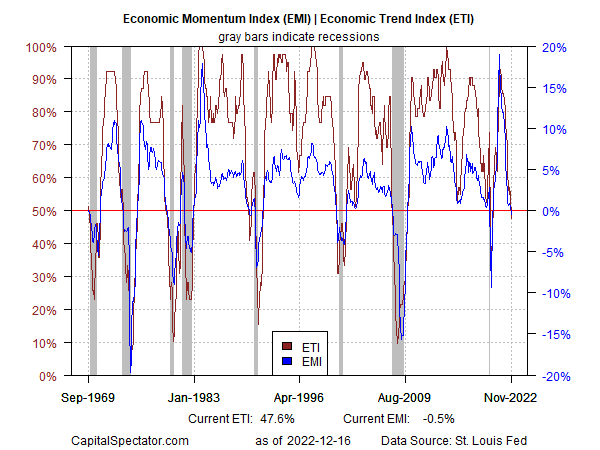

Meanwhile, this week’s edition of The US Business Cycle Risk Report continues to show that a mild NBER-defined recession started in November, based on current estimates for the Economic Trend Index (ETI) and Economic Momentum Index (EMI). Both indicators fell slightly below their respective tipping points that signal declining economic activity.

The main counterpoints to the recession call: consumer spending and payrolls have been relatively resilient. True, although the November retail sales data fell, posting a surprisingly steep slide. It’s unclear if this is noise or the start of a new run of stumbling consumer spending.

Payrolls, on the other hand, continue to increase at a solid if slowing pace through last month.

The key risk factor to monitor in the weeks ahead: the lag effects of rising interest rates, which are expected to take a rising toll on growth.

“There’s a pretty good consensus among economists, market participants and others, that the Fed is going to keep interest rates elevated in order to slow down the inflation pressures we’re seeing and that it will have no choice but to create a recession,” says Christian Lundblad, a professor of finance at the University of North Carolina.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report