* Senate passes funding bill that keeps government open through September

* Global supply chains are normal again after Covid disruption, but…

* A new CNBC survey of logistics managers suggests problems will persist

* US economy remains surprisingly strong, even if it’s not obvious

* Mortgage rates drop for sixth straight week

* US population rises 0.4% this year, close to slowest increase on record

* US economy in Q3 grew faster than previously estimated

* Low US jobless claims still highlight tight labor market conditions

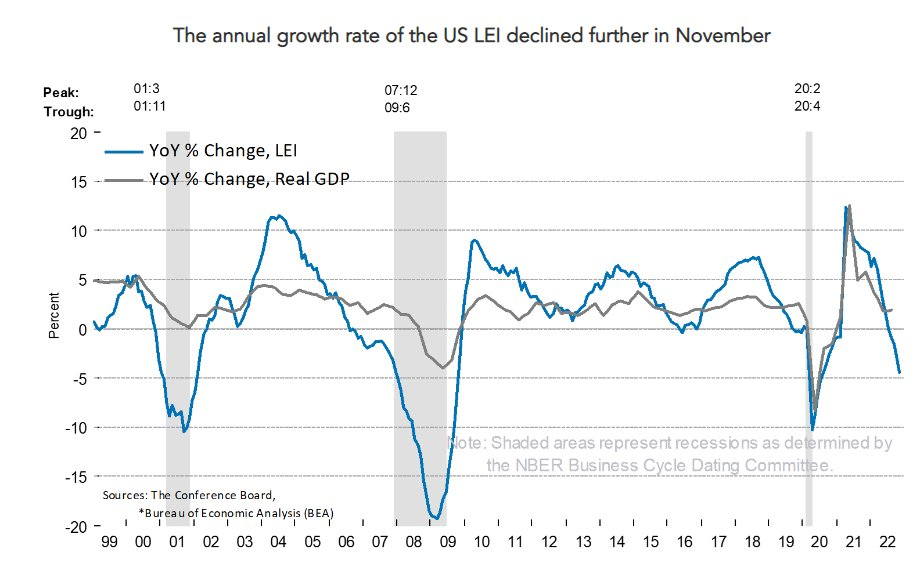

* US Leading Economic Index continues to signal elevated recession risk:

The outlook for China dominance in the world economy has been tarnished recently, writes economist Paul Krugman. “China’s long-running macroeconomic problems seem to be reaching a tipping point,” he advises. “It has been obvious for years that China’s economy, despite an awesome history of economic growth, is wildly unbalanced. Too few of the gains from growth have trickled down to households, keeping consumer spending low as a share of gross domestic product. Extremely high rates of investment have filled the gap — but all indications are that investment is running into severely diminishing returns, with businesses ever more reluctant to spend on new ventures.”

Bitcoin appears to be a leading indicator US stocks, according to analysis by Delphi Digital. “History shows that, on average, BTC has topped ~48 days and bottomed ~10 days before the SPX [S&P 500],” advise strategists at the consultancy. “Over the past five years, all major price reversals in BTC have preceded those in major equity indices,” CoinDesk reports.

Value stocks have posted relatively strong returns vs. growth stocks for the first time in years. “Leadership trends between growth and value tend to shift in multiyear cycles,” says Russel Kinnel, director of ratings and manager research at the firm, “and it’s unclear where we are in the cycle. But there are signs that value stocks are starting to take a more durable lead again, because of factors such as rising interest rates and tailwinds for the energy sector.”