Today’s updates on sentiment in the US services sector and the Federal Reserve’s Labor Market Conditions Index (LMCI) offer more evidence for arguing that economic growth is slowing in the third quarter. There’s still a solid pace of output in services, but LMCI confirms the weakening trend that’s conspicuous in Friday’s disappointing release on payrolls for September.

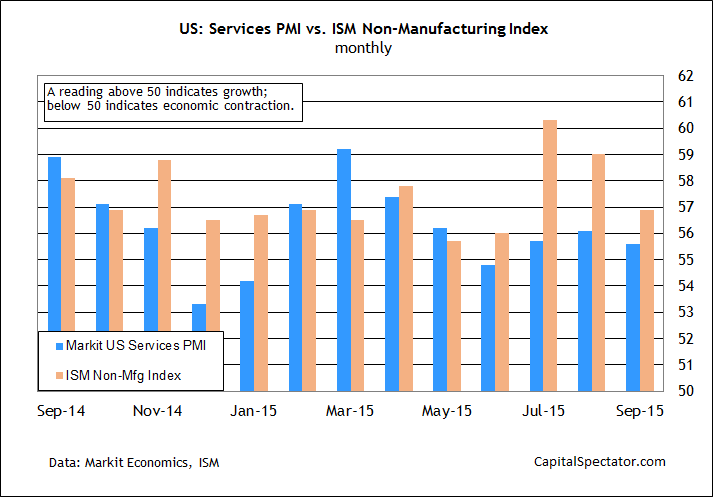

Let’s start with the services sector. New data published this morning by the Institute for Supply Management (ISM) and Markit tell a similar story of deceleration for this slice of the US economy in September. “US economic growth slowed in the third quarter according the PMI surveys, down to around 2.2%,” said Markit’s chief economist, Chris Williamson. “But this largely represents a payback after growth rebounded in the second quarter, suggesting that the economy is settling down to a moderate rate of growth in line with its long term average.”

Today’s update of the ISM Non-Manufacturing Index aligns with this view. The headline data fell to 56.9 in September, a three-month low. But that’s still well above the neutral 50 mark and so it’s clear that this corner of the economy—the dominant slice of macro activity in the US—continues to expand at a healthy if modestly diminished clip. The concern is that the services sector will continue to slow in sympathy with softer numbers from manufacturing and employment.

Meanwhile, LMCI’s decline last month to zero marks the lowest reading in five months. This broad-brush review of the labor market has turned weaker lately, but it’s not yet at the tipping point that clearly signals a new recession. Analyzing LMCI’s historical record, in context with NBER’s business cycle dates, via a probit model tells us that the odds are extremely low that September was the start of a new US downturn.

Nonetheless, business-cycle risk is elevated when peering into the near-term future. As I discussed in the Oct. 4 update of the US Business Cycle Risk Report, the growth trend is decelerating. It’s unclear if this is just another soft patch that will soon stabilize–or something darker. Much depends on how the October economic profile stacks up–a profile that will begin revealing itself in the weeks ahead. If the result is a materially weaker set of numbers vs. September, the potential for trouble will look more convincing.

Meantime, the evidence is mounting that US growth is slowing. Last week’s nowcast of third-quarter GDP growth (as of Oct. 1) for the US from the Atlanta Fed was revised down to a tepid 0.9%–far below the robust 3.9% gain in Q2 (seasonally adjusted annual rate). Managing expectations down is also front and center for Macroeconomic Advisers, which slashed its Q3 GDP estimate for growth to 1.4% from its previous Q3 estimate of 2.4%, according to The New York Times.

It’s still too early to make a definitive call that a new recession is fate. Most of the first run of numbers for last month’s macro profile have been published and it’s clear that moderate growth prevailed in September. But there are some cracks and the risk is rising that a turning point is near. It’s still a low risk, but the signs that trouble’s brewing aren’t currently moving in the right direction. The next several weeks could be decisive for deciding if the Q3 slowdown that’s in progress will roll on. Meantime, recent data all but ensures that a Fed rate hike is nowhere on the horizon until the macro profile delivers more encouraging news.

Pingback: Slower Economic Growth Indicated in Q3

Pingback: 10/06/15 – Tuesday’s Interest-ing Reads | Compound Interest-ing!