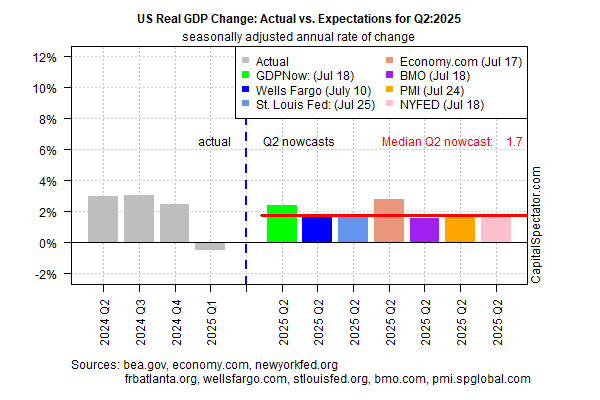

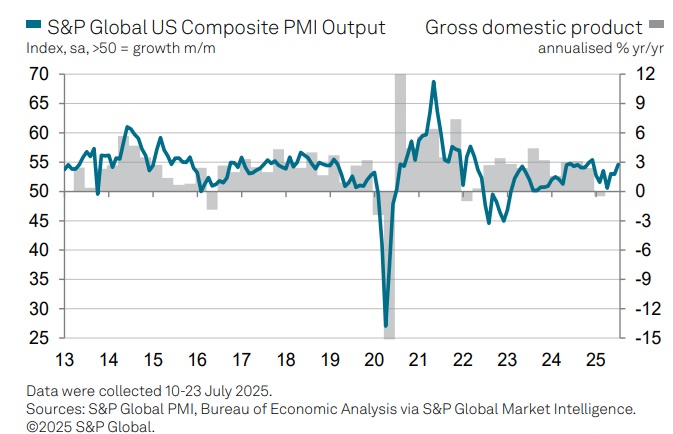

The US economy remains on track to post a moderate recovery in next week’s second-quarter GDP report, according to nowcasts compiled by CapitalSpectator.com. Meanwhile, new PMI survey data for July suggests growth will strengthen further in the first month of Q3.

Today’s revised Q2 nowcast continues to indicate a 1.7% increase, according to the median estimate. The nowcast is once again unchanged from the previous update (July 18). and marks a rebound after Q1’s 0.5% decline. The Bureau of Economic Analysis is scheduled to publish its initial Q2 GDP reporty on July 30.

The Chicago Fed National Activity Index (CFNAI) for June shows a degree of upside momentum at the end of Q2. CFNAI strengthened for a second month, rising to a 3-month high, the regional Fed bank reports.

An early look at the US macro trend for July suggests economic activity has strengthened, based on PMI survey data. This month’s initial estimate of the US Composite PMI Output Index, a GDP proxy, rose to 54.6, a seven-month high that lifts it further above the neutral 50 mark that separates growth from contraction. The reading implies economic growth at a 2.3% annualized pace.

“Whether this growth [in July] can be sustained is by no means assured,” says Chris Williamson, chief business economist at S&P Global Market Intelligence. “Growth was worryingly uneven and overly reliant on the services economy as manufacturing business conditions deteriorated for the first time this year, the latter linked to a fading boost from tariff front-running.”

Meanwhile, yesterday’s update on jobless claims shows that new filings for unemployment benefits fell for a sixth straight week. The drop left claims at a 3-month low, providing a hard-data indicator that suggests relative strength in the first month of Q3.

“Trump 2.0 economic policies have not brought the economy to its knees yet although whether this continues to be the case going forward remains an open question,” said Christopher Rupkey, chief economist at FWDBONDS. “The weekly jobless claims give Fed officials no cover whatsoever if they are seriously thinking of cutting interest rates at next week’s meeting.”

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno