The US economy is still on track to expand in the upcoming second-quarter GDP report, but today’s revised estimate marks a slowdown from recent nowcasts, based on the median estimate via several sources compiled by CapitalSpectator.com

Macro Briefing: 20 June 2023

* China plans a new military training facility in Cuba–90 miles off US coast

* China cuts key lending rate for loans and mortgages to shore up slowing growth

* Bipartisan group of US lawmakers will urge US automakers to cut China ties

* China imports of Russian oil rise to highest level since Ukraine invasion

* Fed Chairman Powell will explain rate pause in Congress this week

* US homebuilder sentiment continues rebounding in June to 11-month high:

Commodities Rose Sharply Last Week But Remain Range Bound

A broad measure of commodities led returns for the major asset classes last week, based on a set of ETFs through Friday’s close (June 16). But even after a strong rally it’s still not clear that the trend for commodities is set to break out of a tight range that’s prevailed for the past year.

Macro Briefing: 19 June 2023

* US Sec. of State Blinken meets China’s Xi Jinping in effort to reset relations

* Congress may be on a collision course with a gov’t shutdown later this year

* China economic recovery at risk due to property-sector woes

* Some economists expect China’s economy will be flat in second quarter

* Why rising interest rates may not push US economy into recession

* Ford chairman says US not ready to compete with China on electric vehicles

* Assumptions about global economy as a force for growth, prosperity are fraying

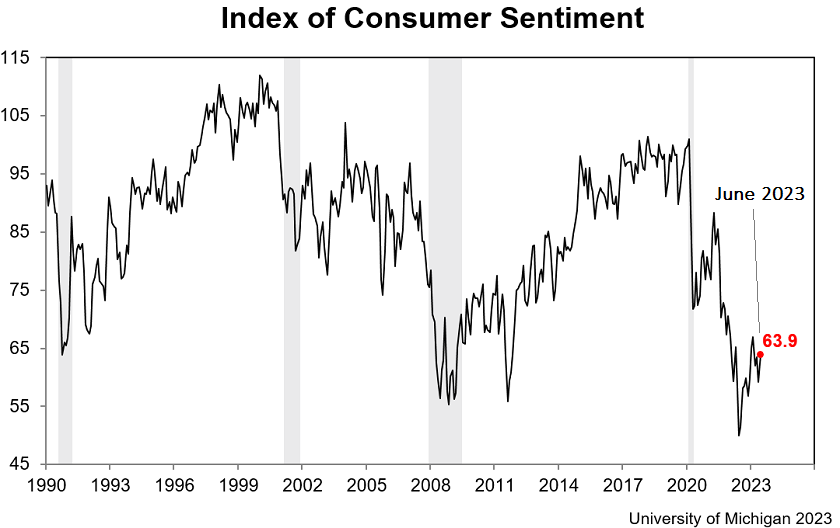

* US consumer sentiment remains low but rebounds to 4-month high in June:

Book Bits: 17 June 2023

● Quantitative Asset Management: Factor Investing and Machine Learning for Institutional Investing

Michael Robbins

Summary via publisher (McGraw Hill Professional)

Whether you’re managing institutional portfolios or private wealth, Quantitative Asset Management will open your eyes to a new, more successful way of investing—one that harnesses the power of big data and artificial intelligence. This innovative guide walks you through everything you need to know to fully leverage these revolutionary tools. Written from the perspective of a seasoned financial investor making use of technology, it details proven investing methods, striking a rare balance between providing important technical information without burdening you with overly complex investing theory.

10-Year Treasury Yield Surges Over Stock Market’s Dividend Yield

There are many factors to consider for choosing how to weight stocks and bonds in an investment portfolio and relative yield is on the short list. By that standard, the recent surge in the 10-Year Treasury yield vs. the dividend payout rate for US equities (S&P 500) looks attractive, at least compared to recent history.

Macro Briefing: 16 June 2023

* US Secretary of State Blinken flying to Beijing for high-stakes diplomacy

* Is it a bull market again? Maybe, but there are still risks to consider

* China economic recovery is stalling, recent indicators suggest

* Beijing planning major steps to revive the country’s sluggish economy

* BlackRock is applying to launch a spot bitcoin ETF

* US Industrial production fell in May, but manufacturing component edged higher

* US import prices fell in May, helping ease inflation pressure

* NY Fed and Philly Fed mfg indexes mixed for June with signs of optimism

* US retail sales beat expectations and rise for second month in May:

Will Sticky Core PCE Inflation Ease In Months Ahead?

The Federal Reserve left interest rates unchanged in yesterday’s policy announcement, marking the first time the central bank has not lifted rates since the hiking cycle began in March 2022. But Fed Chairman Jerome Powell was careful to advise that more hikes may be coming.

Macro Briefing: 15 June 2023

* Fed’s Powell sees progress on taming inflation, but says more hikes still possible

* US housing market is tight because most homeowners have low mortgage rates

* China industrial output grows less than expected in May

* China central bank cuts its key medium-term lending rate

* EU suggests breaking up Google’s ad business in preliminary antitrust ruling

* US wholesale inflation fell more than expected in May

* Fed leaves interest rates unchanged but expects more hikes ahead:

10-Year US Treasury Yield ‘Fair Value’ Estimate: 14 June 2023

The market continues to price the US 10-year Treasury yield at a relatively wide spread over its “fair value”, based on the average estimate of three models assembled by CapitalSpectator.com for May 2023.