Book Bits: 27 May 2023

● We Need to Talk About Inflation: 14 Urgent Lessons from the Last 2,000 Years

Stephen D. King

Review via Financial Times

Economic history is rarely taught in universities these days. This is a pity, since it is a better guide to policymaking than Nobel Prize winning theses in economic theory. As a result, every two generations or so we are destined to repeat serious policy mistakes. In Britain the Truss government failed to study the Barber Boom of 1972-73 and arguably the world’s central banks too have failed to learn from the oil price shocks of 1973 and 1980.

Stephen D King’s highly readable and informative book provides a welcome antidote… King’s canter through 2,000 years of inflationary history — from Emperor Diocletian’s debasement of the coinage through to the Federal Reserve’s decision in 2021 to allow inflation to run at above the 2 per cent “central target” — is instructive. Money matters.

Research Review | 26 May 2023 | US Debt-Ceiling Risk

Common Fallacies Surrounding the 2023 Debt Ceiling Debates

Paul Kupiec (American Enterprise Inst.) and Alex Pollock (Ludwig von Mises Inst.)

May 7, 2023

We investigate the veracity of current and former government officials’ claims made in the context of the 2023 debt ceiling standoff: that it would be unconstitutional for the US to default on its debt; that the US has never before defaulted; and there are no extraordinary measures that could be taken to avoid a government default by mid-summer. We show that all of these claims are demonstrably untrue.

Macro Briefing: 26 May 2023

* Outline for a possible US debt-ceiling deal takes shape

* Three options to avoid a debt-ceiling crisis without a political compromise

* Europe’s source of economic resiliency–Germany–is breaking down

* New Chinese hacking effort risks derailing hopes for a US-China thaw

* JPMorgan developing ChatGPT-type AI service that gives investment advice

* US GDP growth in Q1 revised modestly higher to 1.3%

* US economic activity strengthened in April via Chicago Fed Nat’l Activity Index

* Pending home sales in US were steady in April

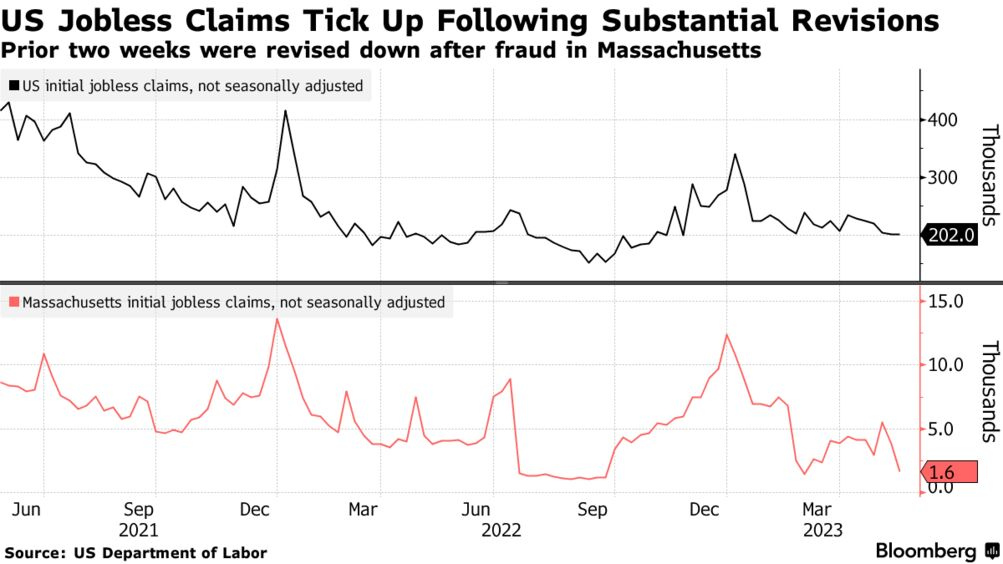

* US jobless claims edged up last week as prior weeks revised lower:

US Debt-Ceiling Deal Remains Elusive As Default Risk Nears

The contrast could hardly be more striking. House Speaker Kevin McCarthy emerged from yesterday’s latest round of negotiations with the White House with an upbeat spin but no deal. Soon after, Fitch Ratings put the AAA credit rating for US debt on watch for a downgrade.

Macro Briefing: 25 May 2023

* Risk is rising for no deal on debt ceiling over long holiday weekend

* Default might not stop US Treasuries from trading

* Fitch puts US credit rating on rating watch negative due to “political partisanship”

* Yields surge for soon-to-mature Treasury bills due to debt-ceiling risk

* Federal Reserve officials divided over rate hikes, minutes reveal

* Threats to the global banking system have eased

* Global investment in solar energy set to overtake equivalent for oil production

* Meta continues brutal round of layoffs

* Buying a US home is cheaper than renting in just 4 cities

* Germany slips into recession after revised Q1 GDP reflects 0.3% decline:

US Recession Risk May Be Easing, No Thanks To Manufacturing

Rarely in the history of US economic analysis have recession forecasts been so plentiful and widely embraced. All the more extraordinary is the ongoing resilience of the economy that defies the gloomy expectations. There are real and present dangers lurking that could quickly alter current conditions, but new numbers published this week reaffirm that business activity in May indicates that recession risk is still low.

Macro Briefing: 24 May 2023

* Debt-limit talks in Washington stumble as time runs out for deal

* US economy in ‘much better shape’ vs. gloomy forecasts: BlackRock’s bond chief

* US Navy increase efforts to stop Iran’s ship seizures in Strait of Hormuz

* Debt-ceiling risk inspires investors to look for new safe havens

* More work needed to tame inflation, says former Fed chief Ben Bernanke

* Chip war with China risks ‘enormous damage’ to US tech, warns Nvidia chief

* New US home sales rise more than expected in April

* Richmond Fed Mfg Index continues to post steep contraction in May

* Apple announces US-based computer chips deal with Broadcom

* US economic activity picks up to 13-month high in May via PMI survey data:

Have Rate Hikes Ended? Fed Officials Leave Room For Debate

Federal Reserve Chairman Jerome Powell on Friday spoke the words that investors have longed to hear: the rate-hiking cycle is ending. Except that maybe it isn’t.

Macro Briefing: 23 May 2023

* Biden-McCarthy debt-ceiling meeting is ‘productive’ but no deal yet

* Treasury Sec. Yellen again warns that US will run out of funds as early as June 1

* US Treasury will issue up to $700 billion in T-bills after debt ceiling is raised

* Pause on rate hikes in June wouldn’t signal end to hiking cycle: Fed’s Kashkari

* Fed’s Bullard says two more rate hikes needed this year

* Share of Americans feeling worse about their finances at 9-year high

* Japan growth will outpace US and Europe over next 2 years, predicts CLSA Ltd

* Can Australia end its lithium-export dependence to China? It aims to try

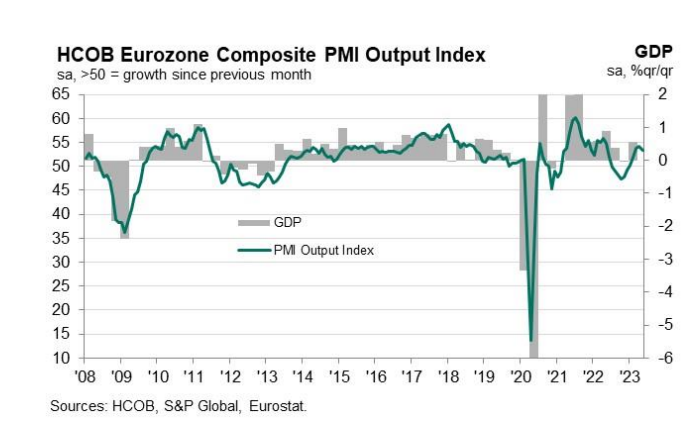

* Weak mfg activity pulls Eurozone economic growth down to 3-month low in May: