* US Navy challenges Beijing in South China Sea amid show of force near Taiwan

* End of rate-hiking cycle may be near

* US is building new factories at a furious pace

* Is the bond market over-estimating the risk of deep recession?

* Half-empty offices are a risk factor for banks

* Apple’s personal computer shipments fell 41% in the first quarter

* Tesla will open mega-factory in China to produce batteries

* Housing data suggests sector correction may be ending

* Growth in US payrolls slows in March:

Book Bits: 8 April 2023

● The Spectacle of Expertise: Why Financial Analysts Perform in the Media

Alex Preda

Summary via publisher (Columbia U. Press)

Financial experts have become ubiquitous on television, radio, and social media. They provide investment advice, interpret market movements, and explain the implications of political events, wielding a great deal of power and influence through their media presence. How do these experts acquire their authority, and what makes displays of financial expertise persuasive to their audiences? Preda demonstrates that analysts and media professionals deploy expertise when they engage with audiences in ways that make it difficult to contest the claims conveyed in their talk.

Macro Briefing: 7 April 2023

* World economy set for weakest near-term growth since 1990, IMF chief predicts

* China’s Xi Jinping willing to speak to Ukraine’s Zelenskyy, says EU chief

* Brazilian President urges Ukraine to give up Crimea to Russia

* China’s economy recovering slower than expected, say Citi analysts

* Trailing US equity premium falls to lowest level since 2007

* US home prices starting to lag inflation, reversing trend in recent years

* Job cuts in US up 15% in March and surge 319% vs. year-ago level

* US jobless claims revised up, reflecting higher layoffs than initially reported

* Global economic growth accelerates in March, according to PMI survey data:

Research Review | 6 April 2023 | Artificial Intelligence and Finance

Multi-(Horizon) Factor Investing with AI

Ruslan Goyenko and Chengyu Zhang (McGill University)

April 2023

Can the backbone technology behind ChatGPT create and manage portfolios? We apply this tech-engine, adapted for finance applications, to multi-factor investing by a long-horizon investor who uses bigger that traditionally used data and takes into consideration long-term versus short-term volatility, liquidity and trading costs trade offs while maximizing expected portfolio returns. The answer is yes, as we are able to actively time factors’ premium realizations while dynamically re-balancing and diversifying between factors. Moreover, the long horizon perspective is critical, as it allows for more patient trading and re-balancing needs, more strategic factor timing, and a different set of fundamental signals to rely on.

Macro Briefing: 6 April 2023

* House Speaker McCarthy meets with Taiwan’s president, defying China

* Wall Street should worry about debt-ceiling risk, says House Speaker McCarthy

* France’s Macron begins talks with China’s Xi Jinping

* US-China tensions will cost world economy 2% of output, estimates IMF

* China service sector growth accelerates in March

* Norway is now Europe’s main supplier of fossil fuels

* US services sector growth eases more than expected in March

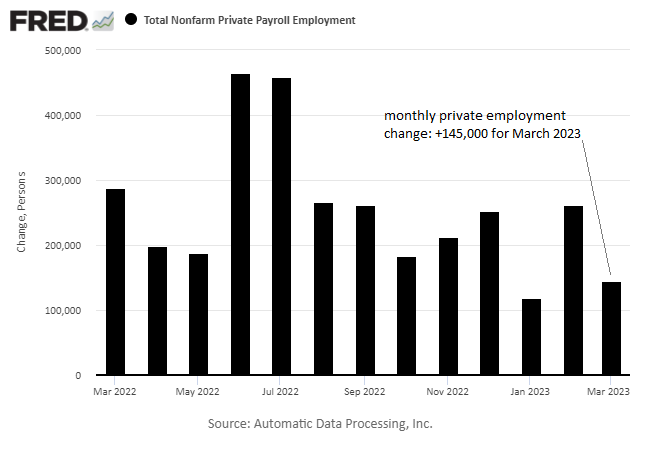

* US private hiring rose less than expected in March via ADP data:

Is The US Facing A Slow(er)-Moving Recession Threat? Part III

Assessing US recession risk isn’t getting any easier, but when it comes to cutting through the noise I continue to rely on combining models for the single-best tool in the toolkit. To paraphrase Churchill, this is usually the least-worst way to evaluate the odds that an NBER-defined downturn is near or has already started.

Macro Briefing: 5 April 2023

* Cleveland Fed President reaffirms central bank’s resolve to tame inflation and…

* Mester says Fed should raise and hold its target rate above 5%

* Eurozone economy expands at strongest pace since May 2022: PMI survey data

* Banking crisis not over yet, says JP Morgan’s Jamie Dimon

* Gold rises well above $2000 an ounce, near an all-time high

* Walmart lays off 2,000 workers at warehouses that fulfill website orders

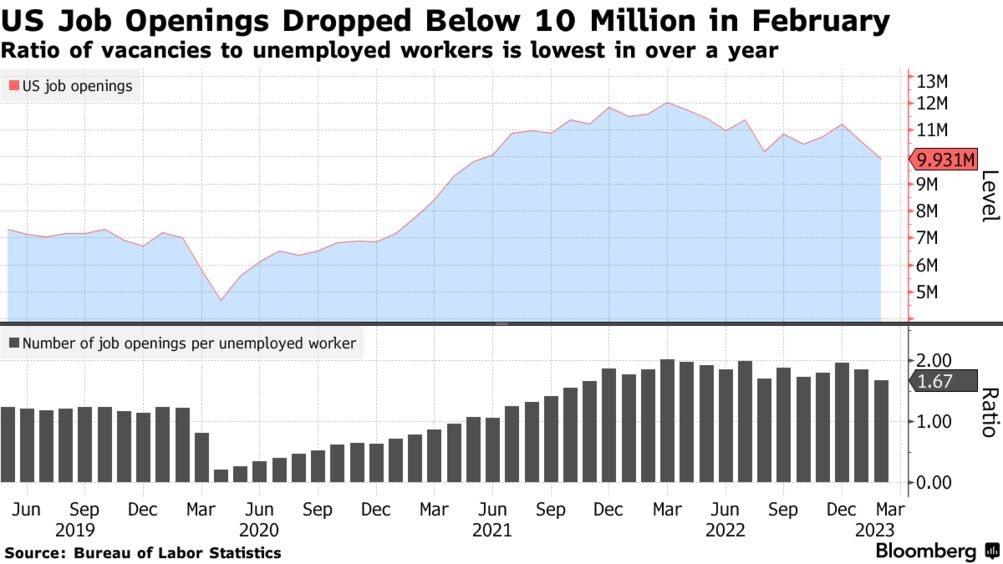

* US job openings in February fall below 10 million for first time in 2 years:

Total Return Forecasts: Major Asset Classes | 4 April 2023

The expected long-run return for the Global Market Index (GMI) held steady at 6.0% annualized in March, unchanged from last month and close to its trailing performance over the past decade. The forecast is based on the average estimate for three models (defined below).

Macro Briefing: 4 April 2023

* US debt-ceiling crisis is still approaching with few, if any, signs of progress

* China launches cybersecurity probe into US chipmaker Micron Technology

* World Bank warns of “lost decade” ahead for global growth

* Italy is first Western country to block AI chatbot ChatGPT

* Global manufacturing output rises for second month in March

* Interest rates for car loans reach record high

* US construction spending unexpectedly eased in February

* US ISM Mfg Index slides deeper in March, indicating contraction for fifth month:

Major Asset Classes | March 2023 | Performance Review

Most asset classes rebounded in March, led by inflation-indexed government bonds ex-US, based on a set of ETF proxies. The downside outlier: real estate shares in the US and around the world.