* Biden describes debt-ceiling talks with Republican leaders as “productive”

* Debt-ceiling deal remains elusive, but leaders will meet again Friday

* Americans lack confidence in key US economic leaders, survey finds

* Cryptocurrency exchange Bittrex files for bankruptcy

* New listings for US home sales fell 21% in April vs. year-ago level

* OpenAi tops CNBC’s list of top-50 firms as 2023 disrupters

* US small business sentiment slips in April to lowest level in a decade:

Macro Briefing: 9 May 2023

* Biden and McCarthy will meet today to discuss debt ceiling

* Wall Street plans for trouble if there’s a US default re: the debt ceiling

* Fed warns of credit crunch in wake of recent bank turmoil

* China exports rose 8.5% in April, beating expectations, but…

* China imports fell sharply in April, suggesting economic growth is weak

* US inflation expected to remain well above Fed target in April data

* Gold holds above $2000 an ounce ahead of Wednesday’s US inflation data

* US consumer inflation expectations fall in April for year-ahead outlook

* Bank lending standards remained tight in Q2, loan officer survey shows:

Foreign Bonds Led Returns In Last Week’s Mixed Trading

Fixed-income markets ex-US led performances during a mixed week for the major asset classes through the close of trading on Friday, May 5, based on a set of ETFs.

Macro Briefing: 8 May 2023

* “Economic chaos” awaits if Congress doesn’t raise debt ceiling

* Time is running short for Biden-McCarthy debt-ceiling talks

* China increases its gold reserves for a sixth straight month

* US payrolls rose more than expected in April

* US economic activity appears to be stabilizing at slow growth pace:

Book Bits: 6 May 2023

● The Little Book of Picking Top Stocks: How to Spot the Hidden Gems

Martin S. Fridson

Summary via publisher (Wiley)

How well does it pay to own the Standard & Poor’s 500 Index’s best-performing stock of the year? Over the 2012-2021 period, the one-year total return ranged from 80% to 743%. This book identifies the quantitative and qualitative traits of stocks that made it to #1 and tells the stories of how they got there. A key indicator, the Fridson-Lee Statistic, makes its debut in these pages. Aiming for the massive upside of the #1 stocks entails substantial risk. It’s not something to do with more than a small percentage of your portfolio. But attempting to pick the coming year’s top performer can provide an outlet for speculative impulses that might otherwise spoil a prudent, long-term investment plan. And by investigating the statistically determined best candidates for #1, you’ll gain important insights into stock selection.

Desperately Seeking Yield: 5 May 2023

Trailing yields have increased for most of the major asset classes recently, based on a set of ETF proxies. The question is whether the relatively high payout rates offset concerns for the possibility of capital losses in the near term?

Macro Briefing: 5 May 2023

* Uncertainty hammers regional bank stocks as confidence wavers

* US Q2 GDP nowcast ramps up to solid +2.7% via Atlanta Fed’s GDPNow model

* Global manufacturing activity remained slightly negative in April

* German factory orders plunged in March

* Growth in China business activity eased in April via PMI survey data

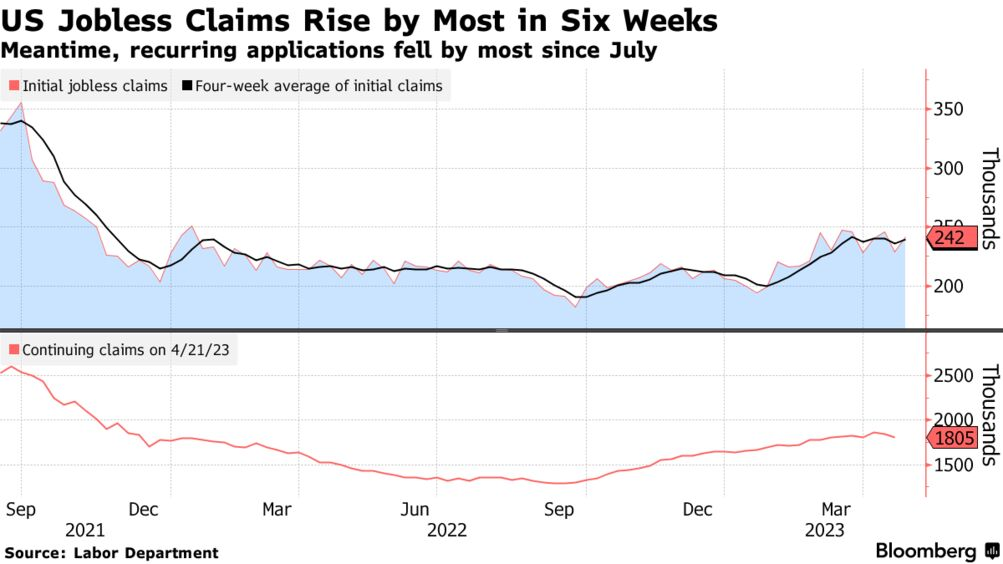

* US jobless claims rose last week, but remain low by historical standards:

Markets Consider A Path For Fed Pause And Cut On Rates

The Federal Reserve raised interest rates for a 10th straight time on Wednesday, lifting its target by a 1/4-point to a 5.0%-to-5.25% range, the highest since 2007. But there are hints that the central bank may be set to pause at the next policy meeting in June and start cutting later in the year. Much depends on how the economic and inflation data compare in the updates during the weeks and months ahead. But for now, the crowd thinks the rate-hiking cycle may have peaked.

Macro Briefing: 4 May 2023

* Federal Reserve raises its target rate 1/4-point to 5.0%-to-5.25% range

* Policy-sensitive 2-year Treasury slides after Fed hike

* PacWest Bancorp shares tumble; latest US bank to seek financial lifeline

* China manufacturing business conditions “moderate slightly in April”

* Eurozone economy in April grows at “strongest pace since May 2022”

* ISM Services Index ticks up in April, reflecting modest growth

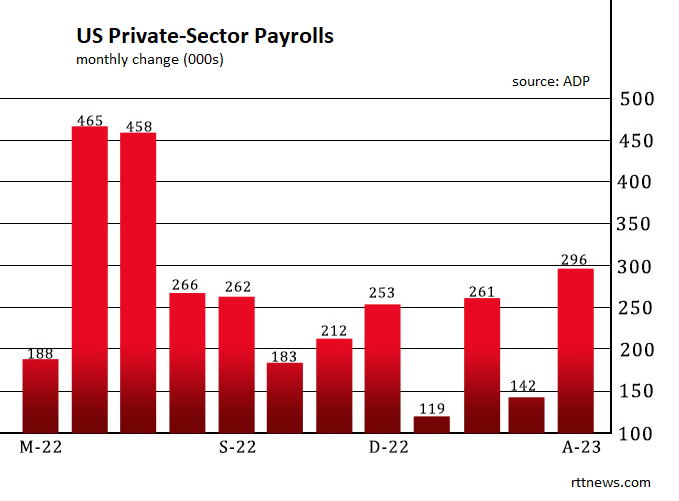

* US hiring at companies rebounds sharply in April via ADP data:

Fed Hike Expected Despite Ongoing Risks For Regional Banks

Raising interest rates always comes with risk for the economy, but the stakes are higher than usual at a time when banking turmoil appears to be reviving. Nonetheless, markets are expecting that the central bank will again lift rates at today’s policy meeting.