Despite warning signs flashing from several indicators, the US economy is expected to report moderate growth in next month’s “advance” GDP report for the first quarter, based on a set of nowcasts compiled by CapitalSpectator.com.

Macro Briefing: 29 March 2023

* Taiwan’s president heads to US for visit, provoking China

* Fed’s Barr: there’s a ‘need’ for stronger bank regulation after SVB collapse

* BlackRock forecasts that investor bets on Fed rate cuts this year are wrong

* US Consumer Confidence Index ticks up in March, holding at middling range

* US electricity from renewables exceeds coal-based output for first time

* Amazon reportedly eyeing purchase of AMC movie theater chain

* US trade deficit in goods widened modestly in February

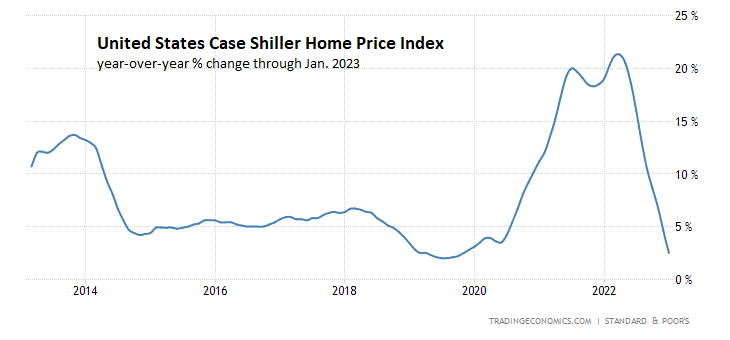

* US home prices continue to decelerate in January, easing to +2.5% annual pace:

Trend Profiles Revive Outlook For US, Big-Cap And Growth Equities

Forecasts that relative underperformers in the equities space are poised for a turnaround is a hardy perennial, but the expected change always seems to be postponed for several of the usual suspects. Notably, projections that foreign, small-cap and value stocks are set to outperform their broad US, large-cap and growth counterparts are facing new headwinds this year.

Macro Briefing: 28 March 2023

* SVB collapse was “textbook case of mismanagement”: Fed official

* Banking turmoil due to ‘sentiment contagion’, say analysts

* US and Japan announce trade deal on electric vehicle battery minerals

* Bond market is still flashing warning signs for the economy

* Semiconductor firms may have to choose between US and China

* Wind-power industry projects rapid growth this year after 2022 slowdown

* China ramps up emergency loans to financially struggling nations

* Modest growth resumes in Texas manufacturing: Dallas Fed Mfg Index

* Regional bank stocks rally, suggesting banking turmoil is easing:

Global Markets Rallied Last Week, Except For Property Shares

Nearly all the components of the major asset classes posted gains last week, based on a set of proxy ETFs. Real estate shares in the US and around the world were the downside exceptions, based on trading through Friday’s close (Mar. 24).

Macro Briefing: 27 March 2023

* Israel in turmoil as mass protests erupt over plan for judicial overhaul

* China’s managed economy continues to postpone a ‘Lehman moment’

* China’s central government borrowing at fastest pace on record

* US recession risk rises from banking stress, says Fed’s Kashkari

* US authorities consider expanding emergency lending for banks

* First Citizens Bank will buy assets of failed Silicon Valley Bank

* Copper prices looks set to rise further this year, analysts predict

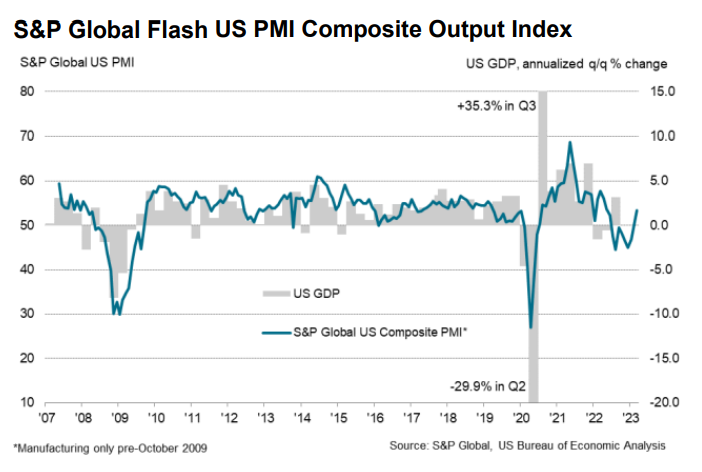

* US business activity rebounds to strongest pace in a year in March:

Book Bits: 25 March 2023

● Better Money: Gold, Fiat, or Bitcoin?

Lawrence H. White

Summary via publisher (Cambridge U. Press)

The recent rise of dollar, pound, and euro inflation rates has rekindled the debate over potential alternative monies, particularly gold and Bitcoin. Though Bitcoin has been much discussed in recent years, a basic understanding of how it and gold would work as monetary standards is rare. Accessibly written by a pioneering economist, Better Money explains and evaluates gold, fiat, and Bitcoin standards without hype. White uses simple supply-and-demand analysis to explain how these standards work, evaluating their relative merits and explaining their response to shocks, allowing for informed comparisons between them. This book addresses common misunderstandings of the gold standard and Bitcoin, using historical evidence to review the history of money with emphasis on the contest between market and government provision. Known for his work on alternative monetary institutions, White offers a reasoned discussion of which standard is most likely to provide a better money.

US Bonds Rally As Market Considers Pause Or End For Rate Hikes

Turmoil in the bank industry and renewed concerns of economic headwinds are driving expectations that Federal Reserve interest-rate hiking is at or near an end. In turn, the outlook has sparked a rally in the US bond market.

Macro Briefing: 24 March 2023

* Eurozone business activity rebounds to 10mo high in March: PMI survey data

* Will banks’ $1.7 trillion in unrealized losses become a problem?

* Expected fall in lending due to bank turmoil will help Fed tame inflation

* China could be a ‘relative safe haven’ this year, advise Citi economists

* Bond market volatility has surged, hinting at greater uncertainty and risk

* Tech consulting firm Accenture to cut 19,000 jobs

* US jobless claims edge down, continue to show tight labor market

* US economic activity eases in February: Chicago Fed Nat’l Activity Index

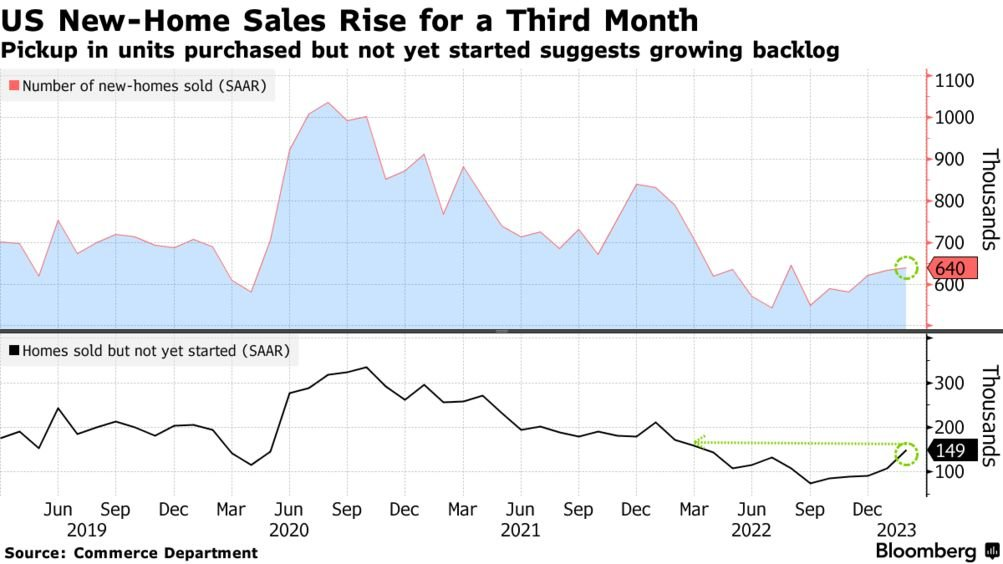

* New US home sales rebound for third month in February:

Another Fed Rate Hike Keeps Policy Modestly Tight

Yesterday’s ¼-point rate hike by the Federal Reserve was expected, although there’s debate about whether another round of policy tightening is wise in the wake of recent bank turmoil following the collapse of Silicon Valley Bank (SVB).