Economists were expecting a sharp recovery in US retail spending in January, but the actual number blew past even the most optimistic forecast. One month could be noise, but for the moment it appears that the Federal Reserve’s aggressive campaign to tame inflation by slowing economic activity is faltering.

Macro Briefing: 16 February 2023

* Embattled World Bank president, David Malpass, will resign early

* Homebuilder sentiment for US rebounds sharply in February

* US Q1 GDP nowcast revised up to +2.4% via Atlanta Fed’s GDPNow model

* US budget deficit set to deepen to 6.9% of GDP by 2033, CBO projects

* US may default in July if debt-ceiling standoff isn’t resolved, CBO warns

* NY Fed Mfg Index rebounds in February but remains in negative territory

* US industrial output flat in January, but rises 0.8% vs. year-ago level

* US retail sales surge in January, in nominal and inflation-adjusted terms:

10-Year Treasury Yield ‘Fair Value’ Estimate: 15 February 2023

US consumer inflation continues to ease, but less so than expected in January. Yesterday’s update suggests that the Federal Reserve will see the latest numbers as new sign that pricing pressure isn’t cooling fast enough. In turn, the case may have strengthened at the central bank for keeping interest rates higher for longer.

Macro Briefing: 15 February 2023

* China says it will ‘take countermeasures’ against US in balloon saga

* European Union bans sales of gas-powered cars starting in 2035

* ‘Earnings recession’ expected for US companies

* Small US business sentiment ticks up but remains below 49-year average

* Logistics managers warn of persistent inflation risk in supply chains

* Rally in emerging markets faces headwinds as US economy remains resilient

* Aggressive regulatory actions from US authorities rattle crypto markets

* US consumer inflation’s one-year trend continued to ease in January:

Foreign Stocks Are Hot Again. Will It Last?

Diversifying into global markets ex-US has been a frustrating choice for asset allocation for much of the past decade. Standard portfolio theory recommends holding an international mix of shares, but the advice has been a dud in recent memory as US stocks have dramatically outperformed broad measures of offshore securities. But the rally in foreign stocks so far in 2023 suggests the tide may finally be turning in favor of global investing strategies.

Macro Briefing: 14 February 2023

* Biden to name Fed Vice Chair Brainard as top White House economic adviser

* Fed will hold rates higher for longer, predicts Wells Fargo economist

* So-called supercore inflation will be in focus in today’s CPI report

* US consumers still spending despite higher inflation

* Japan’s economy expands 1.1% in 2022, down from 2.1% rise in 2021

* New head of Japan’s central bank announced, first change in a decade

* Ford will build $3.5 billion battery plant in Michigan for electric vehicles

* Policy-sensitive 2-year US Treasury yield ticks up to 3-month high:

Global Markets Post Widespread Losses Last Week

This year’s rebound in global markets hit some turbulence last week, with the exception of commodities, based on a set of ETFs through Friday’s close (Feb. 10).

Macro Briefing: 13 February 2023

* US shoots down several aerial objects over North America

* Some economists consider possibility of an economic growth upturn for US

* Fears of a US debt crisis are overblown, writes economist Barry Eichengreen

* This week’s US consumer inflation data will test disinflation optimism

* Recession risk is lower due to labor hoarding, analyst reasons

* Will higher yields in Japan pull back assets invested overseas?

* US home prices set to fall further despite lower rates, says market expert

* Half of Americans say they’re worse off vs. year ago, survey finds

* US consumer inflation revised up for December

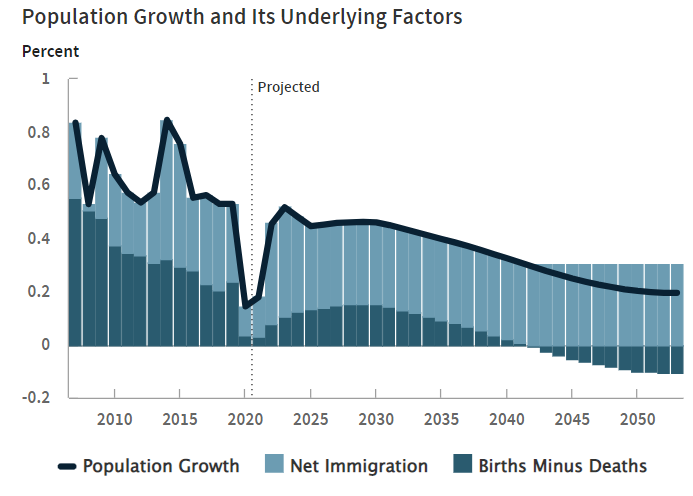

* Population growth in US is increasingly driven by net immigration, CBO projects:

Book Bits: 11 February 2023

● At Work in the Ruins: Finding Our Place in the Time of Science, Climate Change, Pandemics and All the Other Emergencies

Dougald Hine

Summary via publisher (Chelsea Green Publishing)

In eloquent, deeply researched prose, Hine demonstrates how our over-reliance on the single lens of science has blinded us to the nature of the crises around and ahead of us, leading to ‘solutions’ that can only make things worse. At Work in the Ruins is his reckoning with the strange years we have been living through and our long history of asking too much of science. It’s also about how we find our bearings and what kind of tasks are worth giving our lives to, given all we know or have good grounds to fear about the trouble the world is in.

Will This Year’s Recovery In US Bonds Continue?

After taking a beating last year, US fixed income securities have clawed back some of the losses so far in 2023, based on a set of ETFs through yesterday’s close (Feb. 9). But with the Federal Reserve still intent on lifting interest rates to tame inflation, the outlook for bonds is still murky.