Every corner of the US bond market has rallied year to date, led by intermediate Treasuries, based on a set of ETFs through Wednesday’s close (June 18). Several risk factors are lurking for the second half of the year, but fixed income looks set to score a win for the year when 2025 reaches the halfway mark in a few days.

Macro Briefing: 20 June 2025

President Trump said he will he would decide within two weeks whether or not the US will become directly involved in the conflict between Israel and Iran. “Based on the fact that there is a substantial chance of negotiations that may or may not take place with Iran in the near future, I will make my decision whether or not to go within the next two weeks,” Mr. Trump said in a statement read by the White House press secretary on Thursday. The price of Brent crude oil — a proxy for market sentiment regarding expectations for the Israel-Iran conflict — remains steady at the moment after running sharply higher in recent days.

Will The US Aid Israel By Attacking Iran?

The question resonates after President Trump publicly mused about what could be the most momentous decision of his presidency. Bound up with that decision are high-stakes repercussions that could reverberate through the US economy and around the world.

Macro Briefing: 19 June 2025

Israel-Iran conflict continues as Trump considers US involvement. The President said he was undecided on whether to give the order for a US strike in support of Israel’s ongoing attack on Iranian nuclear and military targets. “I may do it, I may not do it,” he told reporters at the White House on Wednesday.

Solid Rebound Still Expected For US Growth For Q2 GDP Report

Concerns about the US economy persist, but if there’s a slowdown brewing it’s unlikely to show up in the second-quarter GDP report. Revised nowcasts for the government’s Q2 report (due on July 30) continue to indicate a robust recovery following Q1’s slight contraction.

Macro Briefing: 18 June 2025

US retail sales fell the most in four months in May, dropping more than expected. “Tariff announcements have had a clear impact on the timing of large-ticket purchases, notably autos, but there are few signs yet that tariffs are leading to a general pullback in consumer spending,” said Michael Pearce, deputy chief economist at Oxford Economics. “We expect a more marked slowdown to take hold in the second half of the year, as tariffs begin to weigh on real disposable incomes.”

Industrials Take The Lead For US Equity Sectors This Year

In a year of shocks, turmoil, and tariffs, investor sentiment has been whipped to and fro as the crowd struggles to assess the outlook for risk and reward. But as 2025 approaches its mid-point, stocks in the industrial sector have found their footing and are now the performance leader, based on a set of ETFs through Monday’s close (June 16).

Macro Briefing: 17 June 2025

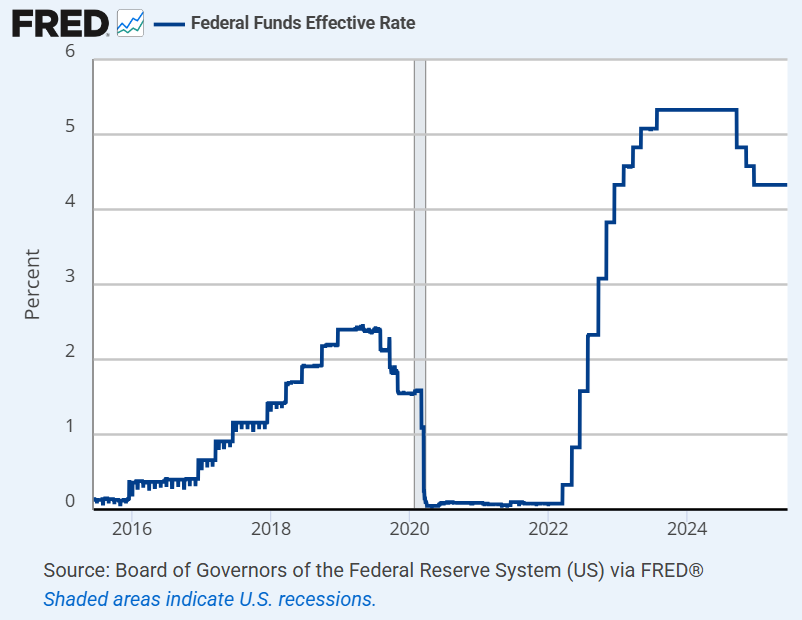

Fed funds futures are pricing in a near certainty that the Federal Reserve will leave its target rate unchanged today for the 2:00pm eastern policy announcement. The main focus will be on comments Fed Chair Jerome Powell in the press conference that starts at 2:30pm. Investors will be listening closely for hints of lingering concern over inflation, the path ahead for rate cuts and the outlook for economic activity. The Fed will also publish revised economic projections today.

The Israel-Iran Conflict Complicates The Macro Outlook

The Israel-Iran conflict continued for a fourth day as each country launched attacks on Monday. The fighting threatens to elevate oil prices for an extended period and bring a new phase of instability to the global economy that’s still reeling from elevated tariff risk.

Macro Briefing: 16 June 2025

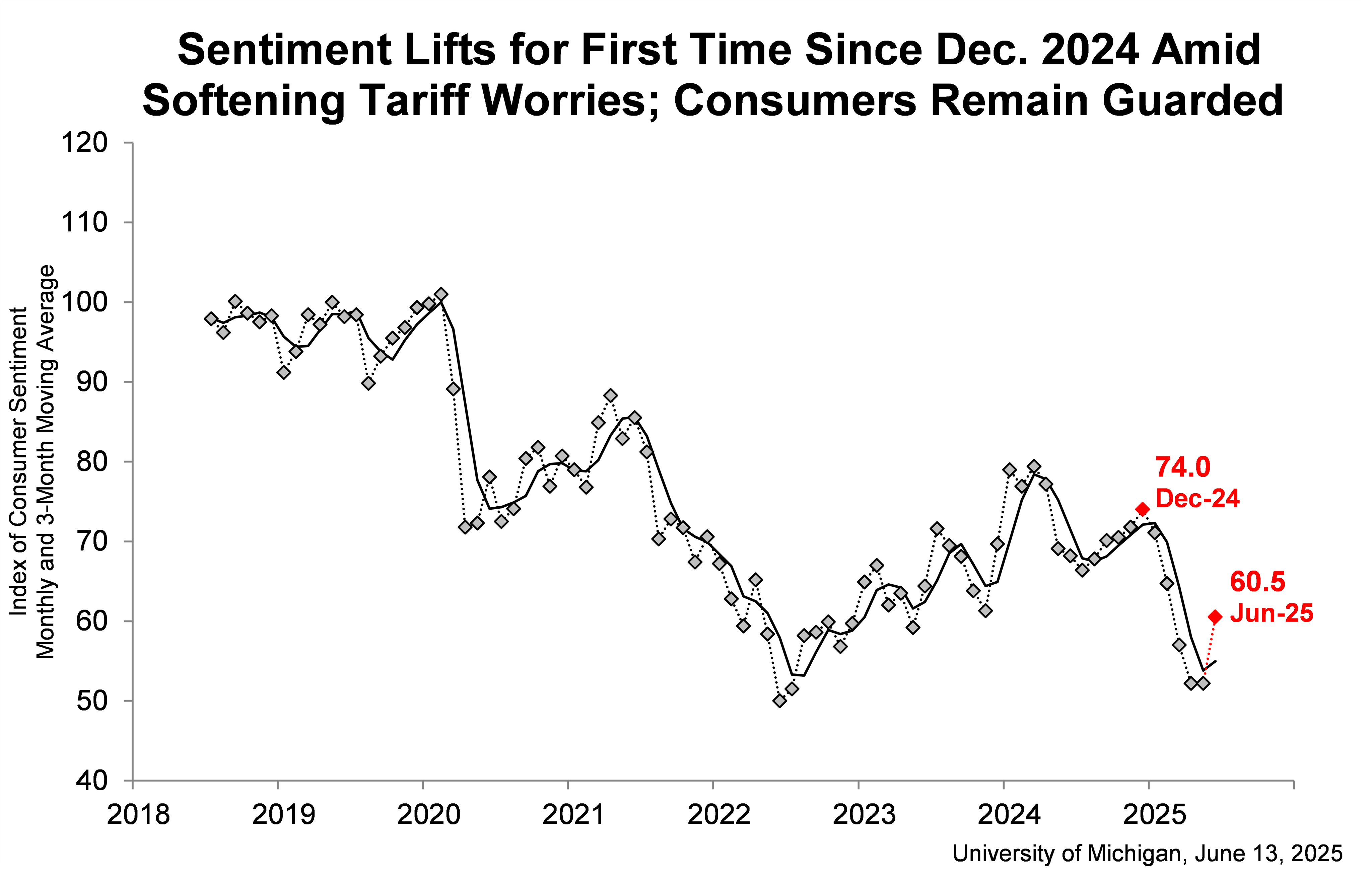

US consumer sentiment improved in June for the first time this year. The rise was modest and still leaves the University of Michigan’s index about 20% below December 2024, when sentiment posted a post-election bump. “Consumers appear to have settled somewhat from the shock of the extremely high tariffs announced in April and the policy volatility seen in the weeks that followed. However, consumers still perceive wide-ranging downside risks to the economy,” said Joanne Hsu, survey director, said in a statement.