* Zelensky, in visit to Washington, urges US to help it defeat Russia

* US unveils new $1.8 billion of new military aid for Ukraine

* Kremlin warns that more US arms in Ukraine will aggravate war

* China’s Xi bets on economic growth as distraction from Covid outbreak

* Netanyahu on brink of returning to power as Israel prime minister

* US life expectancy in 2021 fell to lowest level since 1996

* Will AI chat bots become the next big disrupter in tech?

* Existing home sales in US continued falling in November–10th straight decline

* US consumer confidence rebounds in December after two months of declines:

Is The Yield Curve A Reliable Predictor Of Recession?

Judging by the ink spilled on the topic over the years, the overwhelming assumption is “yes.” Surely by the standard of using one indicator, the spread on short-term less long-term yields for US Treasuries is a tough act to beat. But just when you thought it was safe to rely on the yield curve to forecast recession risk, the “godfather” of this indicator is expressing doubt.

Macro Briefing: 21 December 2022

* Ukrainian President Zelensky visits Washington today

* US continues to refine restrictions on China’s potential chip stars

* Congress moving forward with funding bill to avoid government shutdown

* High prices for crops and livestock fueling boom in US farm belt

* Congress may pass new law to promote accumulating retirement savings

* US housing permits fall sharply, posting deepest 1-year decline in 13 years:

Desperately Seeking Yield: 20 December 2022

Markets continue to fall and trailing yields continue to rise. The inverse relationship, in theory, presents yield-hungry investors with enhanced opportunity. The challenge, as always, is whether to believe that what’s rising in the rear-view mirror will translate to hard cash in your account.

Macro Briefing: 20 December 2022

* Putin visits Belarus, raising concern of new front in Ukraine war

* China appears to be facing surging Covid cases

* US worried that new China Covid outbreak will spawn new virus mutations

* Bank of Japan widens 10-year government bond yield range

* Global oil market remains tight: Saudi Aramco, world’s largest oil producer

* Meta may face $12 billion in new fines from European Union

* US homebuilder sentiment continues falling in December:

US Bonds Rose Last Week As Risk-Off Sentiment Strengthened

Most of the major asset classes suffered last week as markets reassessed the risk of ongoing hikes in interest rates and elevated recession risk, based on a set of ETFs for the trading week through Friday, Dec. 16. The main exception: US bonds rallied amid firmer demand for safe havens.

Macro Briefing: 19 December 2022

* Putin ‘planning for long war’ in Ukraine, predicts NATO chief

* US border cities prepare for expected migrant surge

* Tech firms focus on heading off tougher regulation

* Morgan Stanley analyst: drop in US corporate profits could rival 2008 era

* Goldman Sachs planning deep job cuts as it faces sharp business downturn

* US Senate banking chair considers banning crypto

* Germany business climate sentiment improves for third month in December

* Fed officials reaffirm plan to extend hawkish policy to tame inflation

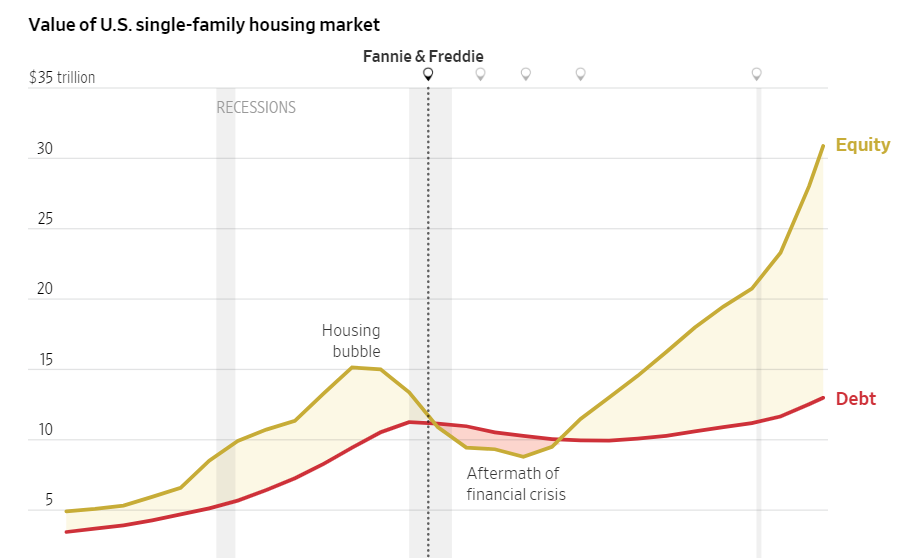

* The housing market appears relatively insulated from the downturn this time:

Book Bits: 17 December 2022

● Leveraged: The New Economics of Debt and Financial Fragility

Moritz Schularick (editor)

Summary via publisher (U. of Chicago Press)

The 2008 financial crisis was a seismic event that laid bare how financial institutions’ instabilities can have devastating effects on societies and economies. COVID-19 brought similar financial devastation at the beginning of 2020 and once more massive interventions by central banks were needed to heed off the collapse of the financial system. All of which begs the question: why is our financial system so fragile and vulnerable that it needs government support so often? For a generation of economists who have risen to prominence since 2008, these events have defined not only how they view financial instability, but financial markets more broadly. Leveraged brings together these voices to take stock of what we have learned about the costs and causes of financial fragility and to offer a new canonical framework for understanding it. Their message: the origins of financial instability in modern economies run deeper than the technical debates around banking regulation, countercyclical capital buffers, or living wills for financial institutions.

Will The Tight Labor Market Keep The US Out Of Recession?

The recession warnings have been piling up this year, but thanks to growth in consumer spending and hiring the US economic expansion has endured. Yesterday’s surprisingly weak retail sales data for November, however, suggest that the consumer sector may be buckling. If so, that leaves the labor market as the last major firewall that keeps the economic trend from slipping over the edge.

Macro Briefing: 16 December 2022

* Senate passes bill to avoid end-of-week government shutdown

* Russia continues to attack Ukraine with missile barrage

* US jobless claims fall to 3-month low, highlight tight labor market

* Eurozone economic contraction eased in December via PMI survey data

* European Central Bank hikes interest rates, warns of more to come

* NY Fed Mfg Index declined in December but outlook is relatively bright

* Philly Fed Mfg Index slumps to lowest level since May 2020

* US industrial output fell in November, weighed down by fall in manufacturing

* US Q4 GDP nowcast revised down to +2.8% via Atlanta Fed’s GDPNow model

* US retail sales fell more than expected in November: