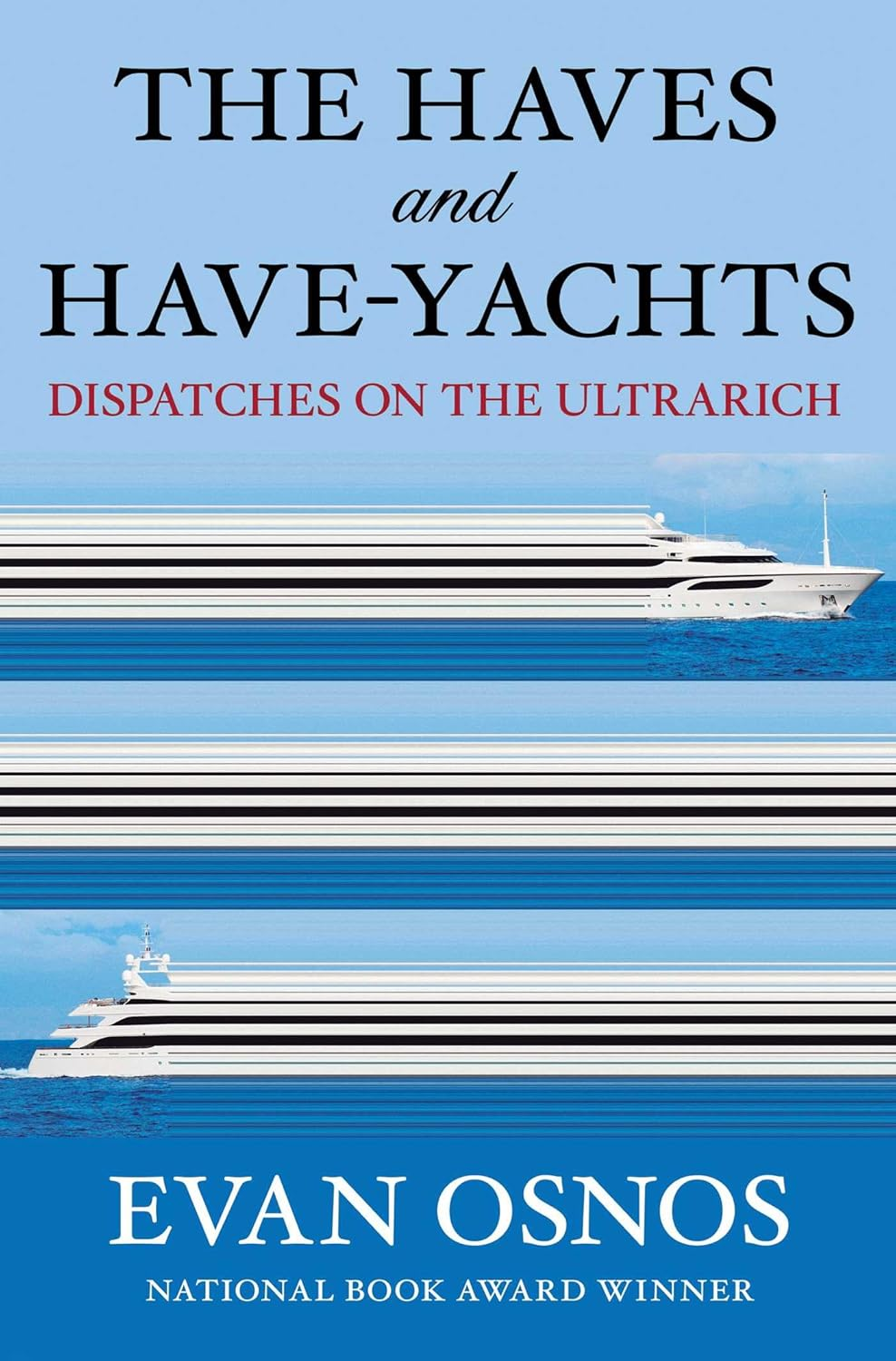

● The Haves and Have-Yachts: Dispatches on the Ultrarich

● The Haves and Have-Yachts: Dispatches on the Ultrarich

Evan Osnos

Interview with author via Marketplace.org

Currently, there are more than 3,000 billionaires in the world, and nearly one third of them are in the U.S. In the years between President Trump’s first and second inaugurations, 2016 to 2024, the wealth held by America’s billionaires more than doubled.

And yet, these ultra-high-net-worth individuals are something of a mystery to most of us. Average people could probably name a handful of them, such as Jeff Bezos, Mark Zuckerberg, or Warren Buffet, but their habits, their spending, or their values are something of an enigma.

So during those eight years, Evan Osnos, a staff writer for The New Yorker, was studying that population. The essays he wrote in that time have come together in his new book, “The Haves and the Have-Yachts: Dispatches on the Ultrarich.”

Research Review | 13 June 2025 | Analyzing And Monitoring Risk

Stock-Bond Return Correlation: Understanding the Changing Behaviour

David G. McMillan (University of Stirling)

March 2025

The stock and bond return correlation remains important given its central role in, and implications for, portfolio behaviour. Previous, primarily US, evidence indicates sign switching behaviour, which implies that bonds change between being a diversifier and a hedge. This paper considers the time-varying nature of the stock-bond correlation for G7 markets, including its economic drivers, and whether they are themselves time-varying. Using monthly data over a period spanning 1980 to 2023 evidence demonstrates that the correlation switches from positive to negative around 2000 for six of the seven markets (the switch for Japan occurs in the first half of the 1990s).

Macro Briefing: 13 June 2025

Israel attacked Iran’s capital early Friday, targeting the country’s nuclear program. The attacked also killed at least two top military officers. Iran vowed a “harsh” response. President Trump said that “the next already planned attacks” could be ”even more brutal,” and warned that Tehran “must make a deal, before there is nothing left.”

10-Year US Treasury Yield ‘Fair Value’ Estimate: 12 June 2025

The market premium for the US Treasury yield remained mostly unchanged in May vs. a “fair value” estimate. As the 10-year yield continued to trade in a tight range last month, combined with virtually no change an model-based assessment of its fair value, today’s update for May is in line with the previous month’s analysis.

Macro Briefing: 12 June 2025

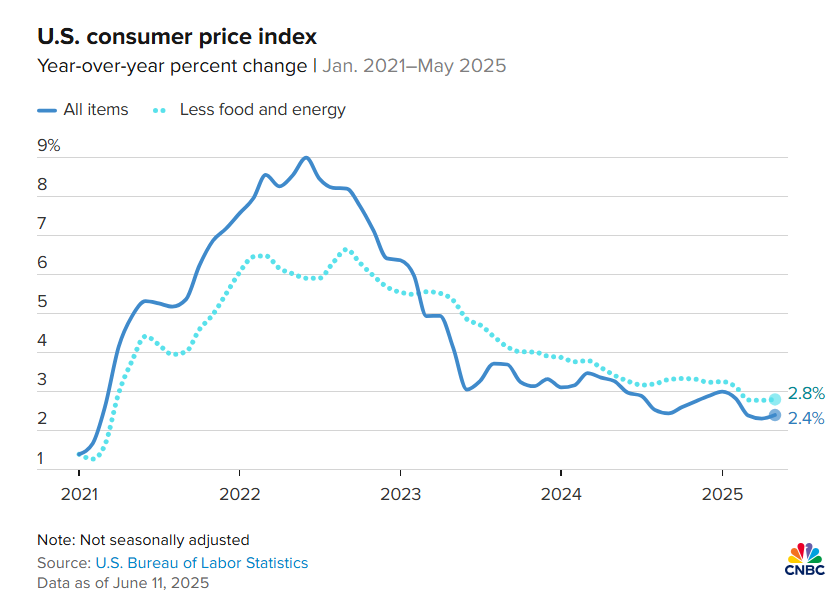

US consumer inflation remains muted in May as headline CPI’s year-over-year change ticked down to 2.4%. Core CPI, a more robust measure of the trend, held steady, which could be a sign that pricing pressure will remain “sticky” at a time when tariffs are only just starting to factor into prices. “It was a very good report,” said Mark Zandi, chief economist at Moody’s. “Basically, it says inflation has finally gotten back to the Federal Reserve’s annual inflation target.” He added: “I think it’s the calm before the inflation storm. This [report] still reflects the disinflation that began a few years ago and continued on through the month of May.”

When Will The Unemployment Rate Influence Fed Policy?

There are many indicators to monitor for reading the monetary policy tea leaves, each with its own distinctive set of pros and cons. Here’s one more that’s worth pondering: the unemployment rate.

Macro Briefing: 11 June 2025

The World Bank downgrades the outlook for US and global growth, citing tariffs. Due to “a substantial rise in trade barriers,” the US economy would grow half as fast (1.4%) vs. 2024 (2.8%). The new forecast reflects a downgrade from the 2.3% growth forecast for 2025 that the bank published in January. The forecast also projects the slowest decade for global growth since the 1960s.

Fed Policy Is Still On Hold, But For How Long?

A lot of ink has been spilled on the economic and inflation outlook since President Trump shocked markets in April with a dramatic change in US trade policy. But while tariffs have increased and the outlook has become a guessing game, the Federal Reserve’s monetary policy has been a rock of stability and remained frozen. That’s not necessarily a positive, but for the moment it’s one of the few things that’s been reliably boring on the macro landscape.

Macro Briefing: 10 June 2025

Americans reduced expectations for year-ahead inflation, according to survey data for May. One-year-ahead inflation expectations fell 0.4 percentage point to 3.2%, the New York Fed reported. For the 3-year horizon, the outlook fell to 3% and the 5-year forecast ticked down to 2.6%. The declines still leave inflation expectations above the Federal Reserve’s 2% target.

Bitcoin Wins, The US Dollar Loses Since “Liberation Day”

Bitcoin remains a winning asset since President Trump’s tariff announcement on Apr. 2 — “Liberation Day,” as he called it. In relative and absolute terms vs. the world’s primary markets, the cryptocurrency is outperforming by a wide margin, based on a set of ETFs through Friday’s close (June 6). The US dollar, by comparison, has slumped and is the worst performer.