Expected long-run returns for most of the major asset classes remain relatively attractive, based on updates of models run by CapitalSpectator.com. The outlier: US stocks, which are posting the softest relative performance forecast compared with the trailing 10-year return.

Macro Briefing: 2 December 2022

* Fed’s preferred inflation gauge shows signs of slowing in October

* US consumer spending accelerated in October

* OPEC+ considers deeper oil output cuts

* Construction spending in US fell sharply in October due to weak homebuilding

* Atlanta Fed’s Q4 GDP nowcast revised down sharply to still-solid +2.8%

* Global manufacturing conditions deteriorated again in November

* US mfg activity contracts in November via ISM Mfg Index:

Major Asset Classes | November 2022 | Performance Review

The rebound in global markets strengthened and broadened in November, building on October’s rebound. Only commodities lost ground last month. Otherwise, all the major asset classes posted gains, based on a set of proxy ETFs.

Macro Briefing: 1 December 2022

* Smaller rate hikes may start as early as Dec. 14 meeting, says Fed’s Powell

* House votes to block rail strike

* China signals slight easing of Covid policy after protests

* Pending home sales in US fall for fifth straight month in October

* Mortgage rates drop for third week but housing demand weakens further

* US job openings cooled in October

* Fed’s Beige Book: economic uncertainty rises as economic growth eases

* Q3 GDP growth is revised up to +2.9%

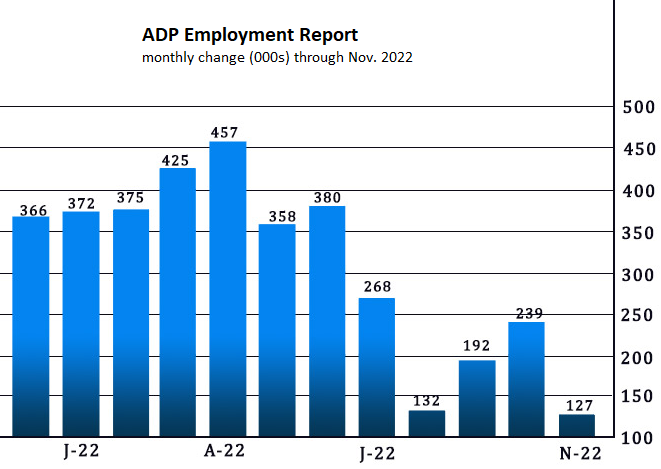

* US private employment growth slows sharply in November via ADP data:

Waiting (And Hoping) For A Bottom In Global Equity Markets

For most equity strategies diversified across global markets, this year’s results will be painful. Short of a dramatic run higher between now and the end of 2022, red ink will prevail. But when losses dominate, it’s time to start looking for bargains.

Macro Briefing: 30 November 2022

* Biden calls on Congress to ‘immediately’ pass legislation to avert rail shutdown

* Junk bonds rise, fueled by speculation that rate hikes have peaked

* China manufacturing activity fell at a deeper pace in November

* China may reopen in March, easing zero-Covid policy, predicts economist

* Eurozone inflation eases slightly as energy-price surge softens

* Stagflation risk for the US is rising, warns analyst

* Home prices in US fell for third straight month in September

* US consumer confidence eased for second month in November:

Is The Bond Market Pricing In The End Game For Rate Hikes?

It’s been an unusually rough year for bond investing, but there are hints that the market is forecasting that the worst has passed. If correct, shifting to a risk-on posture offers the opportunity for hefty returns going forward.

Macro Briefing: 29 November 2022

* Protests in China create new uncertainty global economic outlook

* China reports first decline in daily Covid infections in more than a week

* Inflation fight could last through 2024, says NY Fed president

* Business groups ask Congress to prevent rail strike

* Eurozone economic sentiment in November rises for first time in 9 months

* Cryptocurrency lender BlockFi files for bankruptcy, latest casualty in FTX crisis

* Meta fined $276 million in Eurozone for Facebook data leak

* Texas factory activity slumped for seventh straight month in November:

Stocks In Developed Markets Ex-US Roared Higher Last Week

This year’s selling looked excessive in developed-market shares ex-US and so the crowd continued to snap up stocks in this bucket during the trading week through Friday, Nov. 25. The rally delivered the strongest weekly gain for the major asset classes, based on a set of ETFs. But the return of risk-on sentiment may be short-lived if the eruption of widespread protests in China against Covid restrictions in recent days continues.

Macro Briefing: 28 November 2022

* Protests broke out across China against Covid restrictions

* Public anger over China’s zero-Covid policy Covid creates political risks for Xi

* China reports third straight day of daily record for new Covid cases

* China reaffirms its zero-Covid policy after widespread protests

* Recession risk may be rising, but hiring remains strong

* US gives Chevron permit to restart Venezuelan oil sales

* Markets pricing in a softer rate hike for Dec. 14 Fed meeting

* Risk appetite is rebounding, driven by outlook for softer Fed policy: