● Trade Wars: Past and Present

Nils Ole Oermann and Hans-Jürgen Wolff

Summary via publisher (Oxford U. Press)

This book explores the causes and instruments of 500 years of armed and non-armed international trade conflicts. Nils Ole Oermann and Hans-Jürgen Wolff draw on decades of experience to examine trade wars, economic sanctions, and different types of economic warfare, investigating their history, ethics, economic driving forces, and legality under current rules. They provide a clear and accessible account of the economics of trade, of trade and financial policy since the nineteenth century, and of the effectiveness of sanctions and the ‘winnability’ of trade wars.

Happy Thanksgiving 2022!

Treasury Market Warns US Recession Risk Is Elevated

Recent data for the US economy reflect a mixed profile, but several widely followed business-cycle indicators are screaming recession.

Macro Briefing: 23 November 2022

* World economic growth projected to “slow further” in 2023, OECD predicts

* Despite slowing growth, world economy expected to avoid recession

* China’s ability to maintain zero-Covid policy may be fading

* Workers in China protest over pay amid anti-virus controls

* US and allies plan to announce oil price cap for Russian crude

* Eurozone business activity contracts for fifth month in November

* HP will layoff 6,000 workers in latest downsize in tech industry

* NY governor signs law banning certain bitcoin mining

* Richmond Fed Mfg Index continues to signal weak mfg conditions in November

* US 2yr/10yr Treasury yield curve falls to -0.71, taking out previous low in 2000:

10-Year Treasury Yield ‘Fair Value’ Estimate: 22 November 2022

Last month I reported that the ‘fair value’ of the US 10-year Treasury yield appeared “lofty” relative to the average estimate for a combination model. In the weeks since, the benchmark rate has fallen. That’s probably noise, but a month later the model continues to advise that the 10-year rate is lofty.

Macro Briefing: 22 November 2022

* Another 75-basis-points rate hike is possible, says San Francisco Fed president

* Iran starts producing uranium enriched to 60 percent

* OPEC oil producers are discussing an output increase

* Goldman Sachs lowers oil-price forecast

* China signs 27-year liquefied natural gas deal with QatarEnergy

* US rail strike is possible after unions disagree on contract vote

* Investor-related home buying falls 30% amid rising interest rates

* Digital-asset brokerage Genesis may file for bankruptcy

* Bitcoin falls to two-year low

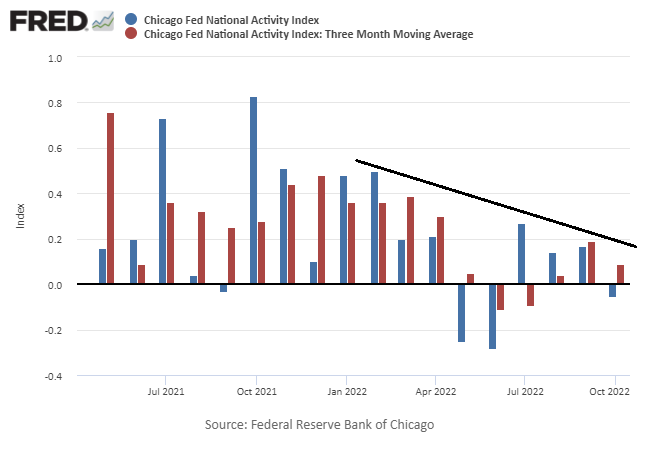

* US economic activity slowed in October via Chicago Fed Nat’l Activity Index:

Inflation-Indexed Bonds Ex-US Led Global Markets Last Week

As markets continue to grapple with various macro risks, government bonds indexed to inflation ex-US extended their recent rally and posted the strongest gain last week for the major asset classes, based on a set of ETFs.

Macro Briefing: 21 November 2022

* Will GOP control of House shield industries from new taxes and regulations?

* China locks down major transportation hub amid new Covid outbreak

* Goldman Sachs predicts bear market for US stocks will continue in 2023

* Finding workers still tough for small firms despite higher layoffs

* Analyst predicts US economy can absorb tech industry layoffs

* Will Saudi Arabia succeed with plan to keep global oil demand strong?

* Existing home sales in US fall for ninth straight month in October

* Foreign Treasury holdings in September drop to lowest level since May 2021

* US Leading Economic Index suggests US economy is contracting:

Book Bits: 19 November 2022

● The Capital Order: How Economists Invented Austerity and Paved the Way to Fascism

Clara E. Mattei

Excerpt via Promarket.org

Austerity has been so widespread in its uptake over the last century that it has become largely undetectable: the economics of austerity, with its prescribed budgetary cuts and public moderation, is largely synonymous with today’s economics. This makes a critical history of austerity, especially one rendered in class terms, profoundly challenging. But to the extent that we stop perceiving austerity as a sincere toolbox for managing an economy, and when we consider its history through the lens of class, it becomes clear that austerity preserves something foundational to our capitalist society. For capitalism to work in delivering economic growth, the social relation of capital— people selling their labor power for a wage— must be uniform across a society. In other words, economic growth presupposes a certain sociopolitical order, or capital order. Austerity, viewed as a set of fiscal, monetary, and industrial guardrails on an economy, ensures the sanctity of these social relations. The structural limitations it imposes on spending and wages ensure that, for the vast majority of those living in a society, “work hard, save hard” is more than just an expression of toughness; it’s the only path to survival.

Monitoring Investment Trends With ETF Pairs: 18 November 2022

Risk-off sentiment continues to dominate global markets. Although there have been hints that the worst of the selling has passed, there’s still plenty of room for skepticism, based on trends for key markets via a set of ETF pairs for prices through Thursday’s close (Nov. 17).