* Tensions rising between Moscow and NATO over Russia’s Kaliningrad enclave

* Japan on high alert amid activity by Chinese and Russian warships near its coast

* IEA warns Europe to prepare for total shutdown of Russian gas exports

* Russia earns more oil revenue than before war due to China and India

* Biden expected to call for 3-month suspension of gas tax

* Fed expected to lift rates by 3/4 percentage point again in July

* UK inflation ticks up to new 40-year high: +9.1% annual pace in May

* Existing home sales in US fell for fourth straight month in May

* US growth slowed in May via Chicago Fed business-cycle index:

Monitoring Fed Policy Expectations With The 2-Year Treasury Yield

Markets-based forecasts aren’t flawless, but for some projects in finance these estimates are the baseline estimates that are often tough to beat. An example is monitoring the outlook for trends and changes in Fed monetary policy. On that front, you could do a lot worse than keeping a close eye on the 2-year Treasury yield.

Macro Briefing: 21 June 2022

* European Central Bank plans two rate hikes this summer

* Goldman Sachs raises US recession-risk probability to 30% for 2023

* China’s economy continues to face downside risks

* Fed’s rate hikes are starting to slow borrowing and spending

* Israel’s gov’t collapses, new elections set

* New US ban on imports from the China’s Xinjiang region has started

* German 10-year yield rebounds to highest since 2014:

All The Major Asset Classes Lost Ground Last Week

Markets suffered a clean sweep of losses last week. It’s a rare event, but it happens, as the trading week through Friday, June 17 reminds in the wake of all the major slices of global markets posting simultaneous declines, based on a set of ETFs.

Macro Briefing: 20 June 2022

* Ukraine war could last years, says NATO’s secretary-general

* France’s newly-elected President Macron loses absolute majority in parliament

* EPA’s power over greenhouse gases at stake in upcoming Supreme Court ruling

* Emerging markets face rising pressure from higher interest rates and inflation

* Apple workers in Maryland vote to unionize

* Bitcoin rebounds after a sharp slide below $18,000 over the weekend

* US Treasury real yields rebound to positive terrain but still below 2018 peak:

Book Bits: 18 June 2022

● Money, Magic, and How to Dismantle a Financial Bomb: Quantum Economics for the Real World

David Orrell

Review via Irish Tech News

David Orrell argues that the emerging discipline of quantum economics, of which he is at the forefront, is the key to shattering the illusions that prevent us from understanding money’s true nature. In this colourful tour of the history, philosophy and mathematics of money, Orrell demonstrates how everything makes much more sense when we replace our classical economic models with ones based on quantum probability – and reveals the explosive reality of what is left once the illusions are stripped away.

Recession Watch: 17 June 2022

The outlook is turning grim for the US economy, or so a range of soft data and forecasts advise. But while expectations are deteriorating at the moment, the hard data continues to reflect a growth bias. Short of an epic, sudden (and at this point unexpected) collapse in business activity and/or consumer spending, the US economy will continue to expand for the near term. What happens beyond the next several months is unclear, which is par for the course. The crowd, however, is becoming increasingly pessimistic, which raises the question: Will the next recession become a self-fulfilling prophecy?

Macro Briefing: 17 June 2022

* Putin continues to wield Russia’s energy weapon with a deft hand

* China launches its third, most advanced aircraft carrier

* More than 60% of executives see recession in next 12 to 18 months

* European leaders lay out path to European Union membership for Ukraine

* World Trade Organization changes global trading rules for first time in years

* Cosmetics maker Revlon files for bankruptcy, citing supply-chain disruption

* Philly Fed Mfg Index turns negative in June

* US jobless claims tick lower, but still reflect strong labor market

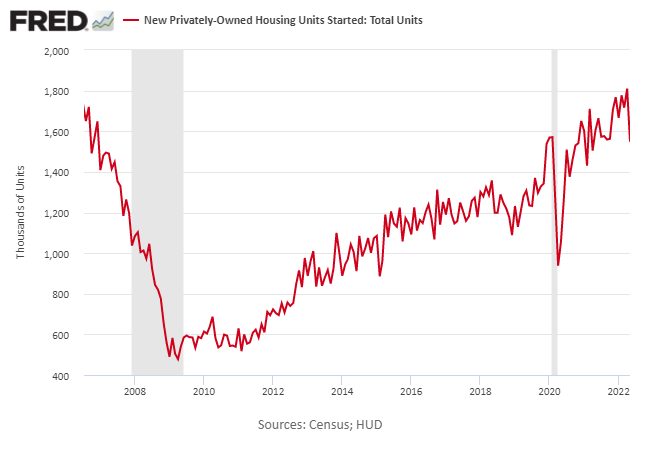

* US housing starts fall in May to lowest level in more than a year:

10-Year Treasury Yield ‘Fair Value’ Estimate: 16 June 2022

The Federal Reserve’s 75-basis-point hike for its target rate on Thursday — the biggest increase since 1994 — signals that the central bank is increasingly committed to fighting inflation.

Macro Briefing: 16 June 2022

* Chinese leader restates support for Russia on “sovereignty and security” matters

* Three European leaders visit Ukraine as US pledges $1 billion in new security aid

* Federal Reserve hikes interest rates 3/4 percentage point

* Business inflation expectations are relatively steady in June

* NY Fed Mfg Index reports second month of contraction in June

* US homebuilder sentiment falls to two-year low in June

* US retail sales fall in May, posting first monthly loss this year: