* Biden may ease some of Trump’s China tariffs

* Fed today may announce biggest rate hike since 1994

* European Central Bank starts emergency meeting after bond-market sell-off

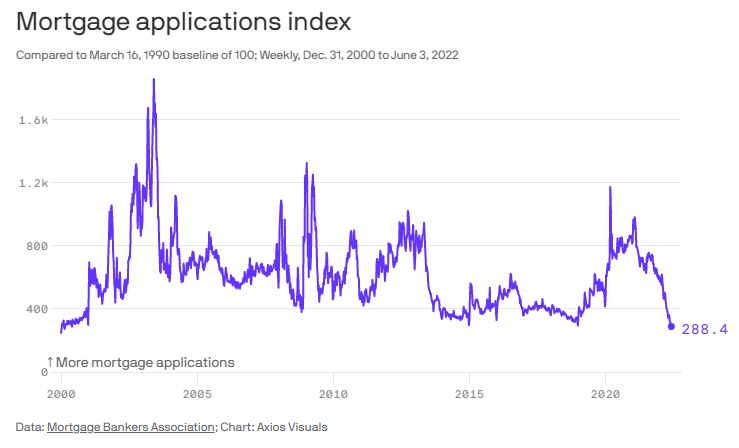

* US mortgage rates jump sharply: national average at 6.28% for 30-year fixed

* Crypto firms lay off staff, freeze withdrawals as digital coin prices tumble

* China industrial production posts modest rebound in May

* US wholesale price inflation up 10.8% in May, near annual record

* US small business sentiment eased to new record low in May

* US Dollar Index holds near 20-year high:

S&P 500 Risk Profile: 14 June 2022

A common definition of a bear market is a 20% stock market decline. By that standard, the S&P 500 crossed that Rubicon yesterday (June 13) for the first time since the pandemic crash in March 2020 as the market’s drawdown reached nearly -22%.

Macro Briefing: 14 June 2022

* Ukraine conflict could last 10 years if Russia isn’t pushed back, analysis warn

* China delivers its sternest warning to date re: US support for Taiwan

* Markets consider the odds of a 75-basis-point Fed rate hike on Wednesday

* 2yr/10yr Treasury curve inverts, flashing new recession warning

* Foreign stocks stabilize after Wall Street selloff on Monday

* Bitcoin falls sharply after crypto lender halts bitcoin withdrawals

* US 10-year Treasury yield jumps to 3.43%, an 11-year high:

Commodities Edged Up Again Last Week As Everything Else Fell

Broadly defined commodities posted another gain for the trading week through Friday, June 10 while the remaining slices of the major asset classes fell, based on a set of ETF proxies.

Macro Briefing: 13 June 2022

* Fed Chair Powell may face choice between inflation or recession

* Another Fed rate hike expected this week, and more to come

* “Ferocious” outbreak of Covid in Beijing raise doubts about China’s reopening

* UK economy contracts for second month in April

* US dollar’s rise to 20-year high translates to hefty losses for US Firms

* The worst of the global food crisis may lie ahead

* Bitcoin falls below $24,000, lowest since Dec. 2020

* Consumer sentiment in US slumps to record low in early June

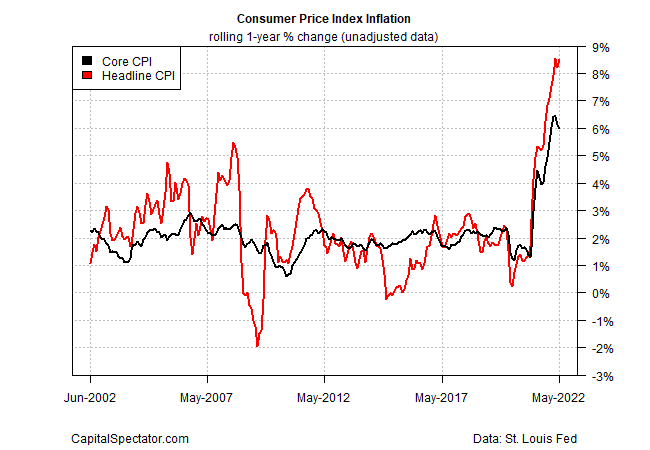

* US consumer inflation rises to annual rate of 8.6% in May, a 40-year high:

Book Bits: 11 June 2022

● Prediction Revisited: The Importance of Observation

Mark P. Kritzman, et al.

Summary via publisher (Wiley)

In Prediction Revisited: The Importance of Observation, a team of renowned experts in the field of data-driven investing delivers a ground-breaking reassessment of the delicate science of prediction for anyone who relies on data to contemplate the future. The book reveals why standard approaches to prediction based on classical statistics fail to address the complexities of social dynamics, and it provides an alternative method based on the intuitive notion of relevance. The authors describe, both conceptually and with mathematical precision, how relevance plays a central role in forming predictions from observed experience. Moreover, they propose a new and more nuanced measure of a prediction’s reliability.

Research Review | 10 June 2022 | Risk Premia Sources

Inflation as the Source of the Bond, Equity, and Value Premia

Martin Tarlie (GMO)

May 2022

A no-arbitrage pricing model with inflation as the only priced risk factor explains the bond, equity, and value premia observed in the United States over the past sixty years. Even though inflation is the only priced factor, in an economy with three state variables – inflation, the real rate, and corporate profitability – the real rate and profitability play a crucial role because of their sensitivity to inflation shocks. For bonds, the shape of excess returns with respect to maturity depends on the dynamic interactions between the three state variables. For stocks, the equity and value premia are largely explained by exposure of cash flows to profitability, whereas growth stocks’ excess returns are largely explained by cash flow exposure to the real rate. With respect to inflation risk, stocks writ large are a store of value, and value stocks are a strong hedge as their dividends move more than one for one with inflation.

Macro Briefing: 10 June 2022

* Treasury Sec. Yellen says US will probably avoid a recession

* US gasoline price average approaching $5 a gallon

* Rising fuel costs rippling across industries and affecting consumer behavior

* China consumer inflation is stable in May as factory-gate prices ease

* ECB says it will raise interest rates next month–first time hike in 11 years

* FTC chair issues a regulatory warning to the tech industry

* Big US banks look set for earnings boost from pickup in credit card use

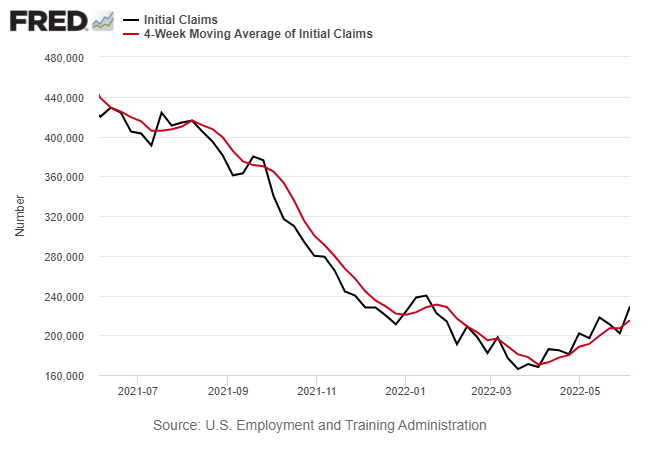

* US jobless claims rise to five-month for week through June 4:

US Economic Activity Still Expected To Post Rebound For Q2 GDP

Recession talk has spread like Covid recently, but next month’s initial estimate of US economic activity for the second quarter remains on track to post a robust rebound after Q1’s loss, based on a set of nowcasts.

Macro Briefing: 9 June 2022

* US and allies looking for ways to limit further surges in global oil prices

* Inflation is an increasingly challenging subject for the White House

* China’s appetite for key commodities remained subdued in May

* ECB expected to confirm intent to raise interest rates next month

* China appears intent on maintaining a permanent zero-Covid policy

* Battery shortage is constraining US switch to wind and solar power

* “Dangerous and deadly heat wave” on the way for the US Southwest

* US mortgage application activity falls to 22-year low for week through June 3: