Yes, according to economists’ forecast for this Friday’s November update (Dec. 10) on consumer prices.

Macro Briefing: 8 December 2021

* Biden says US preparing ‘strong measures’ on Russia if it invades Ukraine

* House takes first step in preventing a possible default on US debt

* Omicron variant partly evades protection offered by Pfizer vaccine, study shows

* Inflation is a leading concern for American voters via a new survey

* Debt-default worries persist for two of China’s biggest property companies

* Credit card giant Visa launches consulting service for cryptocurrencies.

* Germany’s parliament elects Olaf Scholz as new chancellor

* Is the flattening yield curve a sign that the Fed can’t/shouldn’t raise rates?

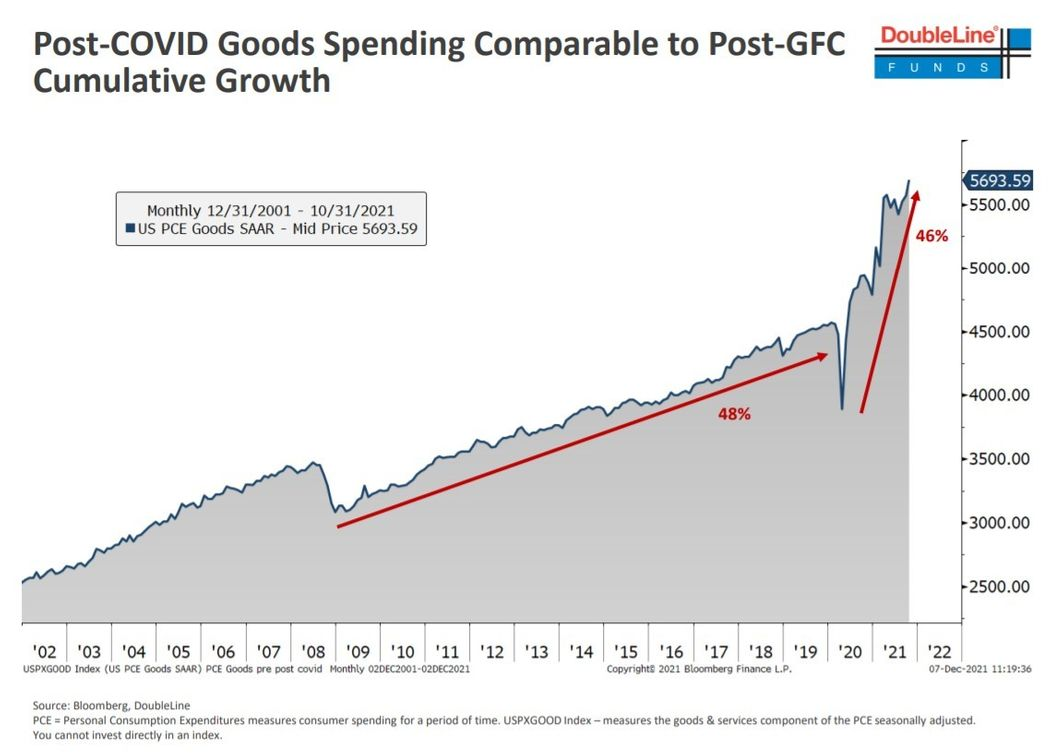

* US post-Covid goods spending has surged:

Inflation-Indexed Treasuries Lead US Bond Market Returns In 2021

How’s that allocation to bonds working out this year? Probably pretty good, if you favored Treasury Inflation Protected Securities (TIPS).

Macro Briefing: 7 December 2021

* Biden expected to give Russia’s Putin stark warning on attacking Ukraine

* China says US will ‘pay a price’ for diplomatic boycott of Olympics in Beijing

* Fed officials suggest bond-buying program will end sooner than expected

* New data law in China makes it hard for foreigners to assess economy

* Consumer spending was biggest contributor to Eurozone Q3 expansion

* Will falling ‘excess’ cash reserves for working class pinch consumer spending?

* Policy-sensitive 2-year US Treasury yield edges up to new pandemic high:

Major Asset Classes Post Wide Range Of Results For Last Week

US junk bonds and several slices of foreign fixed-income markets led a mixed run of returns for the major asset classes last week, based on a set of ETFs through Friday’s close (Dec. 3).

Macro Briefing: 6 December 2021

* Goldman Sachs cuts forecast of US 2022 GDP growth due to Omicron

* US health experts say early signs suggests Omicron less dangerous than delta

* China’s economic influence on global economy has been fading

* China’s central bank eases banking reserve requirement to boost liquidity

* China Evergrande Group is again on the brink of default; shares plunge

* German industrial orders fell sharply in October due to soft foreign demand

* US payrolls grew much less than expected in November

* Services PMI reaches record high in US, reflecting strong sector activity

* US 10yr-2yr Treasury yield curve narrows to smallest spread in over a year:

Book Bits: 4 December 2021

Ray Dalio

Review via Forbes

America’s domestic issues and decline as the world’s leading superpower are more than simply a matter for debate to Dalio. They underpin the core thesis of his latest book, Principles for Dealing with the Changing World Order: How and Why Nations Succeed and Fail, that comes out on November 30. In it, he builds the case that the confluence of rising U.S. debt and income disparities, along with America’s diminished influence, has put the country at risk of not just economic hardship but war. Specifically, he points to growing debt and near-zero interest rates that have led to a massive printing of money ($16 trillion of debt at negative interest rates this year, by Dalio’s estimates), increased conflict and polarization due to widening wealth gaps and China’s increased ability to challenge U.S. hegemony on the world stage.

Major Asset Classes | November 2021 | Risk Profile

If genius is a bull market, it’s been easy to look smart in recent years by holding a multi-asset-class portfolio. That’s been true in total-return terms and the profile holds up after adjusting for risk. But there are hints that the bull run for risk-adjusted performance may be peaking for globally diversified strategies.

Macro Briefing: 3 December 2021

* Senate OKs short-term funding bill to avoid government shutdown

* Fed governor Quarles says rate hikes needed to cool inflation

* Worldwide computer chip shortage lifting inflation will persist ‘deep into 2022’

* China’s modest growth eased in Nov, according to Composite Output Index

* Eurozone growth strengthened in November via PMI survey data

* Chinese ride-hailing giant Didi will delist from NYSE

* Apples reports waning demand for its iPhone 13

* US jobless claims rose last week after reaching 52-year low

* 10yr-3mo Treasury yield curve narrows to 2-month low:

Risk Premia Forecasts: Major Asset Classes | 2 December 2021

The expected risk premium for the Global Market Index (GMI) ticked lower in November, but remains elevated relative to recent history. Today’s revised estimate is 6.0% annualized, down slightly from the previous forecast.