* Dems delay wide-ranging spending bill after GOP leader stalls vote

* Pressure among Democrats builds for Biden to combat inflation

* Japan approves new stimulus spending bill to boost economy

* Austria announces new national lockdown as coronavirus crisis deepens

* German producer prices in October rose at fastest rate in nearly 60 years

* CVS will close 900 stores to respond to changing “consumer buying patterns”

* US Leading Economic Index rose sharply in October, point to strong growth

* Philly Fed’s manufacturing index reports accelerating growth in November

* US jobless claims fall for seventh straight week:

10-Year Treasury Yield ‘Fair Value’ Estimate: 18 November 2021

The 10-year US Treasury yield has been moving higher in recent weeks. Does the shift signal an extended run higher? There’s a firmer upside bias lately, although this change doesn’t yet look decisive, although our average fair-value estimate of the 10-year rate continues to indicate that the path of least resistance is up.

Macro Briefing: 18 November 2021

* Rising shipping costs could drive consumer inflation higher next year, UN warns

* Has loose Fed policy become a threat to jobs?

* Inflation call on Wall Street linked with extreme career risk

* Biden calls for FTC investigation of “illegal conduct” re: surging gas prices

* Japan, S. Korea consider releasing oil from strategic reserves after US request

* Turkey’s currency falls to record low vs. dollar ahead of central bank meeting

* Amazon says it will stop accepting Visa credit card payments in UK

* US housing starts were surprisingly soft in October:

Rebounds In US Payrolls, Industrial Output Are Unusually Strong

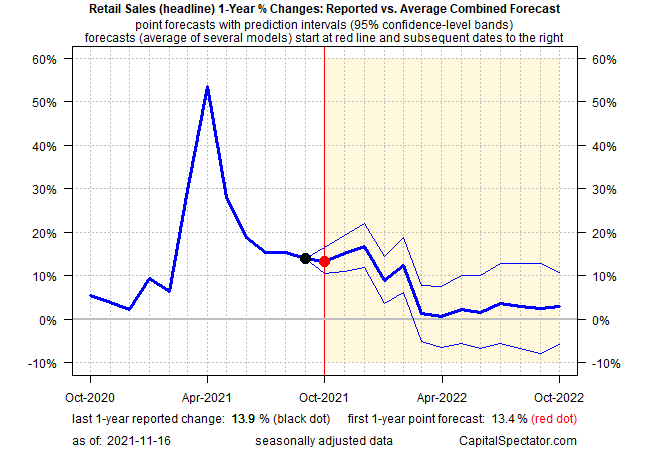

October data for the labor market and the industrial sector continue to paint a bright profile of recovery in absolute and relative terms vs. previous economic expansions. Retail sales data through last month, updated earlier in the week, suggest the same for personal consumption expenditures, which will be updated for October on Nov. 24. The weak outlier is personal income and it’s unclear if this key indicator will deliver more encouraging results in the upcoming report.

Macro Briefing: 17 November 2021

* Treasury Sec. Yellen warns US will reach its debt limit on Dec. 15

* Fed Chairman Powell’s inflation dashboard starting to show signs of overheating.

* US industrial production rebounded in October, rising for first time in 3 months

* Biden says he’ll make decision on Fed leadership within days

* Inflation in UK picked up to 4.2% year over year in October — a 10-year high

* Homebuilder sentiment continued rebounding in Nov after summer slump

* US retail spending accelerated in Oct, rising for third month beating estimates:

US GDP Growth Appears Set For Strong Rebound In Q4

Early estimates of US economic output for the fourth quarter indicate a robust pickup in growth from the mild gain reported for Q3, according to recent nowcasts.

Macro Briefing: 16 November 2021

* Biden signs $1 trillion infrastructure bill into law

* China’s Xi warns Biden about ‘playing with fire’ on Taiwan in virtual summit

* US jobless rate could drop to 50-year low soon, predicts Goldman Sachs

* Inflation expected to be key factor in tight Congressional races in 2022

* Rising crude oil supply could soon ease energy short, IEA predicts

* Biden’s decision on the next Fed chair is ‘imminent’

* Calpers, largest US pension fund, votes to use leverage and alternative assets

* NY Fed Mfg Index: sector growth strengthened in November

* Today’s Oct update for retail sales projected to maintain strong 1yr growth rate:

Will Higher Rates Choke The Latest Rally In Emerging Markets?

Shares in emerging markets topped returns for the major asset classes during the trading week through Nov. 15 12, based on a set of US-listed ETFs. But if interest rates are set to rise, triggered by higher inflation, the prospects for an extended rally could be short lived, or so market history suggests.

Macro Briefing: 15 November 2021

* Expectations are low for today’s virtual meeting between Biden and China’s Xi

* Energy mkt disconnect could trigger shortages, predicts IHS Markit’s Yergin

* US Dollar Index pulls back after approaching 16-month high

* Will interest rates stay low forever? Yes, predicts manager at GAM Investments

* China’s new home prices post biggest decline since 2015

* UK economists expect Bank of England will raise rates in December

* Japan’s economy shrank in Q3, falling much more than expected

* Higher inflation will boost profits for some companies

* Gold at five-month high as inflation surges

* Cargo demand expected to boost aerospace industry, predicts Boeing exec

* Consumer Sentiment Index for US declines to a 10-year low in early November

* US consumer 1-year inflation expectations rise to highest level in over a decade:

Book Bits: 13 November 2021

Bobby Duffy

Summary via publisher (Basic Books)

Millennials, Baby Boomers, Gen Z—we like to define people by when they were born, but an acclaimed social researcher explains why we shouldn’t. Boomers are narcissists. Millennials are spoiled. Gen Zers are lazy. We assume people born around the same time have basically the same values. It makes for good headlines, but is it true? Bobby Duffy has spent years studying generational distinctions. In The Generation Myth, he argues that our generational identities are not fixed but fluid, reforming throughout our lives. Based on an analysis of what over three million people really think about homeownership, sex, well-being, and more, Duffy offers a new model for understanding how generations form, how they shape societies, and why generational differences aren’t as sharp as we think.