The energy sector is a critical part of the US and global economy and this slice of global markets deserves a spot at the asset allocation table. But as an investment it’s been a disappointment in recent years… or has it?

Macro Briefing: 14 October 2020

Eli Lilly’s Covid-19 antibody trial on hold due to safety concerns: SN

Supreme Court rules census counting can end before Oct. 31: CNBC

IMF cuts outlook for global growth in 2021: CNN

JPMorgan, Citigroup: US economic rebound continues to face risks: WSJ

Debate over the relevance of the equity size factor is heating up: II

China’s stock market value rises to record high of $10 trillion: FT

US’s weakest local economies face dire outlook in pandemic: Reuters

Eurozone industrial output continued to rise in Aug but at much slower pace: MW

US small business optimism continued to rebound in Sep: NFIB

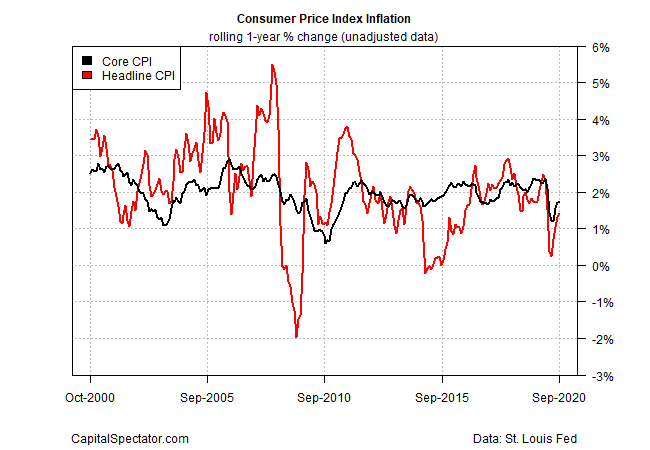

US core consumer inflation’s 1-year change holds at moderate 1.7% for Sep: LD

Consumer Discretionary, Tech Lead Rebound In US Equity Sectors

All the US equity sectors have bounced off the Mar. 23 broad-market low, with consumer discretionary shares leading the way, based on a set of exchange traded funds through yesterday’s close (Oct. 12). Technology is a close second. On both fronts, the rallies have carried prices well above the broad market’s recovery since the depth of the coronavirus crash in late-March.

Macro Briefing: 13 October 2020

J&J halts Covid-19 vaccine trial due to unexplained illness in participant: SN

Democrats and GOP clash in start of Senate hearing on Barrett: FTE

Contracting Covid-19 a second time is a risk, new study finds: BBG

Drug makers eye the potential for big profits with Covid-19 vaccines: NYT

White House moves forward with arms sales to Taiwan: Reuters

Central banks have moved aggressively this year to finance fiscal spending: BBG

Wall St is looking for the upside in a ‘Blue Wave’: II

UK job cuts rose the most on record for three months through Aug: BBG

German investor sentiment falls more than expected in October: Reuters

Most big economies will struggle to regain this year’s losses in 2021: BBG

Commodities Led Last Week’s Broad Rally In Asset Classes

A broad, equal-weighted measure of commodities topped last week’s wide-ranging gains across the major asset classes, based on a set of exchange-traded funds. In close pursuit: US and emerging markets stocks.

Macro Briefing: 12 October 2020

Senate hearing on Amy Coney Barrett begins today: CNN

Reviewing the stakes in the Supreme Court battle over Barrett: BBC

Stimulus talks stall in Senate: Vox

Europe’s economic recovery appears to be fading: NYT

Nobel prize in economics awarded for work on commercial auctions: CNBC

IMF holds annual meeting this week under economic cloud: BBG

China rolls out test of digital currency issued by the central bank: TC

10yr-3mo Treasury yield spread holds near 4-month high:

Book Bits: 10 October 2020

● The Death of Human Capital?: Its Failed Promise and How to Renew It in an Age of Disruption

Phillip Brown, et al.

Summary via publisher (Oxford U. Press)

Human capital theory, or the notion that there is a direct relationship between educational investment and individual and national prosperity, has dominated public policy on education and labor for the past fifty years. In The Death of Human Capital?, Phillip Brown, Hugh Lauder, and Sin Yi Cheung argue that the human capital story is one of false promise: investing in learning isn’t the road to higher earnings and national prosperity. Rather than abandoning human capital theory, however, the authors redefine human capital in an age of smart machines. They present a new human capital theory that rejects the view that automation and AI will result in the end of waged work, but see the fundamental problem as a lack of quality jobs offering interesting, worthwhile, and rewarding opportunities.

The ETF Portfolio Strategist: 9 Oct 2020

Keep (Stimulus) Hope Alive: The US stock market continued to rebound from September’s correction. Vanguard Total US Stock Market (VTI) posted its second straight weekly gain with a 4.1% surge at the close of this week’s trading (Oct. 9). The fund, at 177.32, is now within shouting distance of its record close (180.50) on Sep. 2. Once again, the lesson seems to be: ignore the downside because it never lasts.

continue reading at The ETF Portfolio StrategistActively Choosing Passive Indexing

Index-based investing is often seen as a benchmark for active strategies, and rightly so. But what’s easy to overlook is the fact that indexing also represents an investment strategy, one with a particular set of pros and cons that can compliment active strategies.

Macro Briefing: 9 October 2020

Stimulus talks in Washington stumble on: BBG

WHO reports record one-day rise in global coronavirus cases: Reuters

Louisiana coast braces for Hurricane Delta: AP

Economists expect slow recovery in US jobs, according to survey: WSJ

US budget deficit expands to record $3.1 trillion in FY 2020: AP

Wall St banks see record revenue for govt-backed mortgage debt trades: Reuters

UK economy grew 2.1% in August, less than expected: CNBC

China’s services economy grows at faster pace in September: Reuters

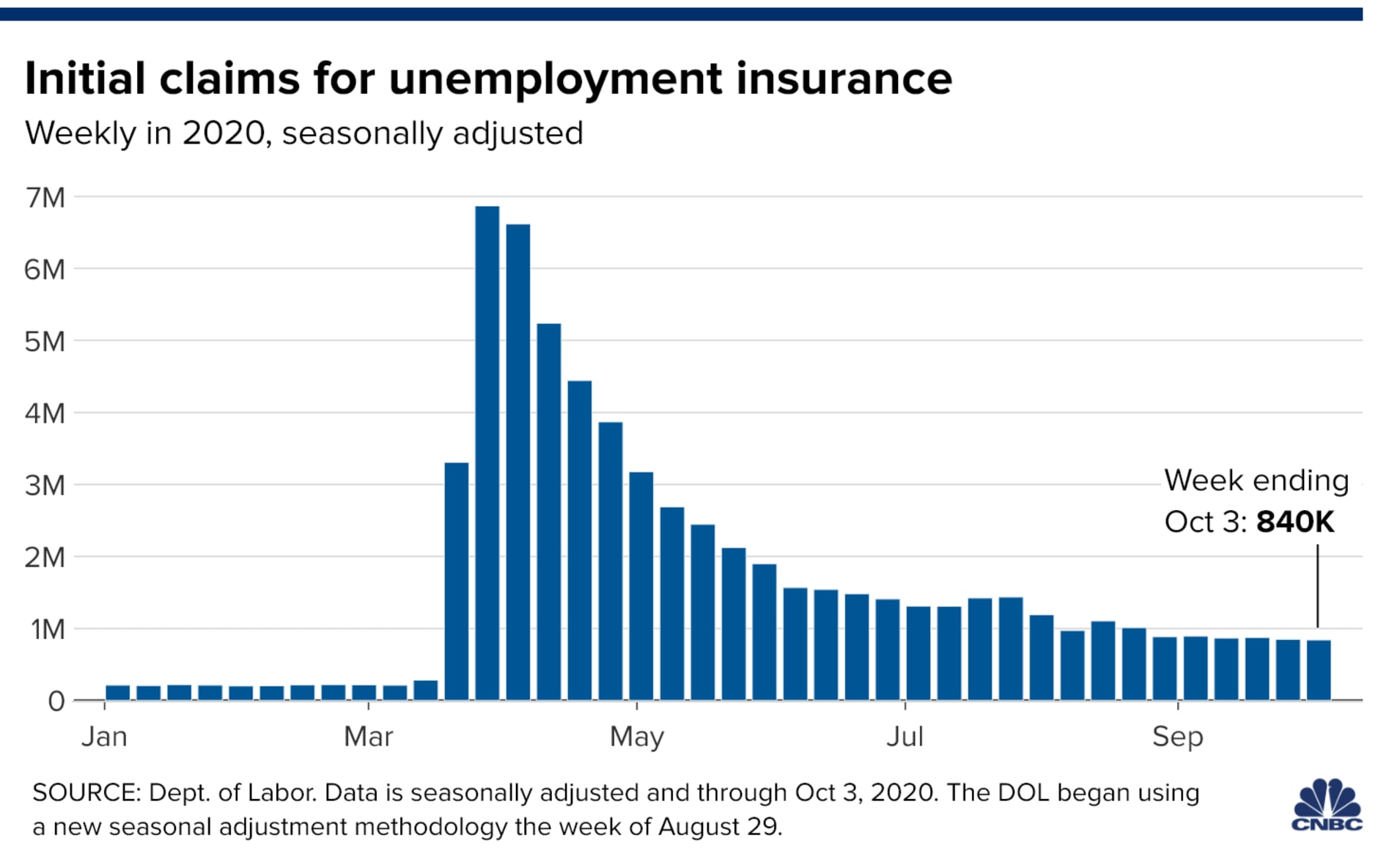

Are the jobless claims numbers accurate? FW

US jobless claims remain high, posing threat to economy: CNBC